Bitcoin [BTC] and Stock Market Traders in Disbelief by Bullish Price Action

The disbelief among traders grew stronger as the price action on crypto and stock markets continue bullish streak despite bearish sentiments.

Bitcoin [BTC] price broke above $7000 the previous day as the price bounced from lows around $6,650. The price of Bitcoin [BTC] at 5: 30 hours UTC on 17th April 2020 is $7065. The next levels for resistance to Bitcoin’s price are around $7,600-$7,700 and $8,000-$8,200.

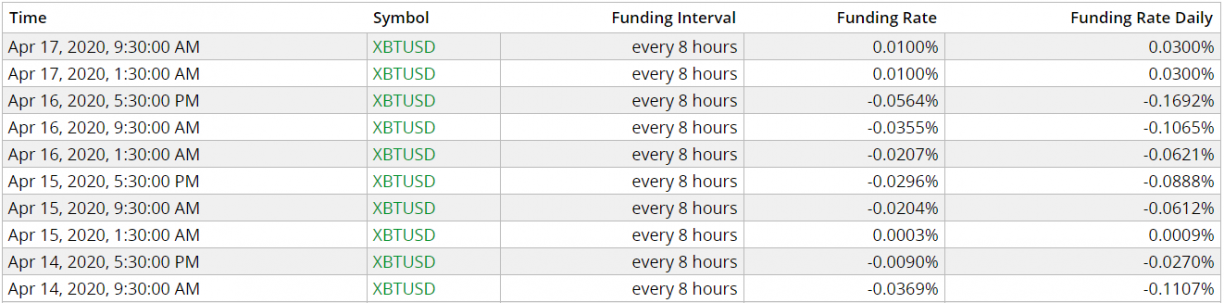

Moreover, the volatility has left traders perplexed on the trend. According to Datamish, in the last 30 days, nearly 500 million each in shorts and longs have been liquidated on BitMEX. The positive funding rate for XBT contracts on BitMEX indicates that the futures traders are now starting to flip bullish.

The sentiments mirror across the stock markets as well. The S&P 500 index also broke above $2800, bearing above the 50% retracement levels from the panic crash in March last month. Thomas Lee, veteran financial analyst and partner at Fundstrat notes,

Equity markets are telling a story divergence from common sense… the recent recovery of 2,800 is saying a new bull market underway.

Are there any Common Causes for Correlation?

Moreover, the fundamentals for the rise in the apparent ‘risk assets’ can be traced to the economic stimulus provided by the U.S. Government. Dubbed as, ‘BRRRR money’ (Onomatopoeia describing the sound of the printing press), the Government is providing eligible individuals $1,200 to go tackle the crisis due to the spread of COVID-19.

While the stock markets seem to be favouring the bulls due to a hopeful recovery from the crisis in the future, crypto enthusiasts are voting against such extreme Quantitive Easing which would hurt the global economy in the long-run.

Nevertheless, in either case, the correlation between the two assets also continues to hold true even after a month from the crash. It reached its peak in the following week of the drop above 0.6 (correlation between SPX and BTC) and continues to hold positive around 0.5.

Traders sentiments and price action seem to be pointing towards a common cause for the correlation. However, crypto trader and consultant Scott Melkar argues that it lacks any commonality. He notes,

There are 4 assets in legacy markets – stocks, bonds, commodities and currencies. All are correlated to various degrees. They are all valued based on similar factors, like corporate earnings, GDP and interest rates.

Bitcoin does not find it’s valuation in any of these things.

The risk associated with Bitcoin and crypto markets is designed to acts as insurance against the collapse of the traditional investments.

Do you think that bullish price action on Bitcoin and the stock markets will continue or heavy correction is underway? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin & Gold Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs