Bitcoin News: On-Chain Data Signals Potential End of Bull Cycle This Month

Highlights

- Analyzing on-chain data to predict the potential timeline for the Bitcoin bull cycle to end.

- Renewed investor interest seen in U.S. Spot Bitcoin ETF with significant inflows.

- Bitcoin price slightly rises amid market volatility, with futures open interest fluctuating.

The recent surge in the cryptocurrency market, propelled by notable rallies in major coins like Bitcoin and Ethereum, has instilled optimism among investors. With significant events such as the approval of the U.S. Spot Bitcoin ETF and the Bitcoin Halving shaping the landscape, investors are now contemplating the potential duration of the ongoing bull cycle.

Meanwhile, CryptoQuant founder Ki Young Ju has recently shared insights based on on-chain data, hinting at a possible timeline for the current bull cycle to end.

Analyzing On-Chain Data for Bitcoin’s Bull Cycle End

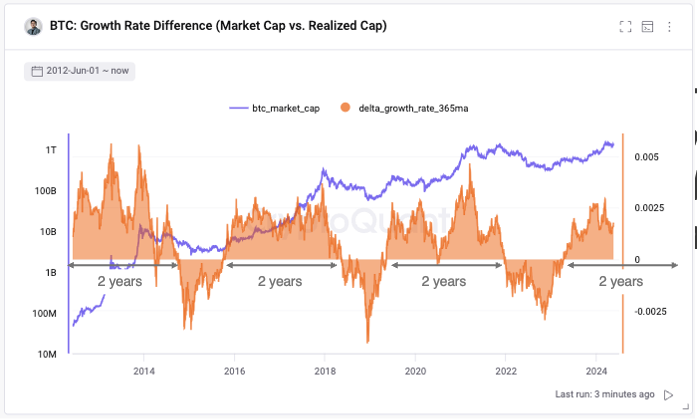

CryptoQuant CEO Ki Young Ju has drawn attention to on-chain data to provide insights into the trajectory of Bitcoin’s bull cycle. Sharing a Bitcoin price chart on the X platform, Ju highlighted that the cryptocurrency is currently amid its bull cycle, with its market capitalization outpacing its realized cap.

Meanwhile, he said that based on historical trends, such cycles typically last for about two years. So, considering the current pattern, he hinted that the current Bitcoin bull cycle might conclude by April 2025.

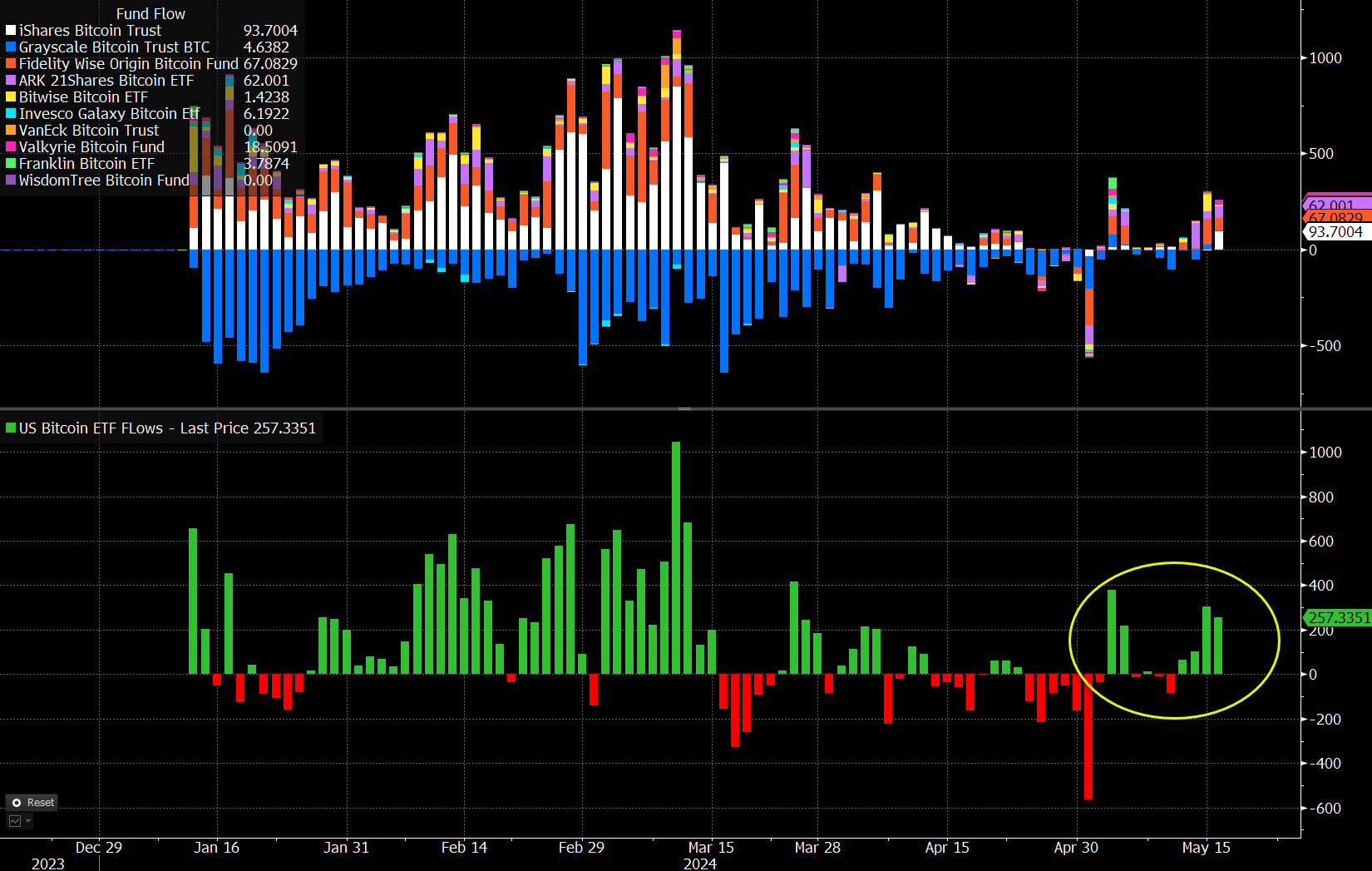

Notably, Ju’s analysis comes at a time of positive sentiment in the crypto market, with the U.S. Spot Bitcoin ETF witnessing significant inflows this week. According to Farside Investors data, the ETF recorded inflows exceeding $726 million over the past four days, reflecting renewed investor interest.

Commenting on the development, Bloomberg Senior ETF analyst Eric Balchunas noted the ETF’s robust performance, with inflows totaling $1.3 billion over the past two weeks. He said that the significant inflow this week has helped offset previous outflows and reinstating confidence among investors.

Also Read: Tether Pumps Liquidity With $1 Billion USDT Mints in 12 Hours, Crypto Market Rally Soon?

Market Sentiment Amid Regaining Momentum

The crypto market enthusiasts seem to be regaining confidence in the digital asset space, as evidenced by the recent performances of cryptos like Bitcoin, Solana, and others. Notably, the recent U.S. Consumer Price Index (CPI) data has contributed to bolstering investor confidence.

The data revealed a cooling of inflation in April compared to the previous month, indicating a potential shift in the Federal Reserve’s hawkish stance on policy rates. If inflation continues to decline, it could prompt the Fed to reassess its monetary policy, potentially influencing market dynamics and investor sentiment in the coming months.

However, despite the positive developments, the volatility, although declined, seems to be dominating the market currently. According to CoinGlass data, the Bitcoin Futures Open Interest fell 1.36% over the last 24 hours while rising about 1.26% in the last four hours to 490.28K BTC or $32.65 billion.

Meanwhile, the Bitcoin price noted slight gains and traded at $66,440.54, up 0.53% from yesterday. On the other hand, the trading volume fell 23.31% to $30.20 billion, with the BTC touching a 24-hour high of $66,545.81. Over the last 30 days, the flagship crypto has gained nearly 7%, while noting a weekly surge of over 5%.

Also Read: Here’s How This Solana Trader Made $200K with $1.5K In 5 Mins

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks