Bitcoin Funding Rates at Sky-High as Crypto Market Saw $380M Liquidation, What’s Next?

Highlights

- Bitcoin funding rate spikes after BTC price rallied over $57,000 amid renewed bullish sentiment

- Crypto market saw over $380 million in net liquidations with massive shorts liquidations

- Matrixport predicts crypto returns will drive FOMO among traditional investors for a rally to new ATH

Bitcoin price briefly rallied over $57,000 triggering a broader crypto market rally. The global crypto market cap leaped 7% to $2.25 trillion, backed by a massive increase in trading volumes. This caused more than $380 million in crypto liquidation in the last 24 hours, with Bitcoin and altcoins funding rates clinching quite high.

Crypto Market Saw $380 Million in Liquidations

Crypto market witnessed 88K traders liquidated over the last 24 hours, according to Coinglass. Over $380 million in net liquidations, with $274 shorts and $106 longs liquidated. The largest single liquidation order ETHUSDT valued at $10.38 million happened on crypto exchange Binance.

Traders got hammered as BTC, ETH, SOL, PEPE, ORDI, and THETA shorts were most liquidated. WLD, UNI, FIL, and XRP longs were also impacted by the sudden shift amid the largest short liquidations seen since December 4.

The crypto market recovery amid a renewed bullish sentiment after Bitcoin price rally caused funding rates to hit higher again. Funding rates are the fees charged by cryptocurrency exchanges for perpetual or futures contracts trading, with high funding rates can erode profits when traders are long or bullish on a crypto asset.

#Bitcoin funding rates are quite high.

👉https://t.co/iyLrhuoty0 pic.twitter.com/6SKbS8Q8sv

— CoinGlass (@coinglass_com) February 27, 2024

The Bitcoin rally has driven a firestorm in the block market, with more than 50 block orders with a notional value higher than $5 million, reported options trading expert Greekslive. Also, the largest of these orders are active open positions, which occurred only a few times in history.

With only nearly 50 days left in Bitcoin halving, options traders are making calls for $60K or even $70K strike price. Derivatives traders are exclusively bullish on Bitcoin and Ethereum, with BTC futures open interests on Binance and CME hitting record higher. The 24-hour futures volume jumped over 133% to over $208 billion.

Also Read: Bitcoin ETFs Saw $520M Inflow As BTC Price Rally Eyes $60K

BTC Price to Hit $60K?

Spot Bitcoin ETFs started the week strongly with another major day, recording an inflow of $520 million and volume of $3.84 billion. Considering high BTC demand and low supply dynamics, BTC price can make new all-time high near Bitcoin halving date.

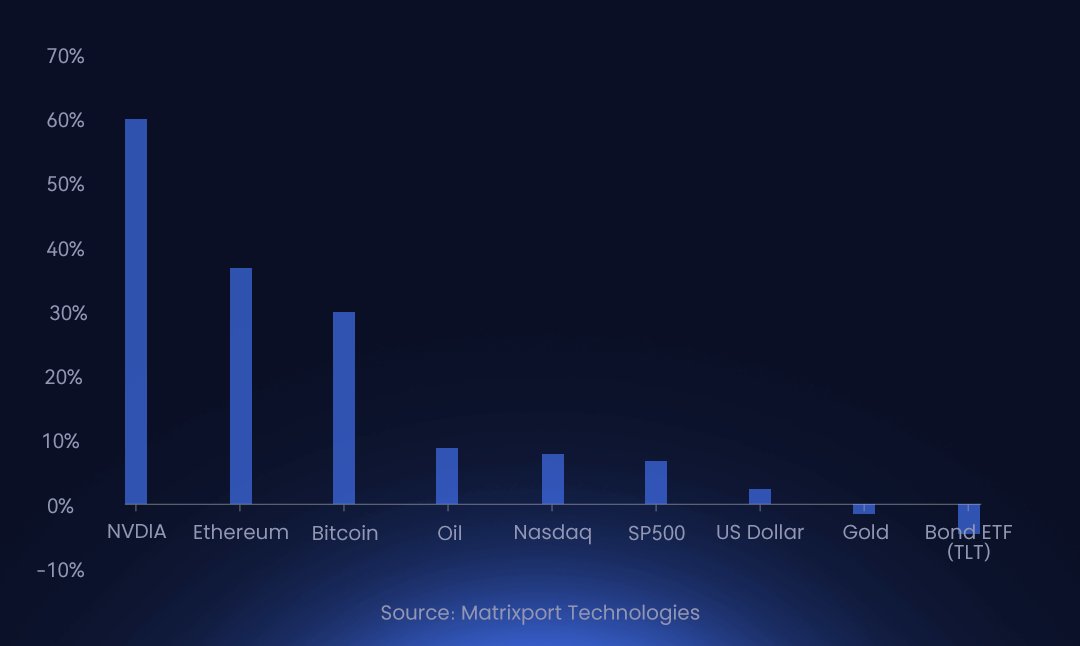

Matrixport said BTC price will hit $60K before Bitcoin halving. Year-to-date, Bitcoin and Ethereum are performing well and are up 30-36%. In a new post, Matrixport predicts crypto returns will drive FOMO among traditional investors, as they perform better than oil, S&P 500, gold, and bond ETF.

BTC price skyrocketed its way to a market value as high as $57,250, reaching within 19.9% of the $68.6K high established 27 months ago. The price is currently trading at $56,325, up over 10% in the last 24 hours.

Also Read: Binance Waives Fees For BTC, ETH, XRP, SOL, But There’s A Catch

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale