Bitcoin Falters as China Pushes Risk-Off, Orders Banks to Sell US Treasuries

Highlights

- China orders banks to reduce and sell US treasuries amid volatility risks.

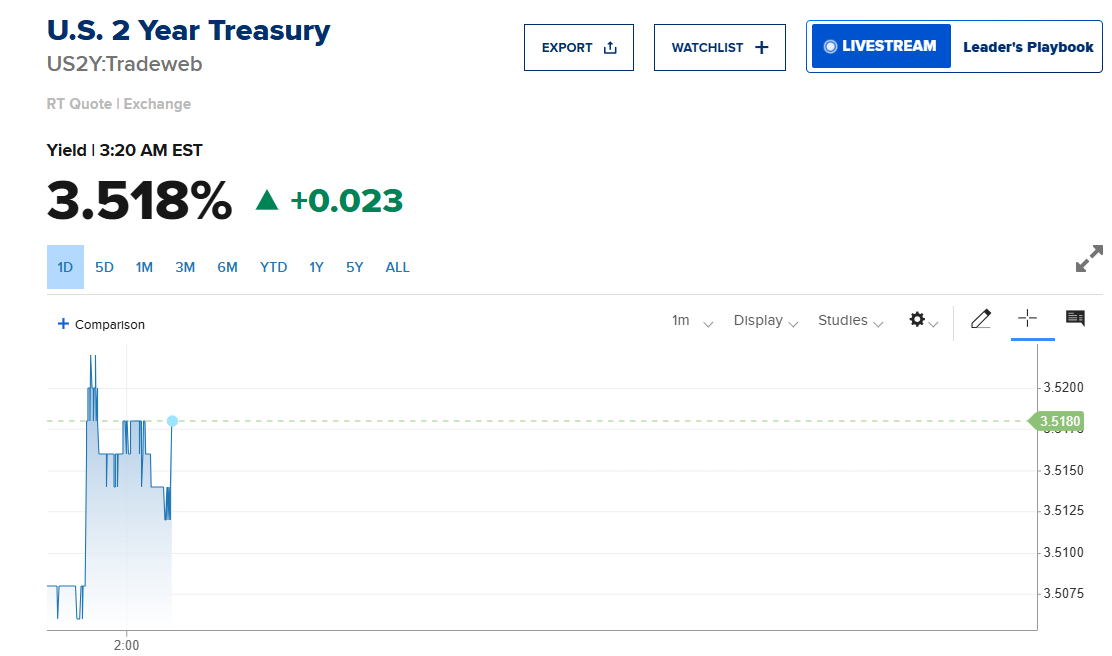

- The US 2-year and 10-year treasury yields have jumped higher.

- Bitcoin pared earlier and moving towards $70K.

Bitcoin declined today after China ordered banks to reduce US treasury holdings. This action reflects risk-off sentiment as the Chinese central bank increases gold purchases and reduces exposure to risk assets.

China Orders Banks to Limit and Trim US Treasuries

China has directed banks to sell and limit purchases of US treasuries, Bloomberg reported on February 9. Chinese authorities have cited concerns about concentration risks and market volatility in US debt, which could expose banks to significant fluctuations.

This guidance is the first public statement on the matter, despite years of reduced US Treasury holdings. It was delivered verbally to several large banks in recent weeks and applies to private and commercial institutions, not to China’s official state holdings of US government debt.

Kai Hoffmann of KAMAVEST Asset Management GmbH highlighted that Chinese banks held about $298 billion of dollar-denominated bonds as of September, according to data from the State Administration of Foreign Exchange.

As a result, the US 2-year and 10-year treasury yields have jumped higher. The 2-Yr Treasury yield climbed above 3.52%. Elevated yields often weigh on risk assets, including Bitcoin.

Bitcoin Slips Towards $70K

BTC price pared earlier gains after China urged banks to sell US treasuries, currently trading at $70,350. The 24-hour low and high were $69,486 and $72,206, respectively. Furthermore, trading volume has decreased by 15% over the past 24 hours, indicating a decline in interest among traders.

CoinGlass data indicates increased selling in the derivatives market in recent hours. At the time of writing, total BTC futures open interest declined by more than 1% to $45.94 billion over the past four hours. Open interest on CME and Binance fell by 1.11% and 1.04%, respectively.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- BitMine’s Tom Lee Bets on ‘March Turnaround’ to Spark Crypto Market Recovery

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

Buy $GGs

Buy $GGs