Can Bitcoin Miners Huge Sell-Off Ruin the $100K Bitcoin Price Expectations?

Highlights

- Bitcoin miners seem to cash out on the fresh BTC rally to all-time high with strong exchange deposits.

- Increased sell-offs from miners may weigh on Bitcoin's current rally and muffle speculation about reaching the $100K target.

- Bitcoin mining stocks like Marathon Digital, Riot Platforms, and CleanSpark saw a decline of 12-15% on Wednesday.

Bitcoin miners went into a sell-off mood and moved 25,000 Bitcoins from their wallets to crypto exchanges for profit booking in the recent rally. However, Bitcoin’s $100K goal could be further than it seems since this kind of behavior could pressure the rally and dampen expectations of reaching the $100K milestone.

Currently, BTC price is showing strength with a 22% weekly gain hitting a new all-time high above $91,000. However, bulls might face roadblocks for a rally to $100K as analysts predict a pullback to $74,000 before hitting this milestone.

Bitcoin Miners Heavily Selling Their BTC

Even though Bitcoin’s $100K seems to be just around the corner, Julio Moreno, the head of research at CryptoQuant noted Bitcoin miners are taking advantage of the recent price surge above $90,000. It is also evidenced by their transfer of a large part of their Bitcoin holdings out of their wallets. On Wednesday, a robust outflow of 25,000 Bitcoin was recorded, highlighting miners’ active selling as BTC price reached new highs.

Following the Bitcoin halving event in March 2024, the BTC miners sold heavily to overcome their rising operational costs and reduced profits. This led to a strong 200 days of Bitcoin price consolidation thereafter before giving a breakout from the previous all-time highs of $74,000. Now that the BTC price crosses $90,000, we might again see renewed selling pressure coming from the miners.

Additionally, Moreno also stated that traders’ unrealized profit margins have reached a high level of 47%. This could indicate a potential Bitcoin price correction or a crypto market crash moving ahead. Historically, elevated profit margins have preceded market pullbacks, with previous peaks at 69% in March and 48% in December 2023. The current level is raising caution among analysts as Bitcoin hovers near recent highs.

Just as Bitcoin hits a new all-time high, there have been growing calls for $100K. However, blockchain analytics firm Santiment reported greater chances of a countertrade that would delay this surge. It noted:

“The hype across social media platforms is calling the tops very reliably. Counter-trade the crowd with confidence while records are being broken right now. Historically, successful traders buy into crowd doubt if prices are causing retail to sell. And if the crowd floods social media with FOMO, this should be taken as a caution flag”.

Bitcoin Miners Could Spoil the $100K Party

Increased sell-offs from miners may weigh on Bitcoin’s current rally and muffle speculation about reaching the $100K target. What can rising miner profitability tell us about BTC’s valuation?

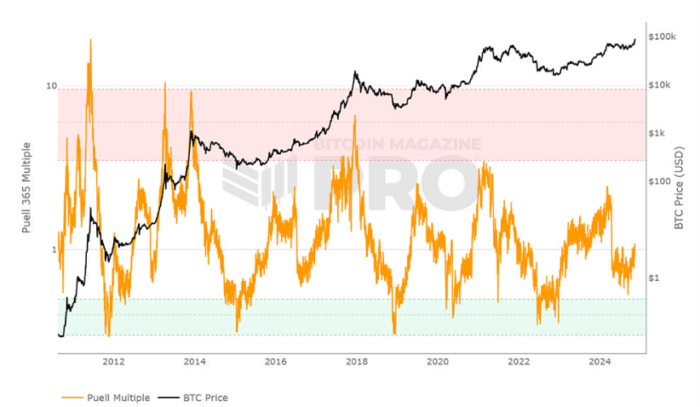

The Puell Multiple, which tracks miner profitability and valuation, suggests that Bitcoin still has much room for rallying even after flying well above $90,000. The Puell Multiple has spiked higher to reflect improved miner profitability but is still reading at 1—far below the critical orange band. Interestingly, the metric’s behavior so far mimics the 2020-2021 cycle.

In November 2020, the reading was also at one before surging to the orange band, coinciding with the $69K cycle top in early 2021. This means that if the pattern repeats, BTC could well reach a cycle top by Q1 2025.

Bitcoin at $90K represents something other than an overheated or overvalued state. On the other hand, a sharp increase in miners’ sell-off and an overheated Puell Multiple in early 2025 may signal looming challenges, hence making it an important metric to observe.

Mining Company Stocks on Freefall, What’s Next for BTC Price?

The US election rally for Bitcoin mining stocks has come to a halt ultimately as the companies’ Q3 numbers fall short of expectations. The stock price of top firms like Marathon Digital (NASDAQ: MARA), Riot Platforms (NASDAQ: RIOT), CleanSpark (NASAQ: CLSK), and others plummeted by 12-15% on Wednesday, November 13.

Some market analysts believe that this shouldn’t be much of a concern considering that the mining stocks have never moved in tandem with the Bitcoin price.

For those worrying about today's price action vs Bitcoin: Miners will do their own thing.

Bitcoin mining stock returns have never been very highly correlated with Bitcoin returns over the last 3 years.

Some miners have a higher correlation than others, but none are above 0.6.… pic.twitter.com/2Ei5ANIhR4

— Matt Faltyn (@mattfaltyn) November 14, 2024

Others believe that Bitcoin might come to retest the previous breakout of $74,000, before making the final push to $100K levels, amid the ongoing Bitcoin miners’ selloff. Thus, investors might take a cautious stand before building any fresh positions. Also, inflows into Spot Bitcoin ETFs have been slowing after a mega boost last week.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale