Bitcoin Could Rally to $170,000 in 2026 If This Happens: CryptoQuant

Highlights

- A CryptoQuant analysis predicts a Bitcoin rally to $170,000 this year if easing expectations materialize early.

- Sustained ETF inflows could also contribute to the projected rally.

- CryptoQuant stated that BTC has still not clearly entered a bullish trend.

A CryptoQuant analysis has explained what needs to happen for Bitcoin to rally to as high as $170,000 this year. However, this is the least likely of the three scenarios the analysis highlighted, with BTC struggling to enter a new bullish trend.

How Bitcoin Could Rally To $170,000 This Year

A CryptoQuant analysis highlighted a potential BTC rally to $170,000 as one of the scenarios, though a low-probability one, that could play out for the flagship crypto this year. The analysis stated that if easing expectations materialize early and ETF inflows stabilize, then BTC could extend toward between $120,000 and $170,000, with the possibility of higher levels only under multiple favorable conditions.

CoinGape reported that the FOMC minutes showed that most Fed officials believe that it is appropriate to hold interest rates steady for now, signaling that a cut in January is unlikely. Notably, the Fed cut rates three times last year, which served as a catalyst for Bitcoin’s run to new all-time highs (ATHs) last year.

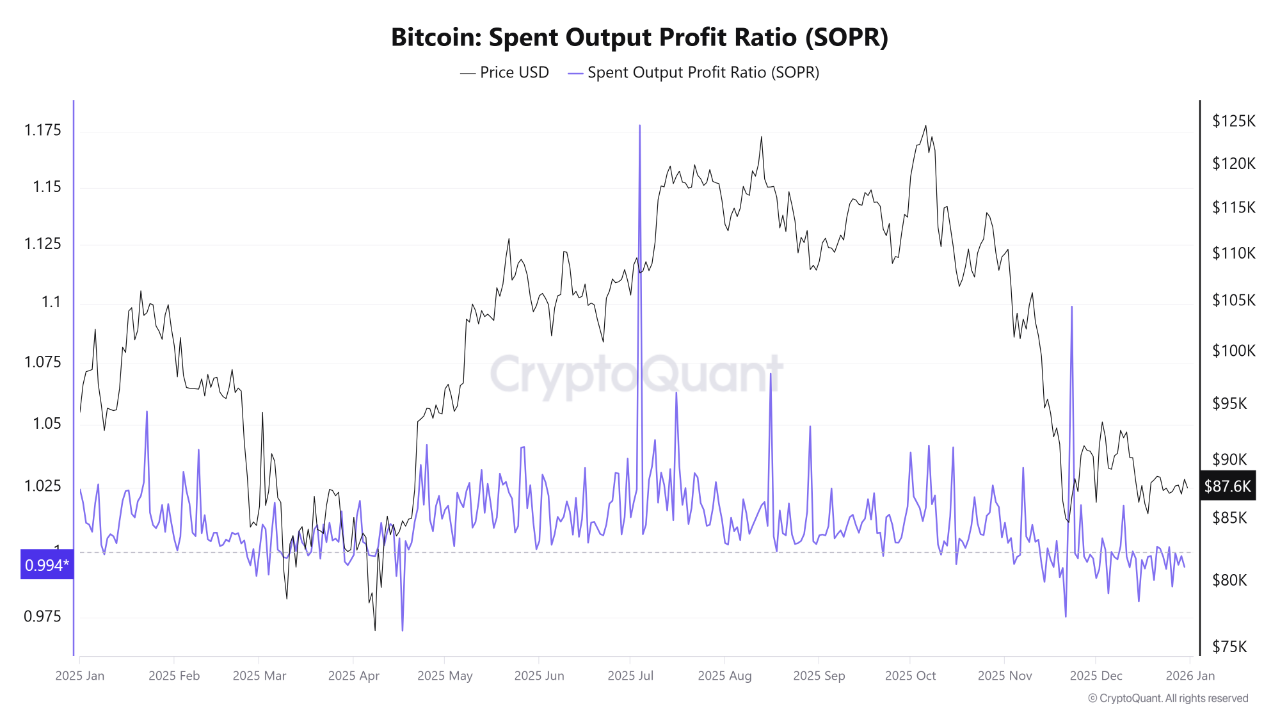

However, with another Fed rate cut unlikely in the early parts of this year, the BTC price may be at risk of extending its current downtrend. The CryptoQuant analysis noted that as 2026 begins, the flagship crypto has not clearly entered a new bullish trend, with the market remaining in a high-volatility range environment, which is neither decisively bullish nor bearish.

CryptoQuant also stated that while ETF adoption and supply constraints provide long-term support, macro uncertainty, U.S. midterm election dynamics, and derivatives-driven price action continue to limit sustained directional moves for Bitcoin. The analysis revealed that the current stance is conditionally neutral to slightly bearish, reflecting insufficient structural confirmation for strong upside momentum.

Two Other Scenarios That Could Play Out For BTC

The CryptoQuant analysis mentioned two other scenarios that could play out for Bitcoin this year. The first is the ‘high probability’ one with the flagship crypto trading within a twisted range. This scenario could play out if Fed rate-cut expectations persist, but real economic recovery remains weak.

The analysis noted that capital flows are intermittent and dominated by short-term ETF activity. Based on this, Bitcoin is likely to trade within a broad $80,000 to $140,000 range, with $90,000 to $120,000 as the core zone.

Meanwhile, the last scenario is the ‘medium probability’ one, which could happen based on a macro shock for Bitcoin. The analysis noted that if recession risk intensifies, deleveraging and ETF outflows could push BTC below $80,000, with a move toward the $50,000 range a possibility.

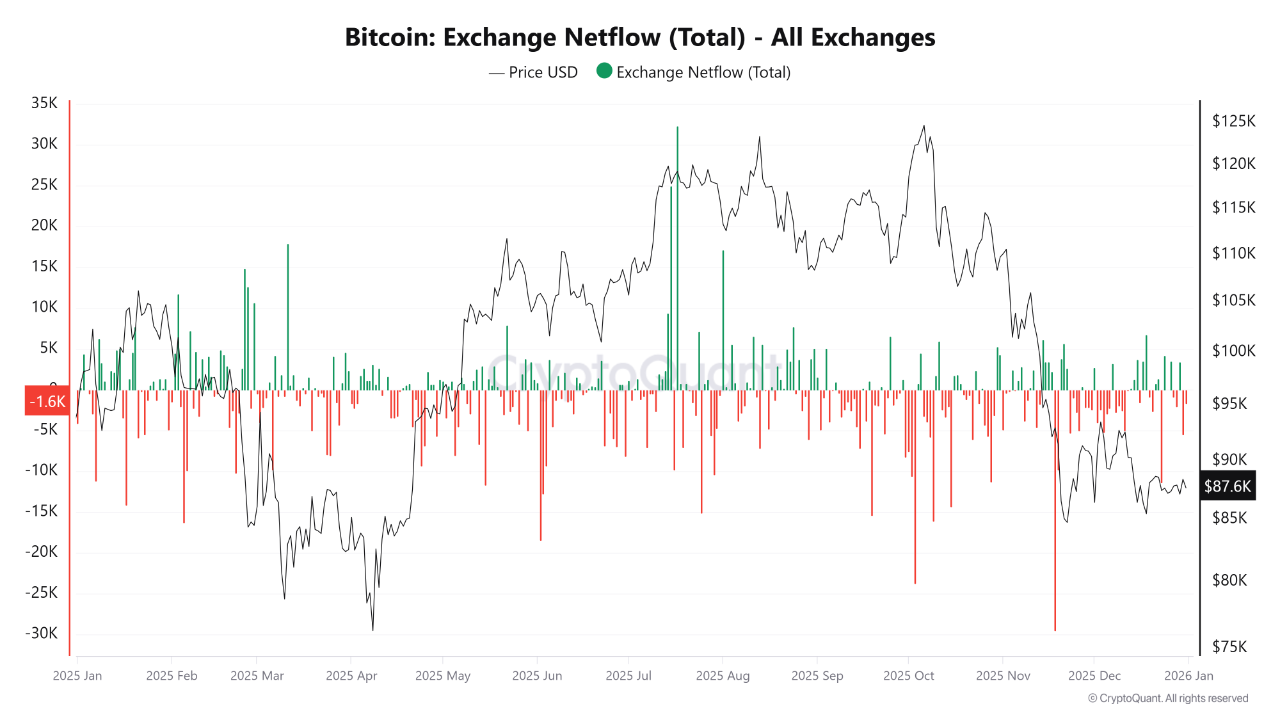

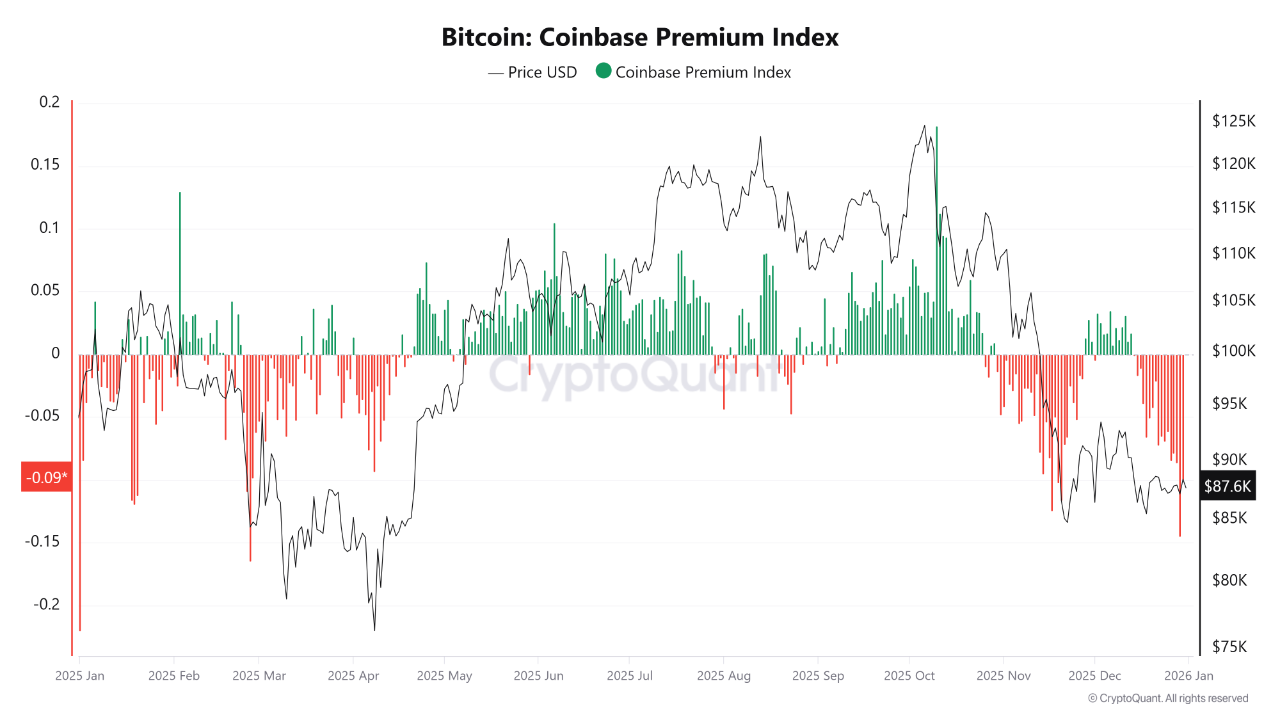

To determine which scenario will play out, CryptoQuant stated that market participants should focus on exchange reserves, net flows, weekly ETF flows, futures open interest (OI) and liquidations, and short-term holders and long-term holders metrics. The analyst added that the key is how these indicators move together, not individually.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Why Experts Are Warning Bitcoin Rally Could Be A “Dead Cat Bounce”

- BTC and Gold Price Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs