Bitcoin ETF Witness $405 Mln Inflow Amid BTC Price Rally To $48K

Highlights

- U.S. Spot Bitcoin ETF witnesses a $405 million inflow amidst Bitcoin's surge to $47,000.

- BlackRock and Fidelity lead ETF inflows, attracting billions since launch.

- Bitcoin Futures Open Interest spikes, reflecting growing confidence in digital asset's potential.

Bitcoin’s rise beyond $47,000 and nearing $48,000 corresponds with a notable $405 million inflow into the U.S. Spot Bitcoin ETF on February 8, as reported by BitMEX Research. This surge in funds, the largest of the week, aligns with the current Bitcoin price rally, piquing interest and speculation among investors and enthusiasts.

Bitcoin ETF Attracts $405 Mln Inflow

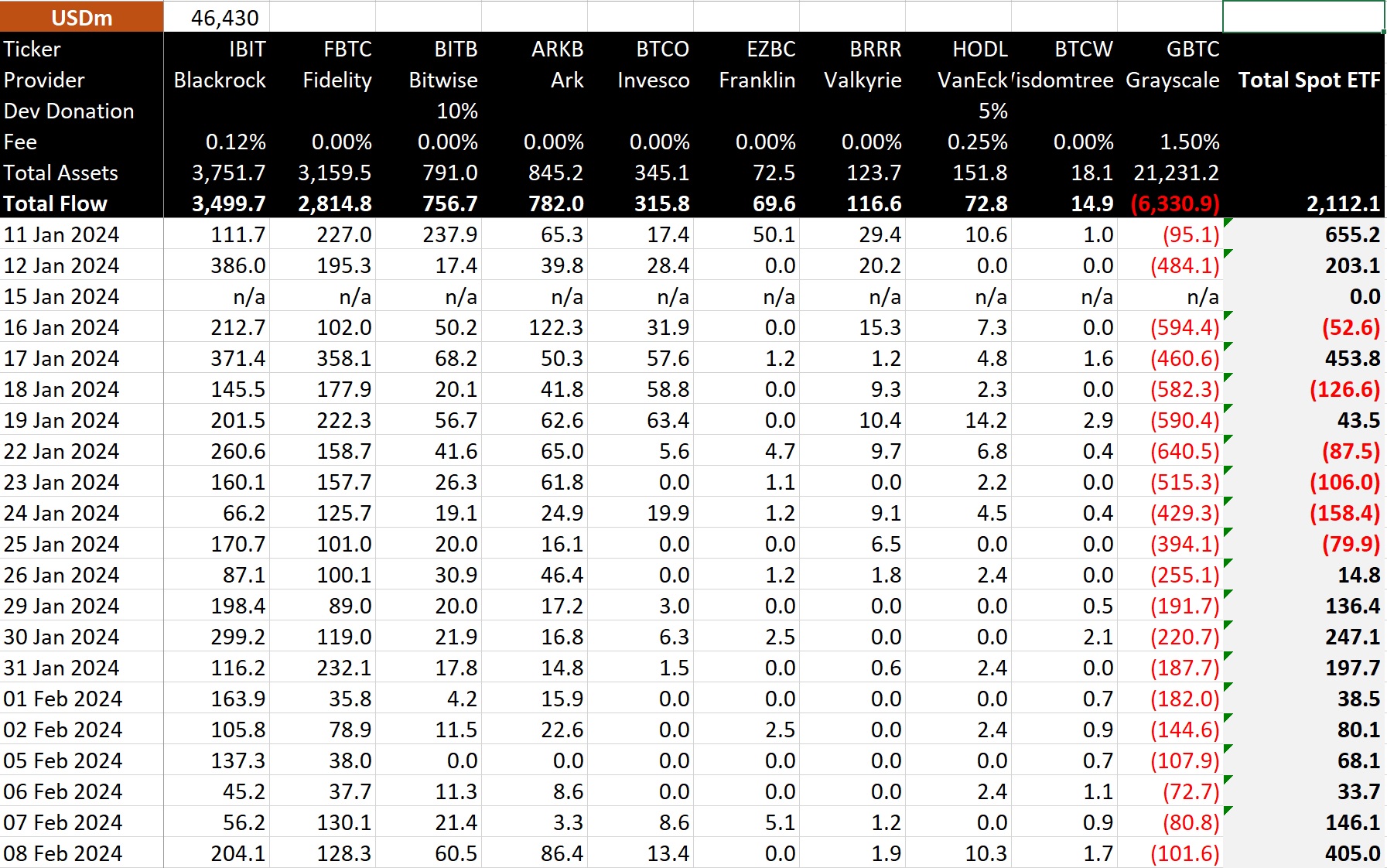

A recent report from BitMEX Research showed that the U.S. Spot Bitcoin ETF continued to attract notable inflow, despite facing challenges in the initial days. Meanwhile, data reveals that the Bitcoin ETF has garnered a total inflow of $2.11 billion since its launch on January 11.

Notably, on February 8 alone, the ETF saw an inflow of $405 million, equivalent to approximately 8,935 BTC. Leading the charge in terms of inflows are investment giants BlackRock (IBIT) and Fidelity (FBTC).

Since its inception, BlackRock ETF has attracted around $3.5 billion in inflows, while Fidelity has seen $2.81 billion flow into its ETF. On February 8, BlackRock noted an inflow of $204.1 million, with Fidelity recording $128.3 million in inflows.

However, the report also showed that the performance of Grayscale’s Bitcoin Trust (GBTC) has weighed on the overall market sentiment, with outflows totaling $6.33 billion since January 11 and $101.6 million on February 8.

Also Read: Space ID Crypto- Trader Moves 5 Mln ID To Binance As Price Soars 17%

Market Optimism Amid Bitcoin (BTC) Price Rally

The report of significant inflows into the Bitcoin ETF coincides with a period of heightened market optimism, as Bitcoin’s price rallies over 4% in the last 24 hours. Investors eagerly await the digital currency’s potential surge past the $48,000 mark. Notably, this recent rally has fueled speculation among enthusiasts, with some attributing it to a pre-halving rally.

Adding to the bullish sentiment is the surge in Bitcoin Futures Open Interest (OI), which has risen by 5.51% in the last 24 hours to reach 444.81K BTC or $20.74 billion, according to CoinGlass data. Leading the charge in OI growth is the CME exchange, which saw a surge of 9.79% to 117.23K BTC or $5.46 billion. Binance follows closely behind with a 5.78% increase to 109.76K BTC or $5.12 billion in the same timeframe.

As Bitcoin continues to capture the attention of investors and enthusiasts worldwide, the convergence of ETF inflows, price rallies, and increasing futures open interest underscores the growing confidence in the digital asset’s potential for further growth and adoption.

Meanwhile, the Bitcoin price was up 6.31% during writing and traded at $47,467.77 over the last 24 hours, its highest level since January 11. Its trading volume also witnessed a significant jump of 19% to $29.48 billion at the same time. Notably, the flagship crypto has touched a low of $44,600.46 in the last 24 hours.

Also Read: Pi42 Launches DOGE, Cardano, AVAX, & LINK Pairs – What’s Next?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs