Bitcoin, Ethereum Options Worth $2.2B Set to Expire Tomorrow Amid Potential Trump Tariffs Ruling

Highlights

- A massive $2.2 billion crypto options expiration could keep Bitcoin’s price stuck near $90,000.

- Ethereum options set up suggests an uptrend in price movements following contract expirations.

- A Supreme Court ruling on Trump tariffs which often drives crypto volatility could create macroeconomic uncertainty in the market.

Around $2.2 billion in Bitcoin and Ethereum options will expire on Deribit tomorrow at 08:00 UTC. This will happen as the market awaits a Supreme Court decision on Trump-era tariffs. The two events are likely to influence short term price action of the most popular cryptocurrencies.

Why Bitcoin May Not Break out of $90,000?

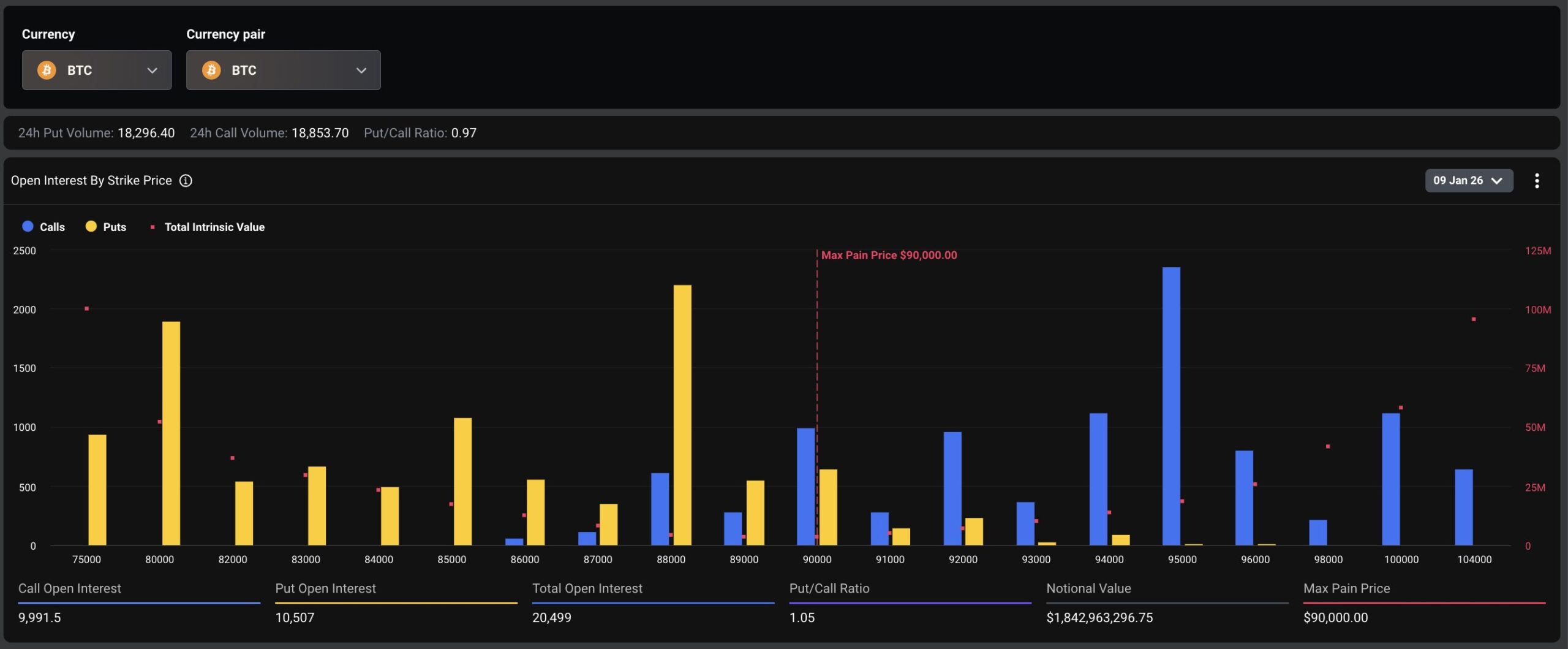

Deribit options data indicates non-aggressive but rather steady price movements. With an approximate of $1.84 Billion nominal value, the amount of Bitcoin options that will expire is the highest. Deribit has a put-to-call ratio for it at about 1.05.

This is a cautious but optimistic expectation and the max-pain limit is within the $90,000 range. In addition, open interest shows that a high number of put positions are below $85,000.

There is an increase in Calls and it’s between $90,000 and $100,000, resulting in pin risk around $90,000. The same trends were observed in a recent BTC, ETH, XRP, and SOL max pain analysis.

Pin risk can make spot prices move close to the max-pain point before expiry. Thus, Bitcoin might not move out of this $90,000 range until settlement of all contracts. Sharp moves generally happen after expiry. This demonstrates that derivatives are driving short-term price behavior of Bitcoin.

Ethereum Options Suggest Price Gains After Expiry

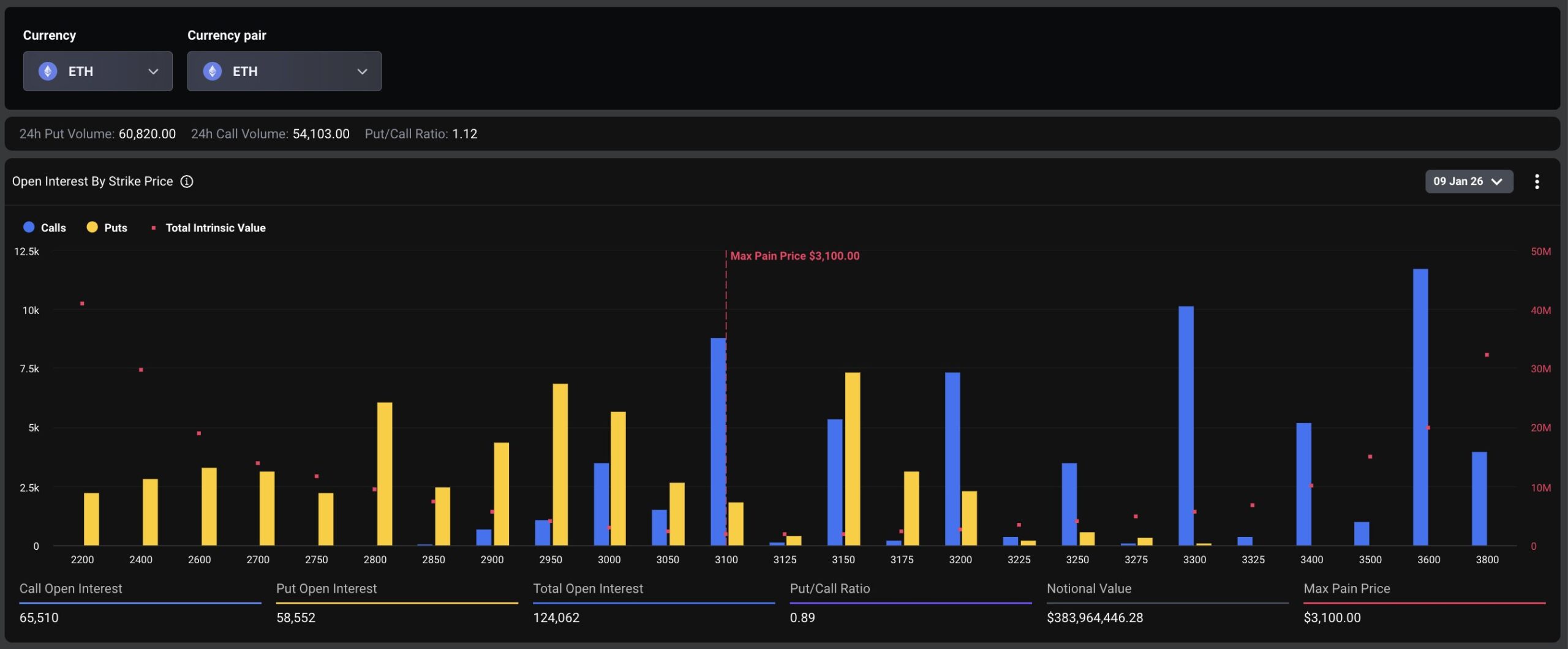

The ETH options set up indicates a different scenario compared to Bitcoin. There is about $384 million notional value with a put-to-call ratio of approximately 0.89. This shows that traders are betting more on price gains than declines.

The max-pain point of ETH is approximately with $3,100, with call options concentrated in the zone above $3,000. If ETH price remains above the max pain point, there could be a shift in hedging dynamics.

Such conditions can enable the token continue its uptrend after the expiration. Traders usually reposition after hedges are removed. Ethereum hasn’t dropped below important price levels despite the pressure from options. Hence, it is likely to rise once this pressure fades.

What Does Trump Tariffs Ruling Mean for Crypto Markets?

In addition to the Bitcoin and Ethereum options expiry on Deribit, there is another factor that will affect the crypto market tomorrow. The U.S. Supreme Court has tentatively set Jan 9 to rule on Trump tariffs. The court will decide if the tariffs imposed under the emergency powers of the U.S. president are legal. Trump has requested the court to take a decision that favors him, saying that the tariffs are helpful for national and financial security.

According to the prediction markets, traders are betting that the court will rule against the tariffs. The odds show that it is likely that the ruling will be one that limits the powers of the current administration. That result from the court is expected to create short-term macro risks.

Crypto market remains responsive to changes in trade policies. Last year, when the tariff announcements were made, BTC price dropped to approximately $74,000. Later prices rebounded following progress in trade talks but the incident showed the vulnerability of crypto to macro events.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

Buy $GGs

Buy $GGs