Current Bitcoin ($BTC) Rally Is Historically Different; Here’s How

Bitcoin News: The current Bitcoin (BTC) rally could perhaps have been a result of relief from the macroeconomic scenario and resistance to the shock events in crypto market in 2022. However, a steady growth since the beginning of January 2023 raised hopes of a prolonged rally, marking an end to the painful crypto winter of 2022. Despite the bullish atmosphere, the top cryptocurrency is currently below the key indicator of 200 day weekly moving average (WMA). An important observation from on chain data could answer the reason behind this behavior in BTC.

Also Read: Solana ($SOL) Soars As Helium Sets Migration Date; Here’s More

The 200 WMA is key for traders as the indicator is generally a sign of change in direction for the asset. When there is a clear signal from this indicator, it is believed that there will be a long term change. This behavior of BTC trading below the 200 WMA was observed quite often throughout 2022.

Bitcoin Active Addresses

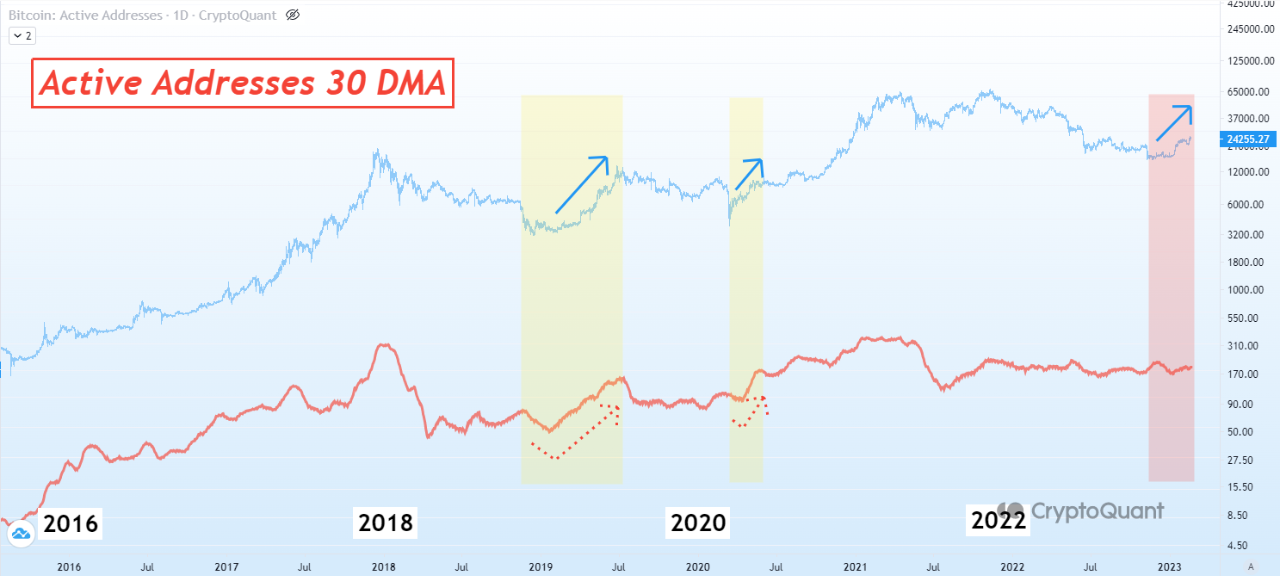

In what could be a sign of lack of strength for next Bitcoin bull pattern, on chain data reveals an interesting comparison from previous BTC breakouts. Unlike the beginning of previous bull cycles, the current cycle does not actually have enough active addresses based on 30 day moving average, or a rise in them, to justify a price movement in upward curve. As per Crypto Quant data, there is no real growth in the number of active Bitcoin addresses.

Currently, the BTC price is fluctuating around the $25,000 milestone but still fails to rise above the 200WMA. As of writing, BTC price stands at $24,783, down 1.09% in the last 24 hours, according to CoinGape price tracker.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs