Bitcoin News: Whale Scoops 500 BTC Worth $33M, BTC Price Eyeing $70K

Highlights

- A fresh wallet withdrew 500 BTC worth $33.07 million from Binance, sparking buying sentiment.

- Whale buying raises speculation of BTC price hitting $70k this week.

- Matrixport reveals weak buying from derivatives traders and arbitrage-seeking crypto hedge funds.

Bitcoin News: Whale accumulation is the first sign of an upcoming rally or upside move in a crypto and Bitcoin and some altcoins are starting to witness a rise in buying from whales. On Tuesday, a whale purchased 500 BTC from crypto exchange Binance as Bitcoin price holds strong above the $66,000 support level. Is a BTC price rally to $70k imminent this week?

Bitcoin Whale Buys 500 BTC

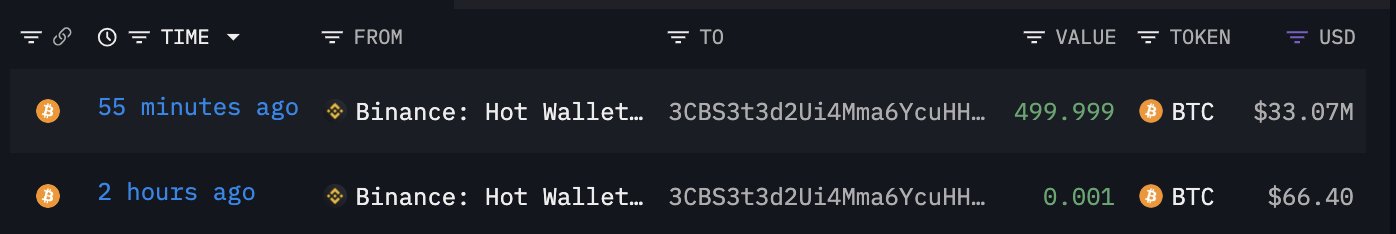

On-chain expert Lookonchain on April 23 revealed a large transfer of 500 BTC from crypto exchange Binance to a fresh wallet address. The large transfer of BTC sparked buzz in the crypto community, with speculation of a test of BTC price to its all-time high of $73,750.

“We noticed a fresh wallet withdrew 500 BTC ($33.07M) from) Binance,” said Lookonchain. This is one of the large transfers after Bitcoin halving that saw transaction fee rising to all-time high of $128.45. Nearly, $2.4 million in fees were paid for transactions in Bitcoin block 840,000 to mark the the halving, said CryptoQuant CEO Ki Young Ju.

The large Bitcoin buy raised excitement and doubts at the same time as experts point to a slight fall in prices as monthly expiry looms this week.

Also Read: Pendle Price Eyes New All-Time High Above $7.5, What’s Behind the Rally?

Matrixport Hints At Slow Buying in the Derivatives Market

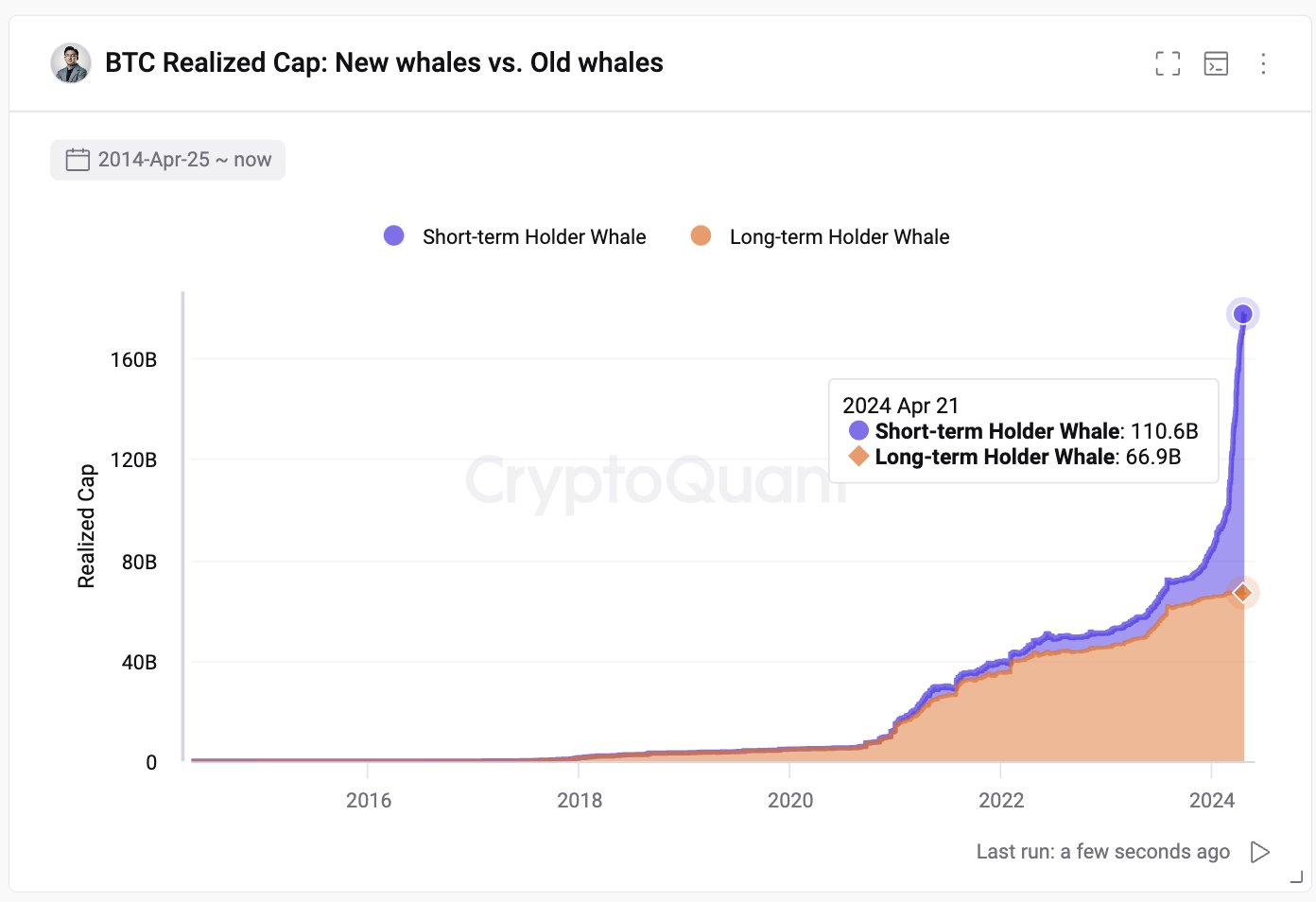

The new whales’ initial investment in Bitcoin are almost twice the old whales’ cumulative total, said CryptoQuant CEO Ki Young Ju. Long-term holders are taking profits and the likelihood of long-term investors capitalizing on price ascents to realize profits is high enough as more number of wallets are in profit.

“A reason could be that futures traders have become uncertain about the upside in the current environment,” stated Matrixport. CME BTC Futures Open Interest fell over 1% in the past 24 hours, with a selling seen in the last few hours, as per Coinglass data.

BTC price is consolidating near $66,000 as expected, with the price currently trading at $66,009. The 24-hour low and high are $65,705 and $67,233, respectively. Furthermore, the trading volume has decreased slightly in the last 24 hours.

Also Read: Ripple Accuses SEC of Violation, Lawyers Unveil End Date

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs