Bitcoin, Ethereum To Rise Amid Positive US Fed & Inflation Data or Fall As Market Makers Exit

Bitcoin and Ethereum prices showing resilience amid positive macro factors. However, the market conditions remain bleak due to US SEC lawsuits against Binance and Coinbase and selling pressure on Cardano, Solana, and Polygon (MATIC).

Investors are bracing for the big week ahead with key events including US CPI, PPI data, and the US Federal Reserve’s monetary policy decision, as well as interest rate decisions by the European Central Bank and Bank of Japan.

Stock markets are inching toward fresh 52-week highs after new market forecasts indicate inflation cooled in May and the US Fed plans to “skip” rate hike in June. Chair Jerome Powell and key Fed officials also support skipping rate hikes. The CME FedWatch Tool shows an 80% probability of the Fed keeping its policy rate unchanged.

Moreover, US treasury yields remain firm and the US dollar slides, bringing some upward momentum in Bitcoin price. US Dollar Index (DXY) fell below 103.50 on Monday.

Also Read: Terra Luna Classic Developer L1TF All Set For v2.1.1 Parity Upgrade

Internal Problems Still Haunts Bitcoin and Ethereum Price

Despite positive developments on the macro front, Bitcoin and Ethereum prices fail to show strong price action due to uncertainty surrounding Binance and Coinbase lawsuits.

The key events for the crypto include a US House hearing on the digital asset industry and the draft stablecoin bill, Hinman documents becoming public, SEC’s Coinbase rulemaking response, and the Binance.US hearing on assets freeze. All are scheduled for Tuesday, June 13.

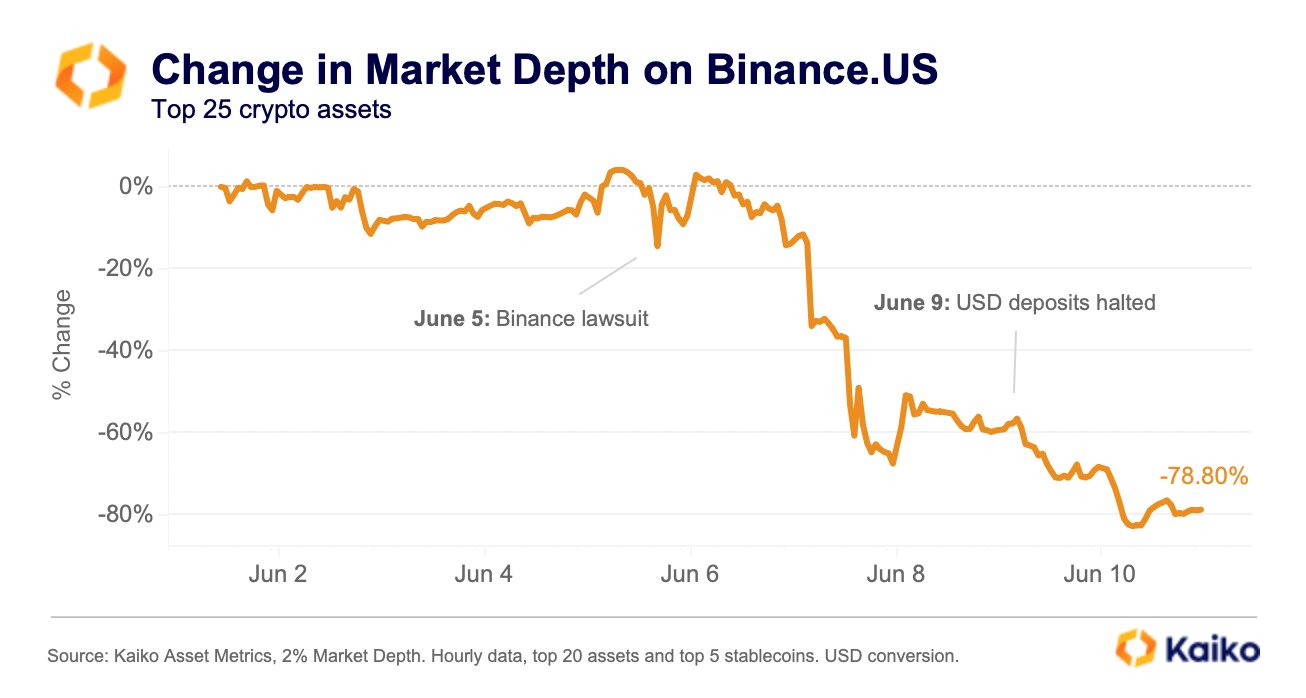

According to Kaiko data, Binance.US market depth is down a staggering 78% since the SEC lawsuit. Marker makers pulled out liquidity after Binance.US ended USD support on the exchange.

Moreover, Bitcoin and Ethereum prices will remain under pressure as the US Treasury Dept is expected to issue $1 trillion in treasury bills by the end of the third quarter.

BTC price is expected to bounce, but it will unlikely cross $30,000 before August due to several factors. BTC price jumped 1% in the last 24 hours, with the price currently trading near $26,000.

ETH price currently trades at $1747. The 24-hour low and high are $1722 and $1776, respectively. (Crypto Price Converter)

Also Read: Registered Crypto Exchange Lists Shiba Inu (SHIB) Ecosystem’s BONE Token

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act