Bitcoin Miners, Whales To Sell BTC In Billions Post Halving: Report

Highlights

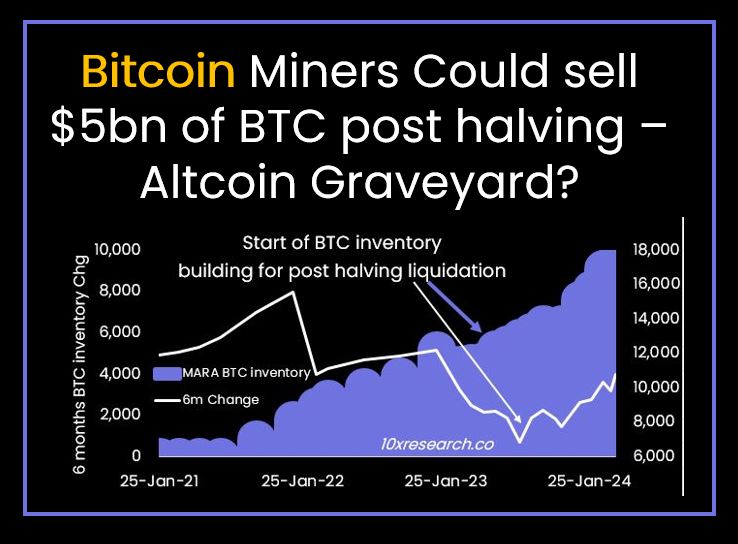

- Bitcoin miners are most likely to sell BTC worth $5 billion after halving, says Markus Thielen.

- Whales set to sell Bitcoin after this halving similar to past halving events.

- BTC price currently trades at $70K but risk liquidation.

Bitcoin miners have been flocking to mine BTC ahead of the most-awaited Bitcoin halving this month as the mining reward to half. Whales also continue to buy BTC and have not sold their Bitcoin holdings yet. However, a crypto research firm by top analyst Markus Thielen predicts bitcoin miners could sell Bitcoin worth billions after halving.

The selloff by miners and whales can shadow bearish sentiment in the crypto market despite experts suggesting a $100K price target for Bitcoin by year-end.

Bitcoin Miners Can Sell $5 Billion Bitcoin

In a dire warning for the crypto community, Markus Thielen, CEO of 10x Research, said Bitcoin miners are most likely to sell BTC worth $5 billion. The move will come after Bitcoin halving, as miners gradually sell their holdings in response to rising mining difficulty and financial needs.

10x Research predicts a six-month lull after the Bitcoin halving in April. This could be a major challenging time for the crypto market as “Bitcoin miners prepare to sell off substantial portions of their BTC inventories.”

Thielen believes the inventories built over the last few months amid bullish market sentiment disrupt the market dynamics. Bitcoin halving, expected on April 20, typically witnesses miners stocking up their BTC holdings. It leads to a supply-demand imbalance and a subsequent rally in Bitcoin prices.

Markus Thielen earlier predicted that Bitcoin to rally 32% into the halving. However, the report suggests $5 billion worth of potential BTC liquidations by miners after the halving.

“The overhang from this selling could last four to six months, explaining why Bitcoin might go sideways for the next few months—as it has done following past halvings, he added.”

CryptoQuant data shows miner reserves fell substantially in the bear market and spot Bitcoin ETFs have increased demand for Bitcoin, creating a supply crunch.

Also Read: Solana Network Congestion — Anza Deploys Crucial Upgrade

Whales Selloff After Bitcoin Halving

CryptoQuant CEO Ki Young Ju revealed in a post on X today that BTC whales are not yet selling their Bitcoin holdings. However, whales tend to switch from Bitcoin to altcoins or continue to trade BTC after halving events as price drops after halving.

$BTC whales are not selling. pic.twitter.com/MIcGknPNkU

— Ki Young Ju (@ki_young_ju) April 12, 2024

While experts predicted a $100K price target for Bitcoin this year, some factors can trigger a short-term selloff. Bitcoin to see a paradigm shift in prices and volumes after the halving due to demand from spot Bitcoin ETFs.

Meanwhile, Ali Martinez revealed that nearly $23 million Bitcoin positions risks liquidation as if Bitcoin jumps to $71,700.

BTC price currently trades at $70,776, up just 0.50% in the last 24 hours. The 24-hour low and high are 24-high of $69,571 and $71,256. However, trading volumes has declined over 22% in the last 24 hours, indicating lack of interest among traders.

Also Read: Bitcoin Options Expiry: How Traders Are Pricing For Bitcoin Halving

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

Buy $GGs

Buy $GGs