Bitcoin Funding Rates Hit Peak Amid Surge Above $60K, What’s Next?

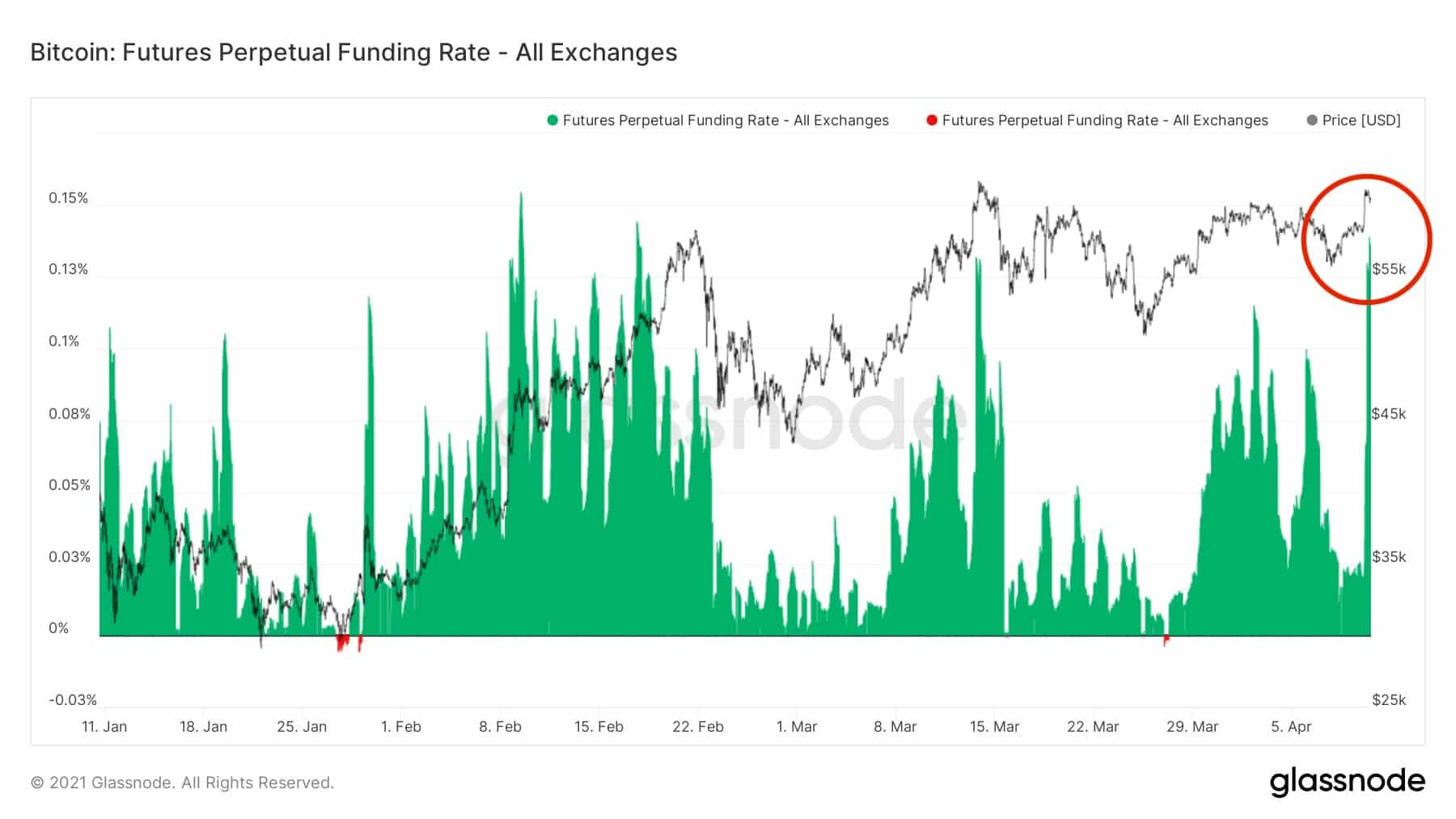

Bitcoin price today broke out of its long consolidation phase between $58K- $60K to register a new monthly high of $61,276. The price has retraced back to $60,300 at the time of writing as funding rates have started to skyrocket.

Rising funding rates are considered bullish as it becomes more costly to long a Bitcoin contract in the futures market. Bitcoin Futures is currently trading at a 95% annualized premium for the weekly contracts.

Bitcoin price has been in the consolidation phase ever since reaching its new ATH of $61,683 on March 17 and has been the case this bull season, the top cryptocurrency is trying to retest its previous ATH after 4 weeks of consolidation.

Bitcoin Might Face a Small Retrace Before Eyeing New ATH

The current rising funding rate might lead to a small price retrace before Bitcoin begins the next leg of the bull run. The on-chain metrics are still quite strong for the top cryptocurrency with periodic exchange outflows and decreasing supply of bitcoin on exchanges. This bull season Bitcoin has recorded a new ATH every month followed by a 3-4 week-long consolidation phase. The consolidation phase has gotten longer with every new ATH.

Bitcoin funding rates are skyrocketing.

This means it is very expensive to long $BTC in the futures market.

BTC is at 95% annualized premium for weekly contracts.

Markets look bullish but I am personally cautious about a minor flush drop at weekly open, which would be healthy.

— Joseph Young (@iamjosephyoung) April 10, 2021

In January and February, the ATH came in the first week itself followed by 3 weeks of consolidation, however, in March the ATH came in the third week followed by 4 weeks of consolidation, thus the new ATH in April could come the following week based on the previous price pattern.

The demand and adoption rate has continued to rise in April as well as two new Bitcoin ETF proposals came in. Institutions and financial giants have continued to show their bullishness towards the top cryptocurrency as Goldman Sachs predicted that Bitcoin is replacing gold at a much faster pace than many had expected. While Meitu, a Chinese firm bought another $10M in Bitcoin.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs