Breaking: Massive Bitcoin ETF Inflows As Supply Dynamics Pushing BTC Price Towards $55K

Highlights

- Spot Bitcoin ETFs saw net inflow of $493.3 million

- BlackRock (IBIT), Fidelity (FBTC), and Ark 21Shares Bitcoin ETF recorded the largest inflows

- Outflows continues from GBTC and Invesco Galaxy Bitcoin ETFs

- Bitcoin price can hit $55K amid massive demand

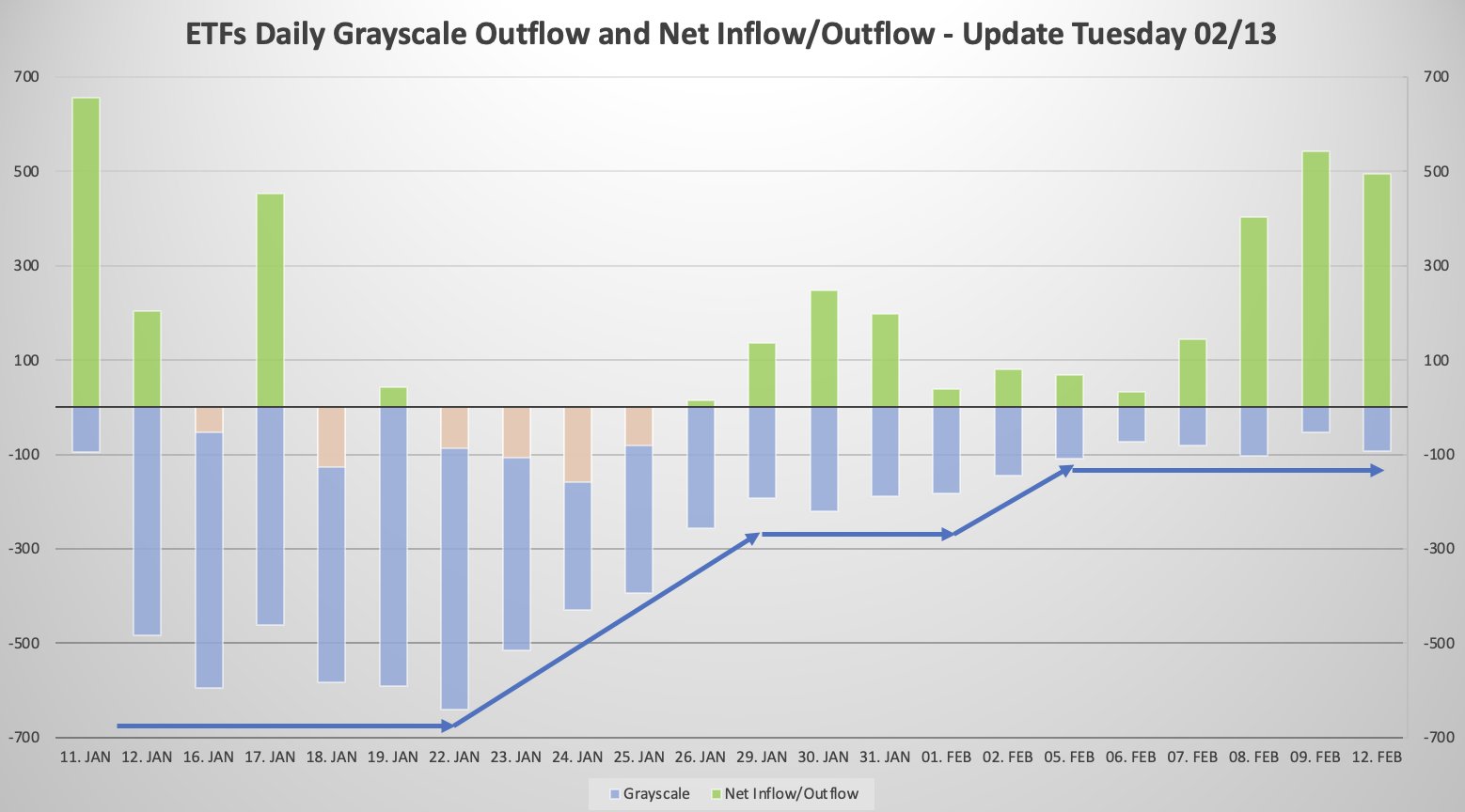

Spot Bitcoin ETFs saw another massive inflow of $493.3 million on Monday, the third-largest net inflow to date, as BTC price breaks above $50,000. Experts believe BTC price rally will continue amid demand build-up from Bitcoin ETFs and derivatives traders.

Spot Bitcoin ETF Saw $493.3 Million Net Inflow

The new nine and Grayscale’s GBTC spot Bitcoin ETF started the week strongly with a $493.3 million net inflow on February 12, according to the latest Bitcoin ETF flow data.

BlackRock (IBIT) recorded a record inflow of $374.7 million, with total inflow reaching over $4.126 billion. BlackRock Bitcoin ETF now has asset holdings worth $4.76 billion.

Fidelity (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF inflows were $151.9 million and $40 million, respectively. Bitwise (BITB), VanEck (HODL), and others also saw significant inflows. However, Invesco Galaxy Bitcoin ETF (BTCO) witnessed another outflow of $20.8 million.

Moreover, GBTC saw a $95 million outflow, an increase from Friday’s 51.8 million outflow, but it is aligned with last week’s range.

Thus, the net inflow for spot Bitcoin ETFs, excluding GBTC, was $589 million. The total inflows for BlackRock and Fidelity Wise Origin Bitcoin ETFs are $4.12 billion and $3.15 billion, respectively. The ETFs are buying 10k Bitcoin per day on top of the standard equilibrium and this is reflected in the price appreciation.

Also Read: Key Reasons Why BTC Soars Past $50K

Bitcoin Price Outlook

BTC price rose beyond $50,000, with high odds of breaking $55,000, which corresponds with a notable flow into Bitcoin ETFs. Crypto Fear & Greed Index hit “extreme greed” with a value of 79, the highest since November 2021.

Bitcoin ETF saw a net inflow of $542 million on Friday as investors FOMO the move towards all-time high. The demand from Bitcoin ETFs and derivatives traders continues to rise, but the supply from miners remains low. The paradigm shift in supply dynamics are causing institutional investors to be super bullish on Bitcoin.

Bitcoin derivatives traders are even making call bets for as high as $70,000 for the month end. Experts believe new buyers may not get the opportunity to buy BTC under the $50K price if demand remains higher in pre-Bitcoin halving trades.

Read More: Wall Street Estimates for US CPI and Core CPI, Bitcoin (BTC) Price To $45K or $55K?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Trump Says The U.S.-Iran War Could End Soon, Mulls Taking Over Strait Of Hormuz

- Bhutan Dumps More Bitcoin as BTC Price Climbs Amid Falling Oil Prices

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

Buy $GGs

Buy $GGs