Bitcoin Price Flashes Top Signal After Rejection At $125K

Highlights

- Bitcoin OG whales have been selling as BTC gains strength into all-time highs.

- Institutional buyers are buying aggressively on BTC price dips hinting a major shift from retail-led speculation.

- On-chain data shows large sell and short positions by veteran holders, while analysts warn of a major liquidity cluster near $118,000.

Bitcoin price has continued to trade below the $125,000 mark as the market undergoes a notable shift from early “Satoshi-era” whales to new institutional investors accumulating positions. However, the pace of whale sell-offs has so far exceeded institutional buying, keeping downward pressure on prices. With uncertainty building, investors remain cautious amid the potential for increased volatility ahead.

Bitcoin Price Momentum Fades Near All-Time Highs, But Institutions Are Buying

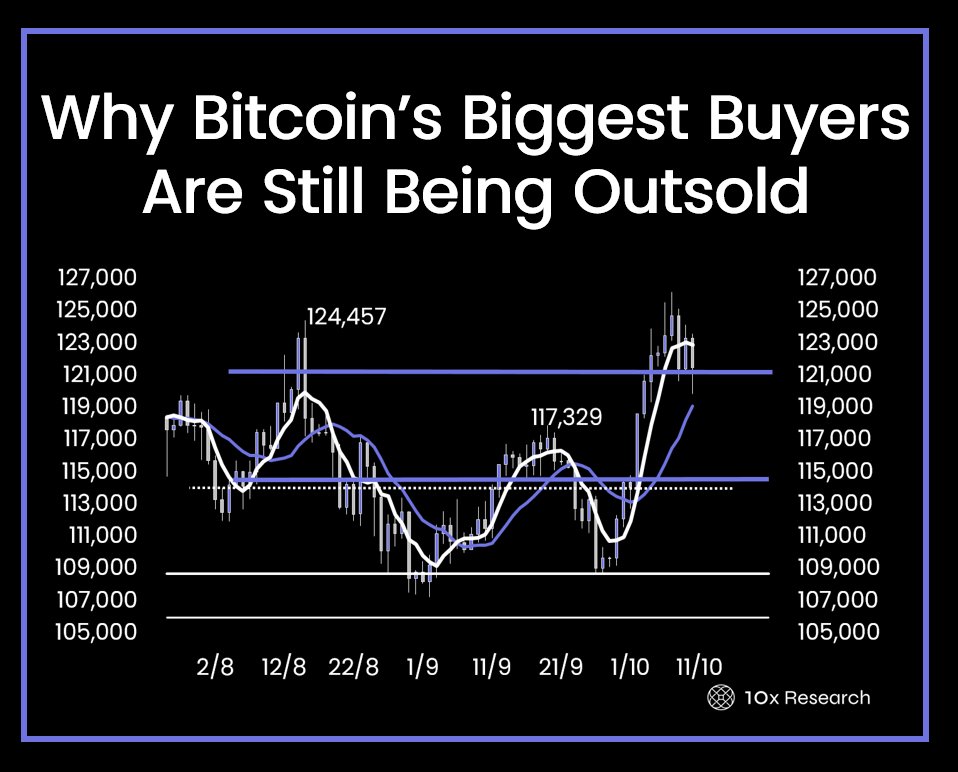

Bitcoin’s ‘Uptober’ rally has been on point with 7% gains so far this month, in a healthy start for the Q4 bull run. However, this time, the rally to all-time highs comes with a different mix. Despite prices hovering near all-time highs, market momentum appears to be fading.

Analysts at 10x Research noted that large institutional investors have been accumulating Bitcoin aggressively. This is also evident with the strong Bitcoin ETF inflows seen over the past few weeks, led by BlackRock’s IBIT. On the other hand, early adopters i.e. Satoshi era whales, have been taking profits into the Bitcoin price strength. This dynamic suggests a shifting market structure, with deeper institutional participation offsetting retail enthusiasm.

10x Research added that broader macro indicators have turned neutral, with options traders growing defensive and volatility remaining high. They added that disciplined accumulation during the consolidation phase could be rewarding in the long term.

BTC OG Whales Are Selling on Rise

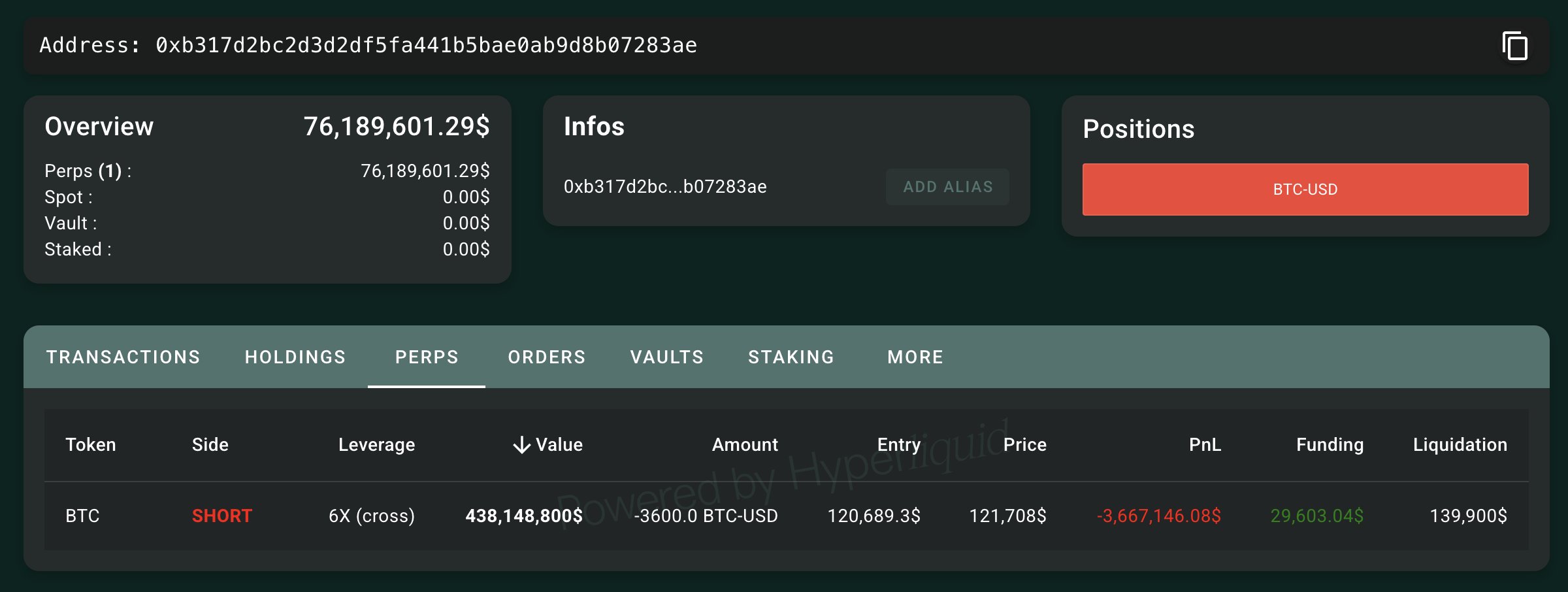

Blockchain analytics firm Lookonchain reported that a “Bitcoin OG,” has expanded his short position on Bitcoin to 3,600 BTC (worth approximately $438 million). The move comes just days after the same wallet sold 3,000 BTC ($363.9 million) earlier this week.

Last month, the investor made headlines for swapping 35,991 BTC, now worth $4.38 billion, for 886,371 ETH, currently worth about $3.88 billion. According to Lookonchain, the trader’s current short position is sitting at an unrealized loss of roughly $3.66 million, with a liquidation price of $139,900 per BTC.

Where’s Bitcoin Price Moving Next?

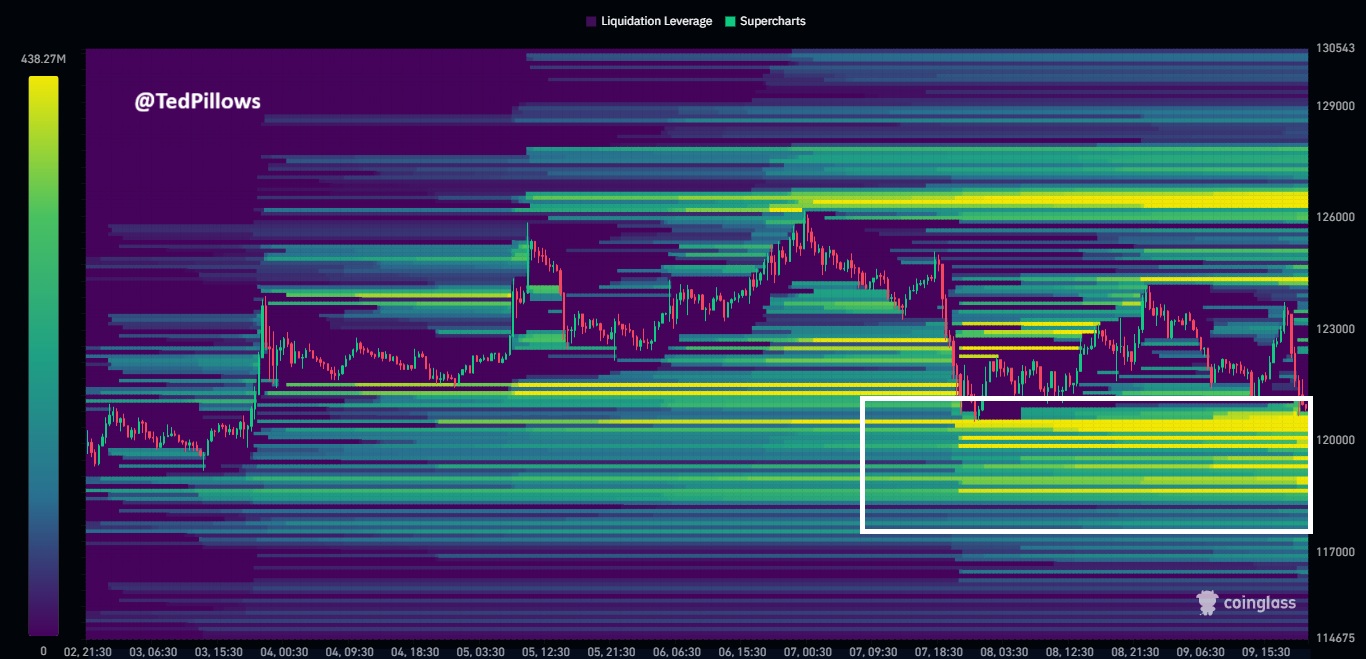

Crypto analyst Ted Pillows highlighted a key liquidity zone forming around the $118,000 level for Bitcoin price, suggesting that the area could trigger significant market movement. According to Pillows, “billions in long liquidations” are currently positioned around that price point.

He warned that a potential liquidity flush could occur if those positions are liquidated, possibly leading to a short-term sell-off. However, Pillows noted that the market’s next direction will largely depend on ETF inflows. “If buyers step in, Bitcoin will see a reversal; otherwise, more downside could follow,” he said.

BitMEX co-founder Arthur Hayes published a new essay arguing that the traditional four-year BTC cycle is no longer relevant. According to Hayes, the major Bitcoin price movements are not driven by halving-induced supply shocks but by changes in global liquidity conditions.

Currently, he noted, global liquidity is expanding again, with the U.S. Federal Reserve cutting interest rates, the Trump administration advocating for new stimulus measures, and both Japan and China easing monetary policy.

Hayes concluded that with money becoming “cheaper and more abundant. Thus, he believes that a new bear market is not imminent, and Bitcoin’s real market top may still be far away.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs