Bitcoin, Ethereum Drag Broader Crypto Market Lower Ahead of FED Powell Speech

Highlights

- Crypto market bracing for volatility ahead of Fed Chair Jerome Powell's speech today.

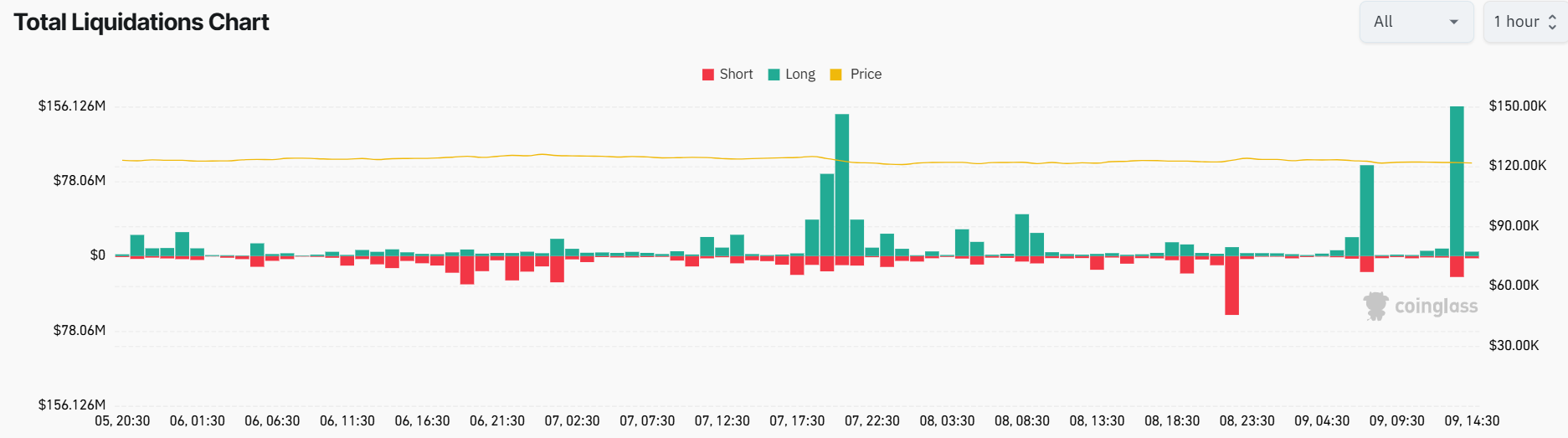

- Bitcoin and Ethereum dragging lower as $156 million in long positions were liquidated in an hour.

- CME FedWatch tool showed two Fed rate cuts this year.

- Analysts predict Bticoin and Ethereum prices could fall amid sell signals.

Bitcoin and Ethereum are dragging lower amid massive volatility ahead of Fed Chair Jerome Powell’s speech today. Comments on dovish monetary policy amid the U.S. government shutdown and the mention of further Fed rate cuts could set the tone for crypto market recovery.

Crypto Market Awaits Fed Chair Jerome Powell’s Speech

Broader crypto market recovery after a dovish FOMC Minutes release indicated that traders are pressing for further upside momentum. However, BTC and ETH prices have dropped again ahead of Fed Chair Jerome Powell’s speech at 8:30 AM ET at the Community Bank Conference.

FOMC Minutes data revealed that most FED officials support easing monetary policy further this year. With key economic data reports on hold amid the US government shutdown, markets rely on Powell’s speech to offer hints of further Fed rate cuts.

CME FedWatch tool showed two Fed rate cuts this year, with a 25 bps rate cut in October and another rate cut in December. The probability of a 25 bps rate cut by the central bank is 80% in December.

Also, the U.S. Dollar Index (DXY) climbed above 99 today, hitting a 2-month high. The 10-year US Treasury yield surpassed 4.13. This happens due to “debasement trade” amid the US government shutdown, as investors shift toward gold, silver, and Bitcoin.

Bitcoin, Ethereum Records Massive Liquidations

Over $156 million in long positions were liquidated in an hour, with Bitcoin and Ethereum dragging the broader crypto market lower. Over $550 million in total liquidation was recorded in the last 24 hours. This comes as a day after $700 million in liquidations caused a crypto market crash on Wednesday, according to Coinglass data.

More than 155K traders were liquidated in the last 24 hours, with the largest single liquidation order of BTCUSDT worth $8.53 million on crypto exchange Binance. Notably, more than $360 million in long positions and $180 million in short positions were liquidated over the last 24 hours.

Analysts’ Prediction on Bitcoin and Ethereum Direction

Crypto analyst Michael van de Poppe claimed that if Bitcoin gains upside momentum, “probably we’ll see another dip in Ethereum.” ETH/BTC on the daily timeframe is trading below the 20-MA. He predicts 0.0325 as the ideal buying zone for ETH.

Bitcoin bullish sentiment is supported by spot Bitcoin ETF inflows. However, popular analyst Ali Martinez highlights BTC sell signals, with RSI and the ChandeMO flashing overbought signs. The RSI touched 74.21 and ChandeMO has reached 100.

Moreover, the TD Sequential flashed a sell signal on the BTC daily chart. “Historically, this signal has been fairly reliable,” he added. The last time it flashed a sell signal, BTC price fell 13%.

Bitcoin price is trading at 1% lower at $121,779. The 24-hour low and high are $121,191 and $124,167, respectively. Whereas Ethereum price fell over 3% to $4,336, with an intraday low and high of 4,324 and 4,556, respectively.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S. Federal Reserve, OCC Approves Banks to Handle Tokenized Securities With New Capital Rules

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs