Bitcoin Liquidity Surges On US Crypto Exchanges, Here’s Why

Highlights

- Bitcoin liquidity surges on the US exchanges, signaling market evolution.

- The introduction of the U.S. Bitcoin ETF fuelled market confidence.

- Weekly inflows into digital asset products hit record highs, with Bitcoin dominating.

The Bitcoin liquidity landscape is experiencing a seismic shift, particularly in US crypto exchanges. Notably, recent data reveals a notable surge in liquidity, attributed to the introduction of exchange-traded funds (ETFs) in the United States.

Meanwhile, this shift marks a significant evolution in Bitcoin trading dynamics, reshaping investor sentiments and market behaviors. Also, the update comes amid a time when the market is bullish on the crypto segment, given the recent rally in Bitcoin and crypto prices.

Bitcoin Liquidity Surge In US Exchanges

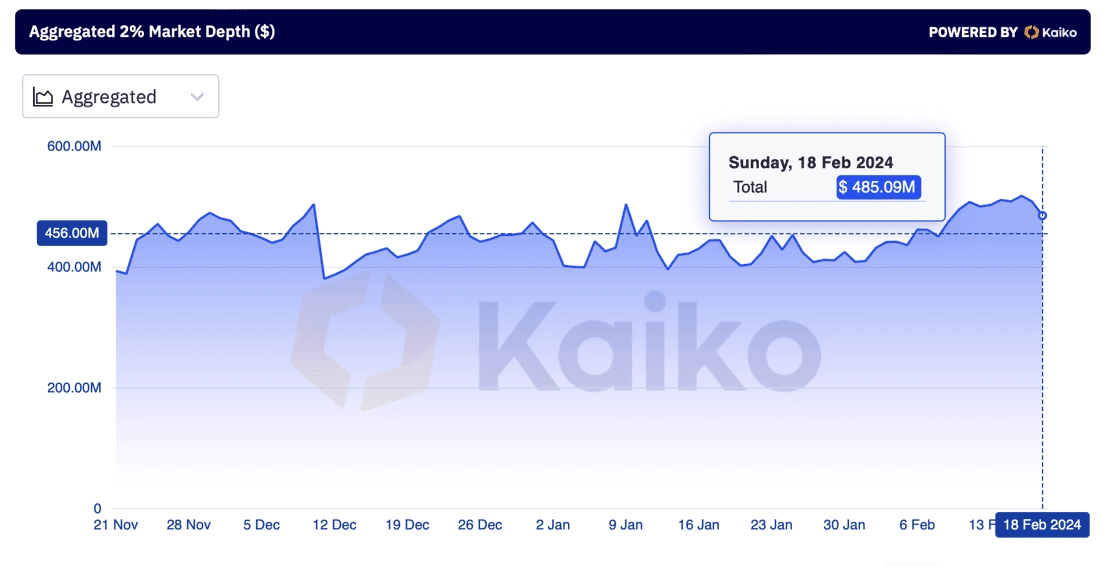

A recent report by research company Kaiko underscores a notable transformation in Bitcoin liquidity dynamics, notably favoring US-based crypto exchanges. Notably, the data reveals that the U.S. crypto exchanges have emerged as dominant players in facilitating Bitcoin trades, especially since the introduction of U.S. Bitcoin Spot ETFs.

Previously, non-US platforms held sway over Bitcoin market depth, but with the advent of the Bitcoin ETFs, there’s been a notable reversal.

Meanwhile, the report indicates that US trading venues have accounted for nearly half of the bids and asks within 2% of Bitcoin’s mid-price since the inception of US spot ETFs. It’s worth noting that this surge in liquidity is a pivotal factor in enhancing the efficiency of trading operations, ensuring smoother execution of orders without significant price fluctuations.

Also Read: Starknet’s STRK Token Gains Momentum with Major Market Makers

Impact Of ETF on Market Dynamics

The debut of nine U.S. Bitcoin ETFs, alongside the transformation of Grayscale Bitcoin Trust into an ETF, has catalyzed a significant influx of approximately $5 billion in investor funds since its launch on January 10. Notably, Matthew Sigel, head of digital-asset research at VanEck, notes that the positive price momentum of Bitcoin has been most pronounced during US trading hours, indicating heightened liquidity accessibility.

In addition, optimism surrounding the Bitcoin ETFs serves as an inflection point, with proponents envisioning broader crypto adoption. This sentiment is substantiated by the revival of digital-asset trading volumes, especially following the subdued levels after the FTX exchange collapse during the 2022 bear market.

In other words, the recent surge in Bitcoin liquidity on US crypto exchanges, fueled by the introduction of Bitcoin ETFs, marks a pivotal juncture in the cryptocurrency landscape. This shift not only enhances trading efficiency but also underscores growing investor confidence in Bitcoin as an asset class.

For context, in the past 24 hours, Bitcoin Futures Open Interest (OI) increased by 0.69% to reach 465.68K BTC or $24.41 billion. According to CoinGlass data, Binance leads in Bitcoin Futures OI, experiencing a 2.31% surge to 116.30K BTC or $6.10 billion.

As of writing, the Bitcoin price traded near the flatline at $52,310.72, with its last 24 hours trading volume soaring 24.12% to $23.37 billion. Notably, the flagship crypto has gained nearly 26% in the last 30 days.

On the other hand, a recent report from CoinShares showed that the digital asset investment products saw weekly inflows hitting $2.45 billion, marking an all-time high. On a year-to-date basis, the crypto-based products witnessed staggering inflows of $5.2 billion, propelling total assets under management to $67 billion, the highest since December 2021.

Notably, Bitcoin dominated with over 99% of inflows, while Ethereum also benefited significantly. Despite recent disruptions from Solana, companies like Avalanche, Chainlink, and Polygon saw consistent weekly inflows.

Also Read: Mike Novogratz’s Galaxy Digital Doing Heavy Ethereum (ETH) Buying

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs