Bitcoin ETFs Attract $332M Inflow, Outshining Ethereum as BTC Price Rebounds

Highlights

- Bitcoin ETFs record $332.7 million net inflows, outpacing Ethereum ETFs.

- BTC price rebounds from $107,250 to $111,700, recovering from recent downturn.

- Analyst Ali Martinez warns BTC faces resistance at $110,700, risking drop to $107K.

The BTC price has rebounded following its recent market downturn. This comes as Bitcoin ETFs record $332 million inflows, outpacing Ethereum ETFs. It signals a clear rotation of institutional demand back toward the No. 1 cryptocurrency.

Bitcoin ETFs Outpace ETH ETFs With Fresh Inflows

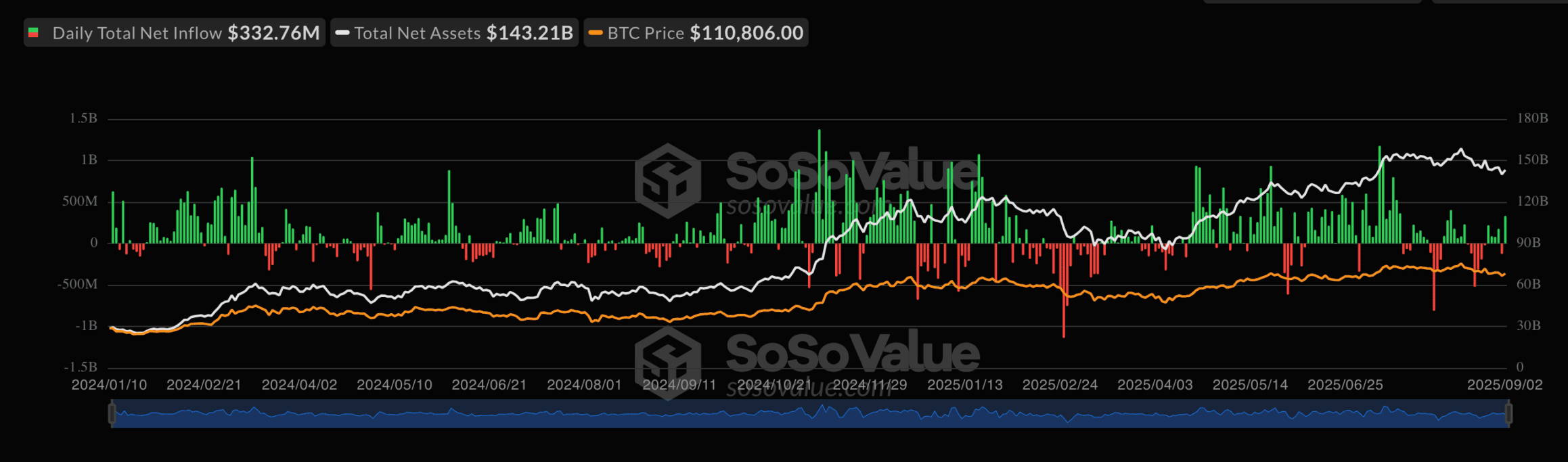

Bitcoin ETFs have outperformed ETH ETFs after it saw a net inflow of $332.7 million on Tuesday, according to SoSoValue. Fidelity’s FBTC led the surge with $132.7 million, followed by BlackRock’s IBIT at $72.8 million. Other funds, including those from Ark & 21Shares, VanEck, Invesco, Bitwise, and Grayscale, also attracted new capital.

In contrast, spot Ethereum ETFs suffered a daily outflow of $135.3 million. This has been led by Fidelity’s FETH, which lost $99.2 million. Bitwise’s ETHW fund also saw $24.2 million in withdrawals. The diverging flows show how institutional investors are increasingly favoring Bitcoin exposure over Ethereum at this stage of the market.

As CoinGape previously reported, Ethereum ETFs recorded outflows of $164 million as the token’s price slipped below $4,300. This is a significant reversal from just days earlier, when BlackRock’s Ethereum ETF absorbed nearly $315 million worth of ETH in a single session.

BTC Price Rebounds Amid Market Rotation

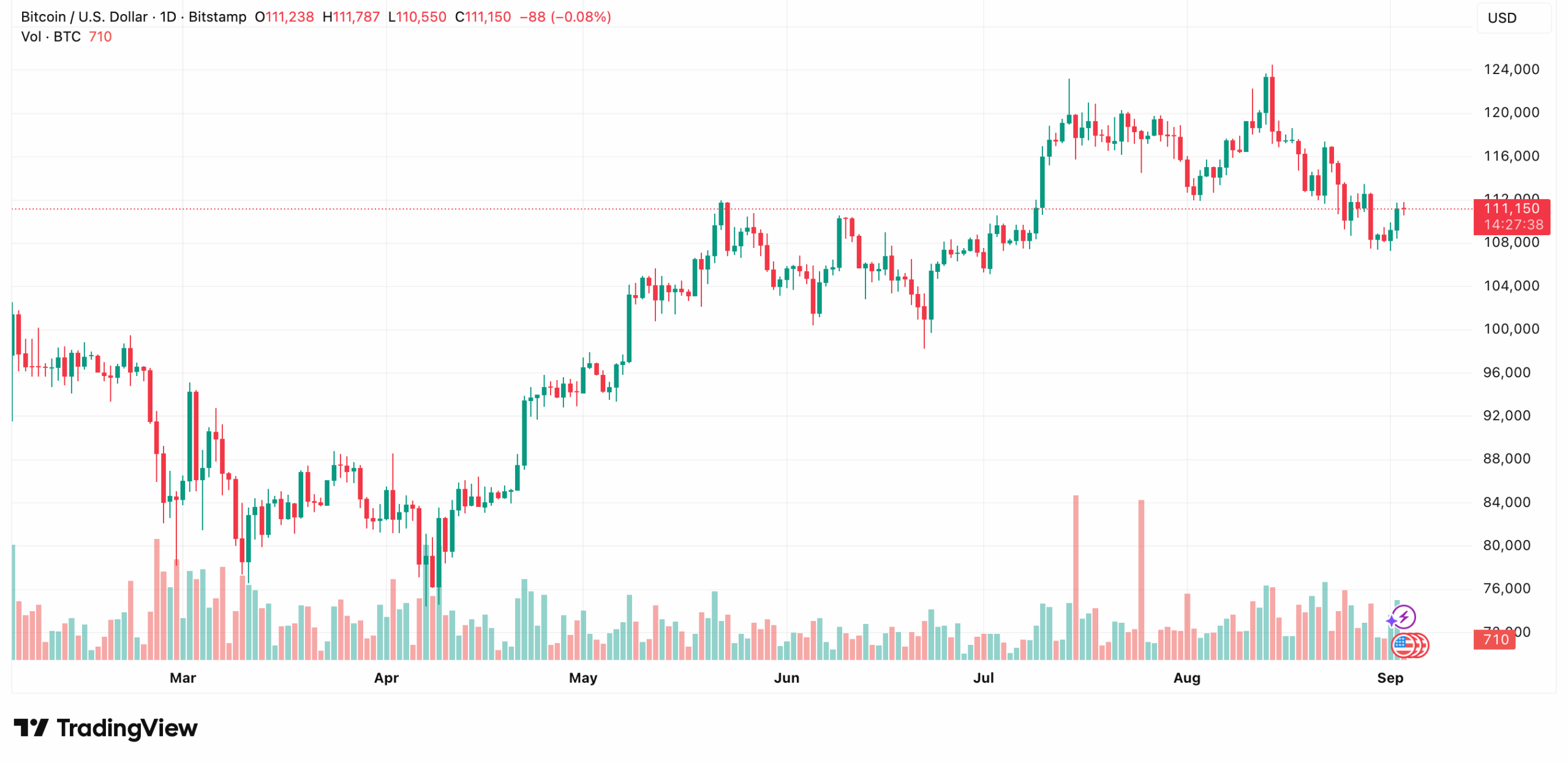

The BTC Price has staged a recovery following these inflows, bouncing from lows of $107,250 to trade near the $111,700 range.

Crypto Patel, a Key Opinion Leader, shared that ETFs now collectively hold around 7% of Bitcoin’s supply. BlackRock alone manages over 746,000 BTC, making it the largest Bitcoin ETF operator globally.

ETFs now hold 7% of Bitcoin's total supply.

Leading the pack, BlackRock controls 746,810 BTC, cementing its position as the largest Bitcoin ETF holder.

Institutional demand continues to shape BTC price action, making their influence stronger than ever. pic.twitter.com/U6B2j7OfTr

— Crypto Patel (@CryptoPatel) September 3, 2025

Notably, Strategy recently purchased 4,048 BTC for $449.3 million at an average price of $110,981. With this acquisition, the firm’s total holdings climbed to 636,505 BTC, worth nearly $47 billion.

It is also worth mentioning that governments are now accumulating Bitcoin. Blockchain analytics firm Arkham revealed that the UAE is a top-four sovereign Bitcoin holder. They oversee more than 6,300 BTC through their state-backed Citadel Mining operation. At current valuations, the UAE’s stash is worth about $740 million.

Despite the rebound, crypto analyst Ali Martinez shared that Bitcoin is struggling against resistance at $110,700, with repeated rejections at that level. He noted that failure to break higher could send the BTC Price back to $107,200, or even $103,000, before a sustained breakout occurs.

The strong inflows into Bitcoin ETFs highlight new institutional confidence. Given its recent price decline, Ethereum’s weaker fund flows indicate that investors are being cautious. Some analysts believe this could present a dip-buying opportunity. Bitcoin, however, shows more bullish momentum.

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?