Breaking: Bitcoin, Ethereum, & XRP Usher $1.18 Billion In Crypto Funds Inflow

Bitcoin, Ethereum, and XRP led the crypto funds’ inflows last week as spot Bitcoin ETFs made their Wall Street debut on January 11, a day after the U.S. Securities and Exchange Commission (SEC) approved all 11 spot Bitcoin ETFs at the same time. CoinShares head of research James Butterfill says it failed to break all-time high records.

Massive Bitcoin Inflows In Crypto Funds

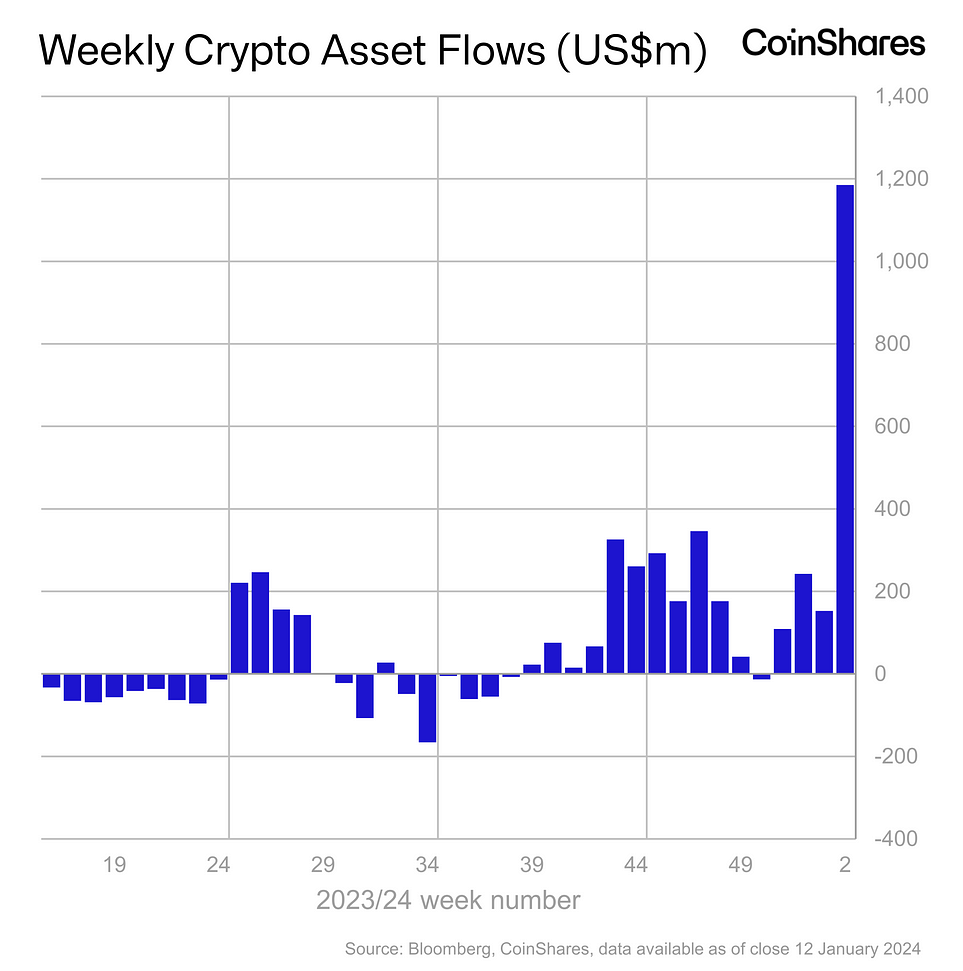

Crypto asset investment products saw $1.18 billion inflows (subject to T+2 settlement), according to CoinShares weekly report on January 15. Despite the huge spot Bitcoin ETF hype, it fails to break the $1.5 billion record of futures-based Bitcoin ETFs in October 2021.

However, crypto funds trading volumes soared record high of $17.5 billion last week. The average trading volume is $2 billion per week.

Bitcoin recorded a $1.16 billion inflows, representing 3% of total assets under management. Short-bitcoin also saw inflows of $4.1 million, with month-to-date inflows of $3.2 million. Experts anticipated a long-term profit of spot Bitcoin ETFs as some remain skeptical about spot Bitcoin ETFs despite bringing money back into the market.

Ethereum also saw inflows of $26 million indicating better investment fundamentals and high demand for its staking yield. XRP saw $2.2. million inflows in a week and $3.1 million in inflows month-to-date, the largest among altcoins.

However, Cardano and Solana inflows declined to just $1.4 million and $0.5 million. Altcoins such as Avalanche and Polkadot also recorded mere inflows as investors looked to other crypto assets.

The U.S. saw $1.24 billion of inflows last week, while Switzerland saw $21 million inflows. Germany, Canada, and Sweden recorded significant crypto asset funds’ outflows.

Also Read: Binance Files Joint Response To US SEC’s Terra Lawsuit Supplemental Authority

Crypto Performance Today

BTC price fell 1% in the past 24 hours, with the price currently trading at $42,592. Furthermore, the trading volume has increased by 40% in the last 24 hours, indicating a rise in interest among traders.

In contrast to Bitcoin, Ethereum saw prices rising above $2500. ETH price currently trades at $2537, with a 24-hour low and high of $2,470 and $2,545, respectively.

XRP price jumped 1% in the past 24 hours, with the price currently trading at $0.57. The 24-hour low and high are $0.574 and $0.592, respectively. Furthermore, the trading volume has increased by 90% in the last 24 hours.

Also Read: Cosmos Ecosystem Chains Affected By CosmWasm Vulnerability

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs