Bitcoin Tops $126,000 as Market Prices In Three-Week U.S. Government Shutdown

Highlights

- Bitcoin has reached a new all-time high, climbing above $125,500.

- This comes as the market participants bet on the U.S. government shutdown lasting up to three weeks.

- Investors are believed to be moving to BTC as a safe-haven asset as part of the debasement trade.

Bitcoin has reached a new all-time high (ATH), extending its current rally, which began at the start of October. This comes as market participants price in an extended U.S. government shutdown, which could last up to three weeks.

Bitcoin Reaches New ATH As U.S. Government Shutdown Persists

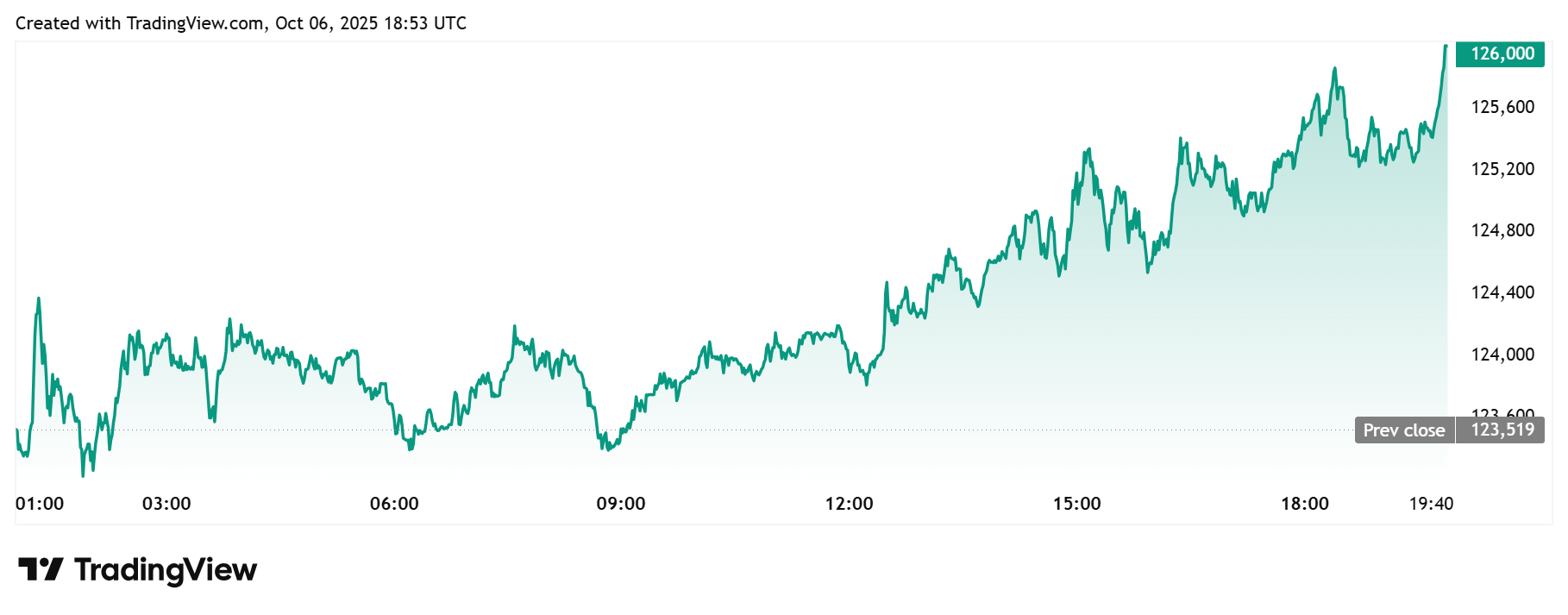

TradingView data shows that the flagship crypto has reached a new all-time high, trading above its previous ATH of $125,500, which it set yesterday. BTC is currently trading at around $126,000, up over 2% in the last 24 hours.

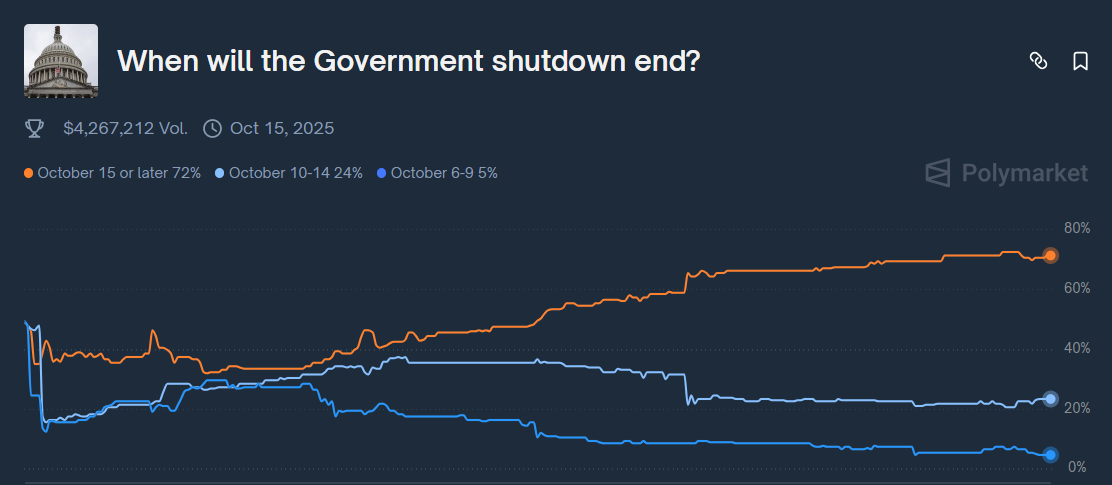

The Bitcoin rally to a new ATH comes as market participants price in an extended U.S. government shutdown. Polymarket data shows that there is currently a 72% chance that the shutdown will end by October 15 or later.

The U.S. government shutdown began on October 1, which coincided with the BTC price‘s surge from around $114,000. The flagship crypto is up almost 10% since the start of this month.

Investors are believed to be piling into Bitcoin as a safe-haven asset in what is now known as the ‘debasement trade’ to hedge against the current economic uncertainty. Notably, the shutdown has withheld key economic data releases, which has also had investors on edge.

As CoinGape reported, thanks to this debasement trade, the Bitcoin ETFs recorded their second-largest weekly inflows last week, taking in $3.24 billion. This marked a turnaround, as these funds had experienced mixed flows for some time.

How High Can The BTC Rally Extend?

Standard Chartered has predicted that this current BTC rally could lead to a surge to $135,000 soon, even as the shutdown persists. The banking giant also expects the flagship crypto to reach $200,000 by year-end, thanks to the ETF boom.

Polymarket data shows that there is a 68% chance that Bitcoin will hit $130,000 this month and a 38% chance that it will reach $135,000, as Standard Chartered predicted. Meanwhile, there is a 9% chance that BTC will hit $150,000, which will mark a historic milestone.

Crypto analyst Titan of Crypto predicted that BTC could rally above $135,000 this month. He noted that the flagship crypto is grinding up a channel, with the trend pointing to a rally above the $135,000 target before the end of this month.

#Bitcoin grinding up the channel 🚀

Trend is your friend. 📈 pic.twitter.com/M0DGSEl096

— Titan of Crypto (@Washigorira) October 5, 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs