Here’s Why Bitcoin Correction Is Probably Over?

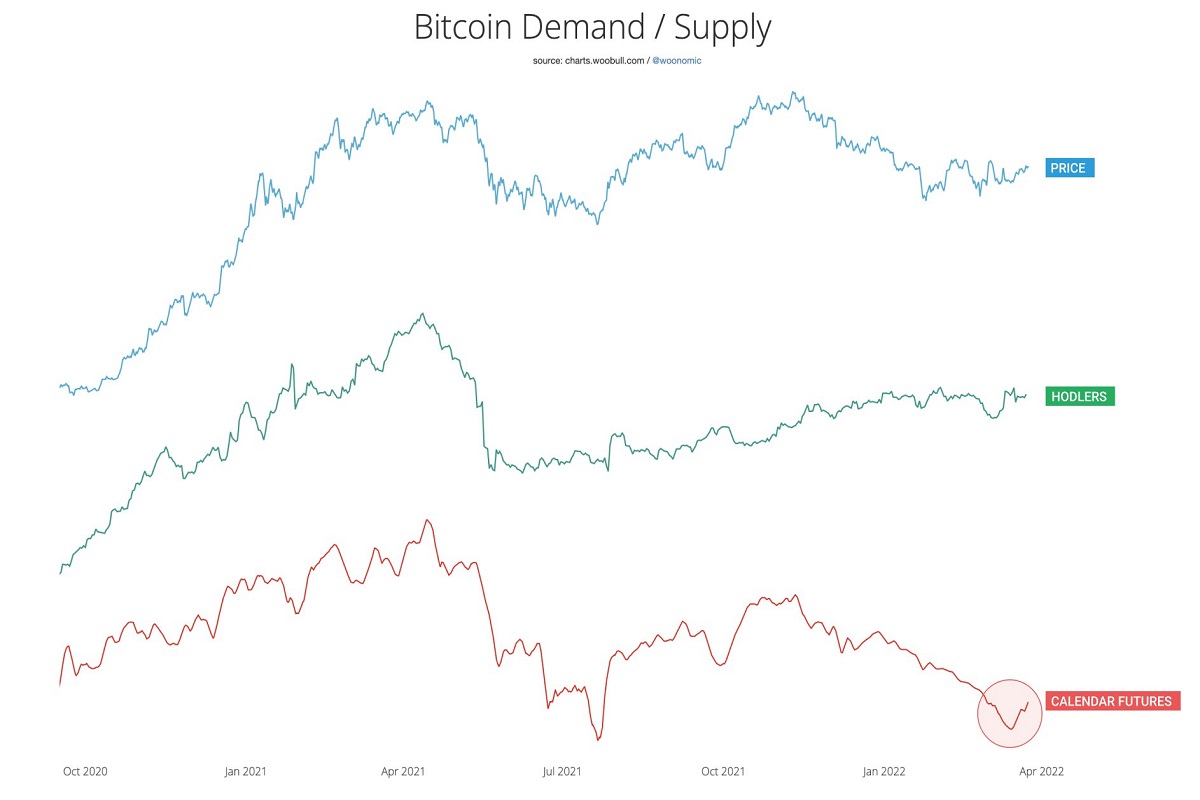

Famous on-chain analyst Willy Woo has explained some important details by keeping Macro headwinds against Bitcoin (BTC) Fundamentals. He hinted that demand for BTC futures is gaining momentum for the first time since November. He added that the market is completely reset, while, accumulation has already happened. Meanwhile, as per IntoTheBlock, for the first time, the number of addresses holding BTC has surpassed the 40 million mark.

BTC on-chain demand rises

Due to the Russia-Ukraine conflict both traditional and crypto markets saw a halt. As the uncertain situations increased, markets become more volatile. Now after countries have pulled the sanctions over the invader country, the crypto market looks fine.

Bitcoin recently crossed the $45K mark and analyst Willy Woo has suggested that on-chain (spot) demand is climbing upwards. Adding on he said that Risk-on/Risk-off correlations to equities are a short-term effect and BTC trades links with this due to short-term speculators. However, he suggested that decoupling may continue.

Bitcoin’s internal demand fundamentals powered by its adoption curve are more powerful. Eventually, the market decouples; the last time was Oct 2020, says Willy Woo

Accumulation is already done

He also mentioned that the market has fully reset but in terms of market pricing vs on-chain demand coming from holders. In the end, Willy suggested that the BTC accumulation has already happened as coins sold by weak investors at a loss have been purchased.

Earlier, he noted that the size of accumulation in the past ended with a 4-year cycle due to strong capitulation. However, these days it is have become smaller and more frequent alongside the shorter and smaller bull/bear cycles.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs