Bitcoin News: Dormant Wallet Moving $1.6B Bitcoin Fuels BTC Crash to $57K Concerns

Highlights

- Bitcoin wallet moves 25,000 BTC in six separate transactions today, sparking fear of market crash.

- Dormant Bitcoin wallet addresses have moved over 45,000 bitcoins this week.

- Bitcoin and altcoins to remain under selling pressure next week due to options expiry and PCE inflation data.

- BTC price jumps 1% but lacks support from the traders.

Bitcoin News: Dormant Bitcoin wallet addresses have been very active this week as BTC price dropped below $65,000 again. On-chain analyst revealed that a Bitcoin wallet moved 25,000 BTC in six separate transactions today, continuing concerns of BTC price crash amid sky-high uncertainty.

Single Wallet Moves 25,000 BTC

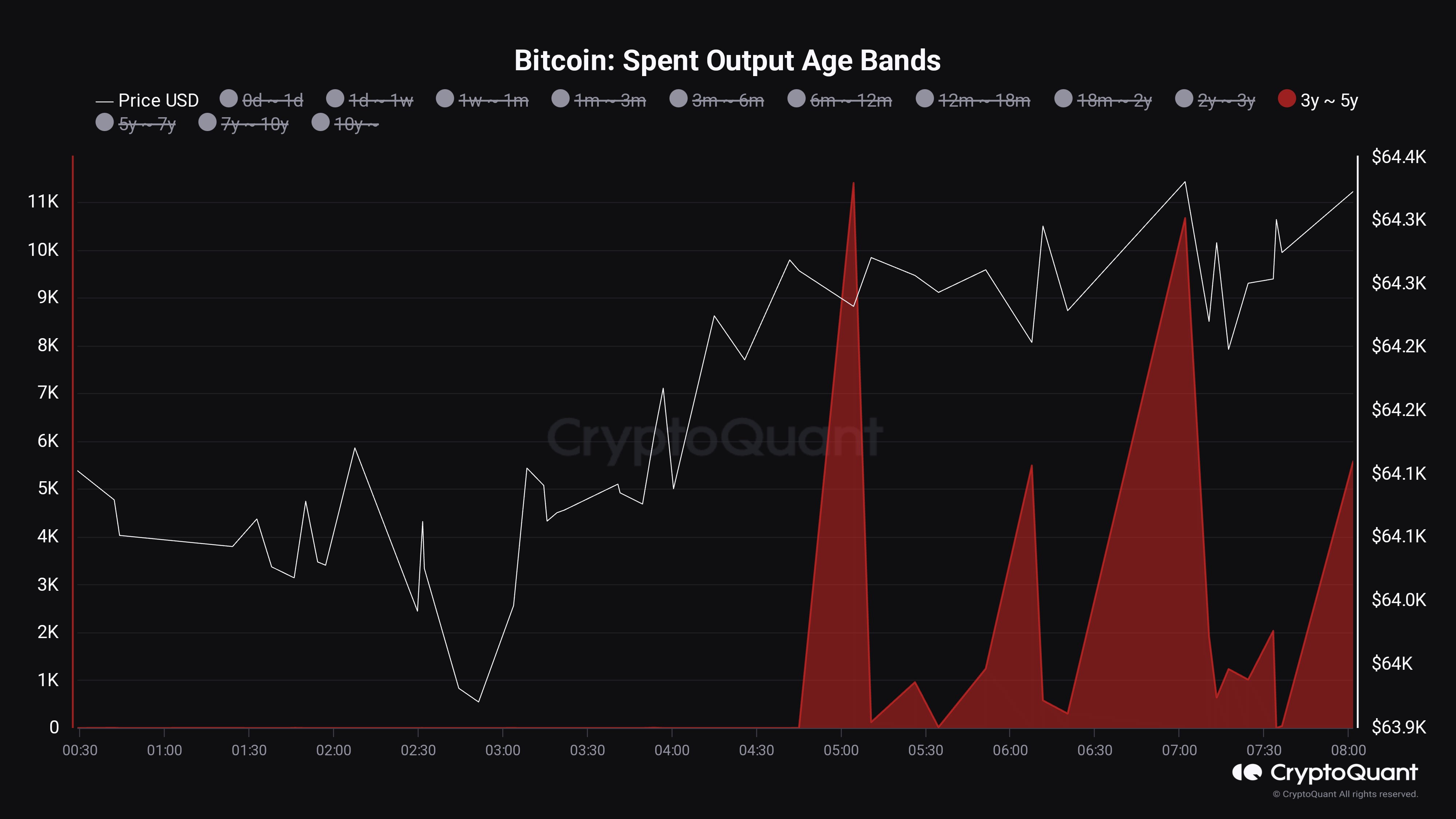

According to Bitcoin Spend output Age Bands data, a single wallet address transferred over 25,000 BTC worth over $1.6 billion. The age of the BTC is from 3 to 5 years, sparking speculation of a selloff as the sentiment for upside wanes.

CryptoQuant verified on-chain analyst Maartunn on June 22 said an unknown entity made two large transfers, moving more than 11,000 in two transactions. The entity moved more than 20,000 BTC in five transactions.

The same wallet again moved 5,577 BTC after a few hours. Therefore, the entity has moved over 25,000 today, which sparked speculation of further drop in BTC price.

Also Read: Is This The End of Bitcoin Bull Market? Top Analysts Issue Dire Warning

Why BTC Price Risks Falling Further?

The next week is going to be crucial for the crypto market as Bitcoin and altcoins remain under selling pressure. In a month, Bitcoin has tumbled 10% and altcoins have dropped 20-30%.

Over 104K BTC options of notional value $6.72 billion are about to expire on June 28, per the largest derivatives exchange Deribit. With a put-call ratio of 0.52 and the max pain point at $57,000, it indicates Bitcoin price is more likely to remain under selling pressure next week.

Traders also brace for U.S. GDP growth rate data on Thursday and the Fed’s preferred inflation data PCE inflation data on Friday. This coincides with the $6.72 billion options expiry. Investors are holding onto their coins, but high volatility and selling pressure amid these factors can cause Bitcoin price to sink below $60,000 and even dip to $57,000.

Moreover, there’s an additional selling pressure on the Bitcoin price due to strong Bitcoin ETF outflows shooting past $500 million during the past week. At the same time, the German government has been sending huge BTC from its holdings to exchange.

BTC price currently trades at $64,286, up 1% in the last 24 hours. The 24-hour low and high are $63,437 and $64,475, respectively. Trading volume has dropped 47% in the past 24 hours, which indicates a lack of interest from traders amid negative sentiment.

Also Read:

- Why Terra Luna Classic (LUNC), USTC Prices Crashed Amid Massive 6.5 Bln LUNC Burn

- US SEC Leverages Ripple XRP Case in Binance Lawsuit

- Base Sepolia Testnet To Launch Fault Proofs In July, Here’s All

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Michael Saylor’s Strategy Moves $83M in Bitcoin as $9B Paper Losses Raises Pressure

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card