“Bitcoin Dead” Google Searches Reach All-Time High Last Weekend, Time to Buy?

Last weekend, Bitcoin (BTC) took a dip under $18,000 putting the entire market in the mode of absolute panic. Interestingly, the “Bitcoin Dead” searches on Google also touched an all-time high over the last weekend.

Popular market analyst Alex Kruger also found that the “crypto is dead” searches also reached their all-time high.

Google searches for "bitcoin dead" hit all time highs over the weekend. pic.twitter.com/oDXNqGEeIL

— Alex Krüger (@krugermacro) June 20, 2022

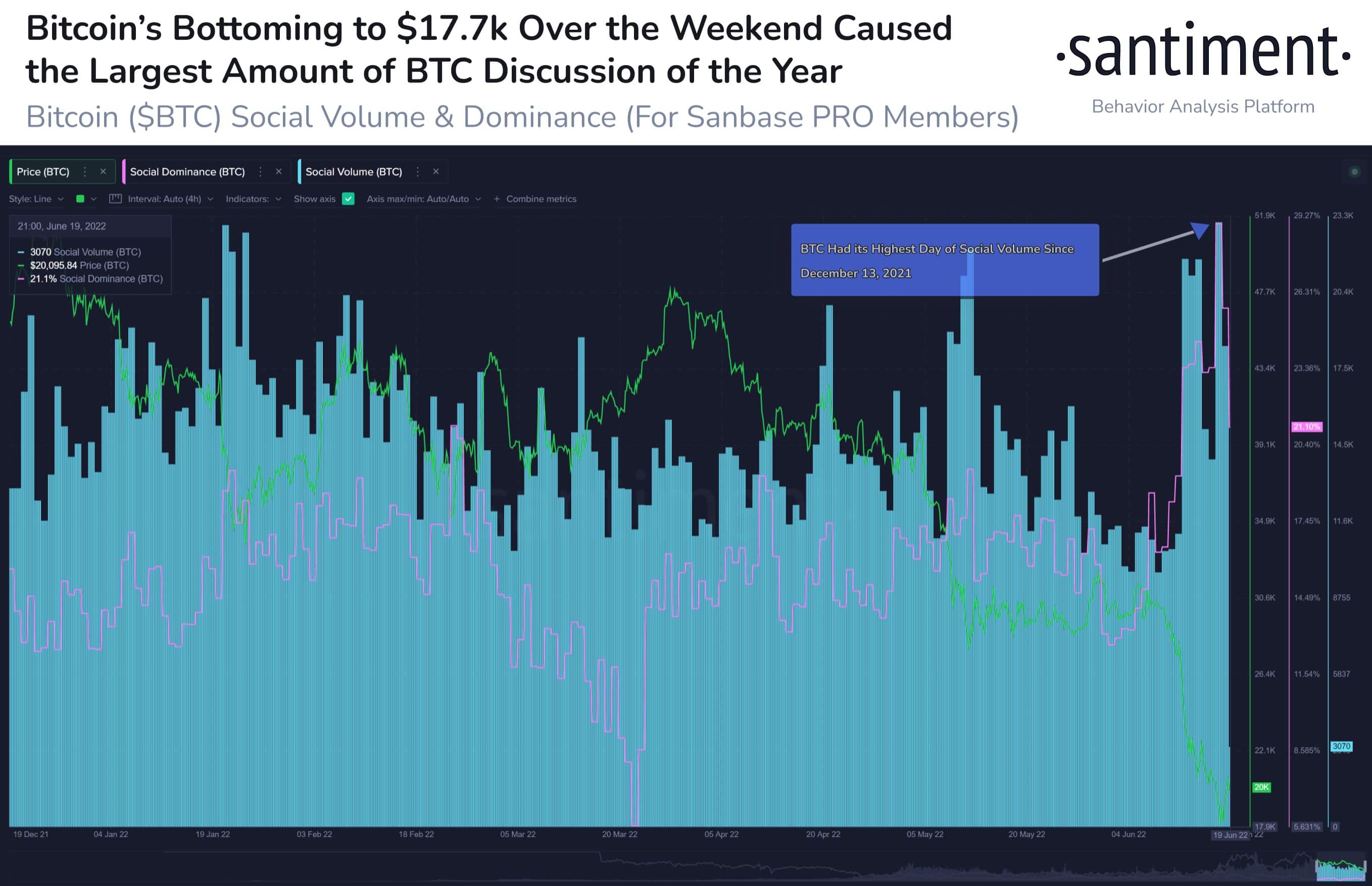

Binance CEO Changpeng Zhao also said that “Historically speaking, if you bought Bitcoin every time there is a “bitcoin is dead” headlines, you would have done well. Logic: when they lose hope, that’s when the bottom is in”. On-chain data provider Santiment explains:

“Bitcoin’s plummet to $17.7k this weekend brought out the most discussion related to the #1 market cap asset in 2022. We often see major price reversals correlate precisely with high social volume rates, and $BTC has jumped +15.8% since”.

Bitcoin Bottom or No Bottom – Why One Should Start Buying?

Very few people have ever managed to predict the bottoms of the bear market cycle. After last weekend’s drop to under $18,000, the BTC price has recovered and is currently staying above $20,000.

Popular market analyst Rek Capital explains that this could be the best time for Dollar Cost Averaging (DCA) instead of waiting for the next Bitcoin bottom. He wrote:

“Many BTC indicators are suggesting that we are close to an absolute bottom in this macro bottoming period But the more confluence we get, the more there is an emotional urge to focus on the one or two metrics that suggest that $BTC could go lower Dollar-Cost Averaging helps”.

He further notes that it would be better to average down Bitcoin from the current levels and hold the amount until the next bull cycle i.e. at least for 4-5 years from now. The analyst further writes: “Bitcoin data science shows that anything below $35,000 is an area that has historically yielded outsized ROI for long-term Bitcoin investors Which is why anything below $20,000 is a gift”.

Bitcoin can certainly head lower concerning the global macro scenario. The Fed is likely to announce more interest rate hikes and there’s every chance of the U.S. slipping into recession. However, it would make sense for investors to start capital of their bags and maintain the investment discipline.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Ethereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

- Analyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

- U.S.-Iran War: Trump Threatens to Hit Iran ‘Very Hard’ Today as Bitcoin Faces New Selling Pressure

- Crypto Market Weekly Recap: US-Iran War Steer Crypto Prices, Kraken Gets Fed Master Account, Tokenization Push March 2-6

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

Buy $GGs

Buy $GGs