Bitcoin ETF Notes $66M Inflow With Fidelity’s FBTC Support

Highlights

- Bitcoin ETFs see a $66M inflow, led by Fidelity's FBTC, reversing the recent outflow trend.

- Fidelity's FBTC attracts a $38.6M inflow, with Bitwise Bitcoin ETF BITB following.

- Renewed investor confidence in Bitcoin ETFs coincides with market recovery.

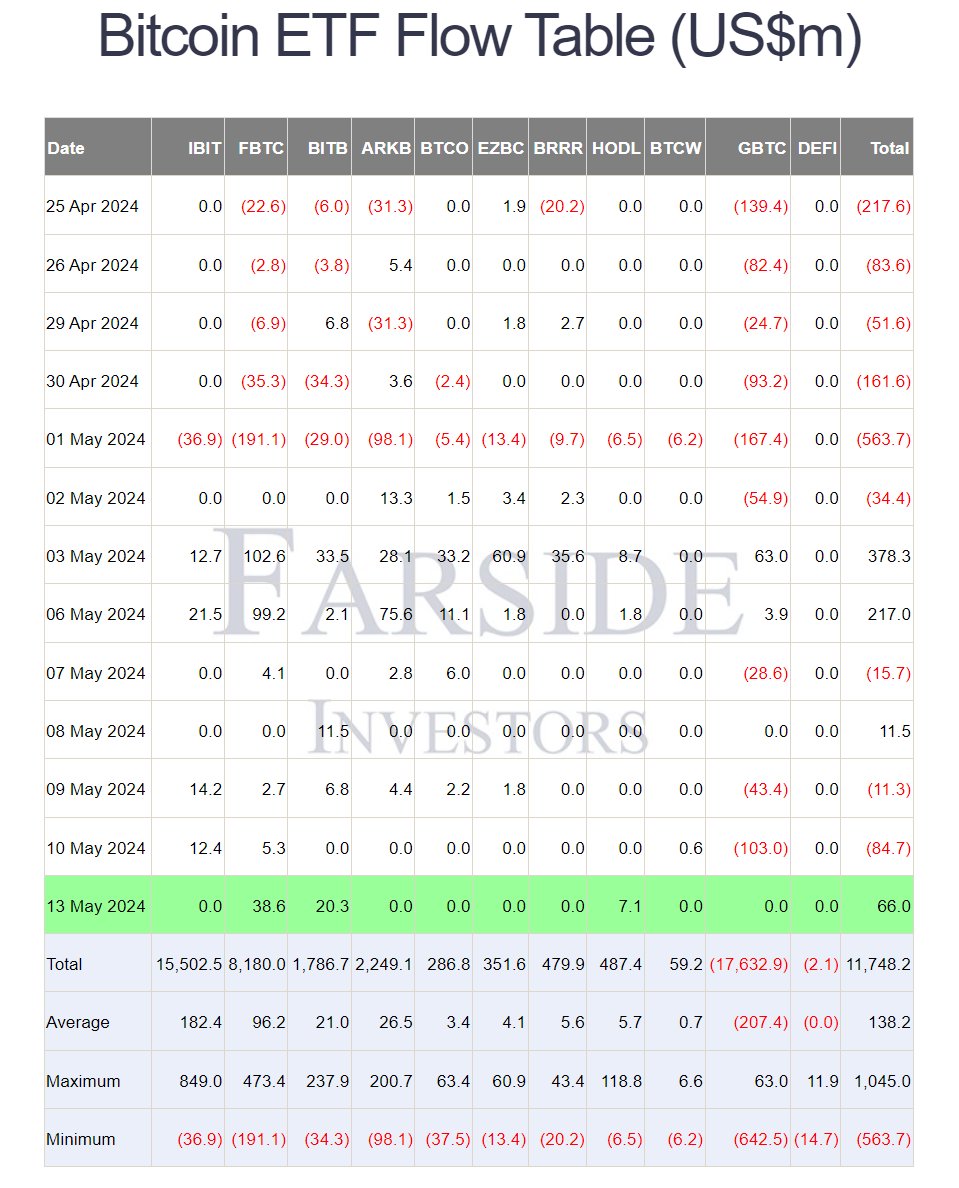

The U.S. Spot Bitcoin ETF sector witnessed a resurgence with a notable $66 million influx, reversing the previous week’s outflow trend for the last two days. Notably, the recent data shows that Fidelity’s FBTC leads the inflow today, signaling renewed investor interest in crypto-backed exchange-traded funds. Besides, the inflow also comes amid a recovery in the Bitcoin price.

Fidelity’s FBTC Leads Bitcoin Inflow Surge

Following two consecutive days of outflow, the Bitcoin ETF market witnessed a turnaround with a significant $66 million net inflow, as reported by Farside Investors. Notably, Fidelity’s FBTC emerges as the frontrunner, attracting $38.6 million in inflows, followed by Bitwise Bitcoin ETF BITB with $20.3 million.

Meanwhile, the recent influx also reflects the renewed confidence of the traders in Bitcoin ETFs. Besides, it also coincides with a recovery in Bitcoin’s performance, which surged past the $63,000 mark recently. Notably, this resurgence in investor interest comes amid heightened volatility in the overall market, indicating a renewed appetite for cryptocurrency investments.

It’s worth noting that the net inflow of $66 million on May 13 marks a positive shift after two days of negative flows. However, while no ETF experienced outflows, seven out of ten US Bitcoin ETFs, including Grayscale and BlackRock offerings, reported zero flows.

Meanwhile, over the last 30 trading days, the ten Bitcoin ETFs saw a net outflow of $297 million, with outflows recorded on 17 of those days.

Also Read: Meme Coin Party Begins After GameStop Rally, Adds $5 Billion To Index

Crypto Market Performance

The influx of $66 million into Bitcoin ETFs signals a renewed bullish sentiment among investors, bolstered by Fidelity’s FBTC garnering the lion’s share of inflows. Notably, with Bitcoin’s price rebounding and analysts providing optimistic forecasts, the cryptocurrency market appears poised for further growth and stability in the coming days.

As of writing, the crypto market noted a surge of 0.37% to $2.27 trillion, while its overall trading volume rose 50% to $71.79 billion. Meanwhile, the Bitcoin price noted slight gains of 0.33% over the last 24 hours, trading at $61,876.45 at the same time.

Meanwhile, the BTC price has touched a high of $63,422.66 and a low of $61,400.88 over the last 24 hours, reflecting the still-volatile scenario hovering over the market.

Also Read: Coinbase Investigates System-Wide Outage, Here’s All

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible