Bitcoin News: Whales And Miners Offload Huge BTC Ahead Of Fed Chair Powell Speech

Bitcoin price failed to hold momentum towards $30,000 after the US Federal Reserve hiked rates by 25 bps, other central banks followed suit and raised interest rates. On-chain data shows whales and miners are selling their BTC holdings as BTC price fell below the key 200-WMA level and remains range bound in 26,500-27,500.

Meanwhile, US Fed Chair Jerome Powell’s speech is scheduled today on the monetary policy outlook. Recently, other Fed officials remain cautious about the policy outlook and hinted at hawkish views on interest rate hikes. CME FedWatch indicates the probability of a 25 bps rate hike in June has risen over 45% from 15% a week ago.

Whales and Miners Selling Bitcoin Holdings

On May 19, CryptoQuant reported that miners’ reserves are indeed decreasing causing significant selling pressure on Bitcoin from miners.

An on-chain analyst revealed that miner dumped 1750 BTC to crypto exchange Binance on Thursday. The same miner deposited 5,791 BTC last month causing the BTC price to fall massively.

Bitcoin Miner Reserve on-chain data indicates the reserves dropped from 1,827,457 to 1,825,618 BTC on Thursday, almost 1840 BTC dumped to crypto exchanges. Today, miners have again sold over 350 BTC until now and are expected to continue selling their BTC holdings.

Moreover, whales are dumping Bitcoin into exchanges. On Thursday, an address transferred 10,000 BTC worth nearly $270 million to Coinbase, when the Bitcoin price was trading at $27,620.

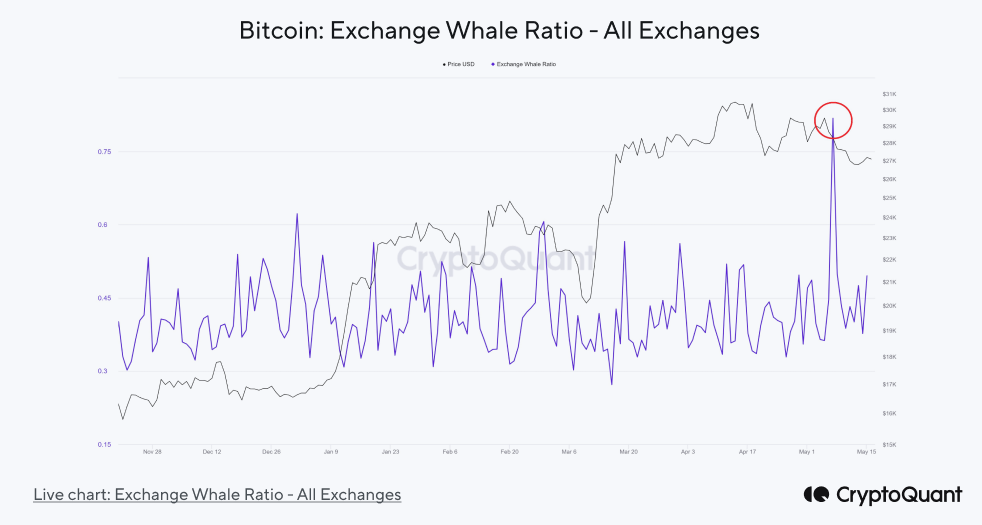

Whales have taken the lead in depositing Bitcoin into exchanges, as evidenced by the early May surge in the Exchange Whale Ratio. Without a doubt, Bitcoin transactions by these whales escalated to high levels, with transfers involving more than 40% of the coins.

Also Read: Leading Crypto Firm Raising Funds At $1 Billion Valuation

Bitcoin Price To Fall Below 200WMA

BTC price fell 2% in the last 24 hours, with the price currently trading at $26,853. The 24-hour low and high are $26,415 and $27,466, respectively. Furthermore, the trading volume has decreased in the last 24 hours, indicating a decline in interest among traders.

Technical indicators such as Bollinger Bands and RSI indicate weakness in Bitcoin upside momentum, with a potential fall to $24,600.

Also Read: Bitcoin Going To The Moon In 2023 Summer, Here’s What Elon Musk Says

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise