Bitcoin [BTC] Hash-Rate Back to ATH Levels, but Halving Poses Bear Threats

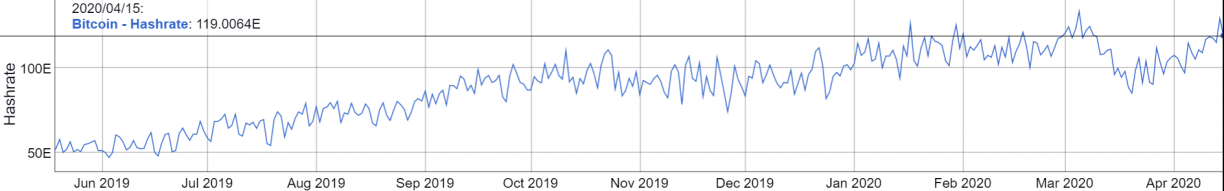

The total hashrate of Bitcoin mining has jumped to 120 E Th/s (levels achieved as it touched new highs in early 2020). Hence, not only Bitcoin [BTC] price but also the hashrate is witnessing a V-shaped recovery.

Currently, the difficulty range and hashrate are at par with the levels in January. However, the price is trading lower compared to the range ($7500-$9000) then. The price of Bitcoin [BTC] at 6: 00 hours UTC on 16th April 2020 is $6650.

Nevertheless, at the time, markets were anticipating a pre-halving pump in January. As we head closer to halving, the apprehension around miner capitulation is beginning to form short-term bearish outlook again.

Normally, hashrate follows price as the primary incentive for mining is profit from selling Bitcoin above the cost of generation. However, miner capitulations which follow extreme price drops have had bearish effects in the market.

Threats from Halving

In the past, halving has been a bearish event for Bitcoin (short-term) due to miner capitulation as the profitability is reduced by 50%.

After the 51% crash to $3850 due to the COVID-19 sell-off in the markets, the hashrate dropped massively indicating unprofitable levels of mining. A majority of the last generation S9 miners were seemingly wiped out after the crash.

Nevertheless, with the gain in BTC price and difficulty adjustments, the miners seem to have plugged their systems back on. However, halving will cause a similar, if not a more adverse drop in the profitability next month.

The break-even cost for new-gen S17 miners is around $5,400-$6000 post halving. Hence, if the price begins to break below these levels, we are likely to witness larger capitulations after halving.

As reported earlier on CoinGape, Willy Woo, leading on-chain analyst notes that market usually bottoms after the weak miners have been wiped out of the system. Nevertheless, since it will decrease the sell-pressure in the markets, it is perceived as a long-term bullish metric for Bitcoin. As for halving, there are 26 days left before the event.

Do you think a pre-halving pump is still on the cards? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs