Open Interest For Bitcoin Options Soars Over 50% In April; Is $8,000 Possible in April?

- Bitcoin options open interest is on a spiking trend since the March 12 crypto market crash.

- Binance crypto exchange processes over $1 billion in BTC options in April

- BTC/USD gives mixed signals as volumes remain low, is $8,000 possible in April?

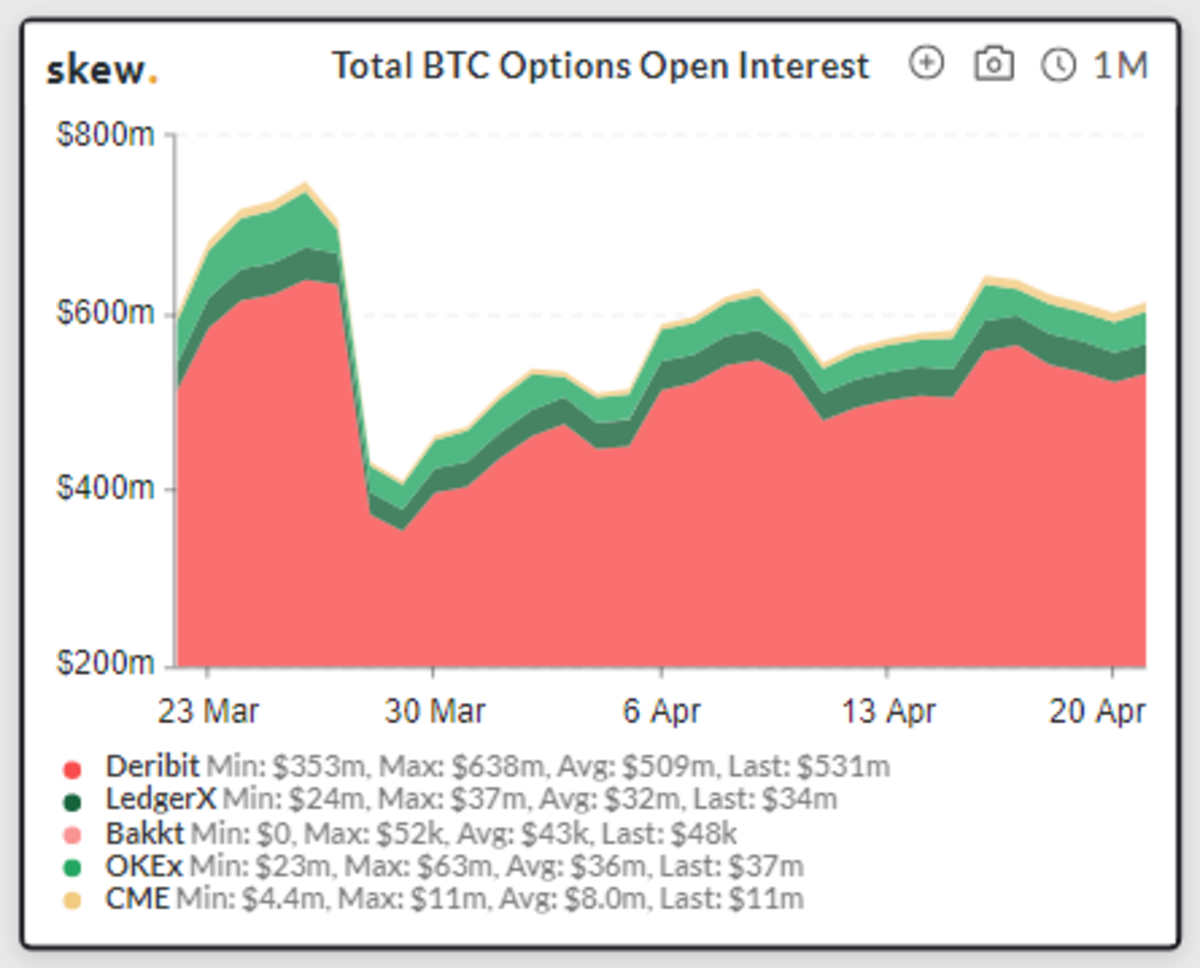

The bitcoin options market is on a sustained growth rate since the start of April as the market finally recovers from the horrors of “Black Thursday” when BTC stooped to $3,800. Since the start of April, the BTC options open interest has grown by 50% to $600 million (without Binance) signaling hope for the cryptocurrency market heading to the halving.

Additionally, the Binance exchange reported $1 billion in BTC option trading volume on the exchange since its inception earlier in the year. Despite the growing funds in BTC’s options market, the institutional investment ratios and declining volumes give a grim view of the short term future of BTC’s price.

BTC options OI soars by 50% in April

Technical indicators on Bitcoin’s derivative markets may give BTC perma bulls some hope going into the final days before May’s halving. According to Skew Markets, a crypto data aggregator, the BTC options market is witnessing a surge in the funds deposited – growing 49% in April alone since hitting a low of $400 million on Mar. 29.

Deribit remains the top exchange according to the data, with a total of $521 million worth of BTC options in the open market. This represents a 47.5% boost in April giving a very bullish signal on BTC’s price in the long term. OKEx and Ledger X hold the second and third largest share of open contracts in the BTCs option market with a total of $37 million and $34 million respectively.

Despite the rocketing heights in OI, the total value of BTC options contracts represents an 8% dip in the past month. Additionally, the BTC options OI is 17% lower since hitting monthly highs of $749 million on Mar 26.

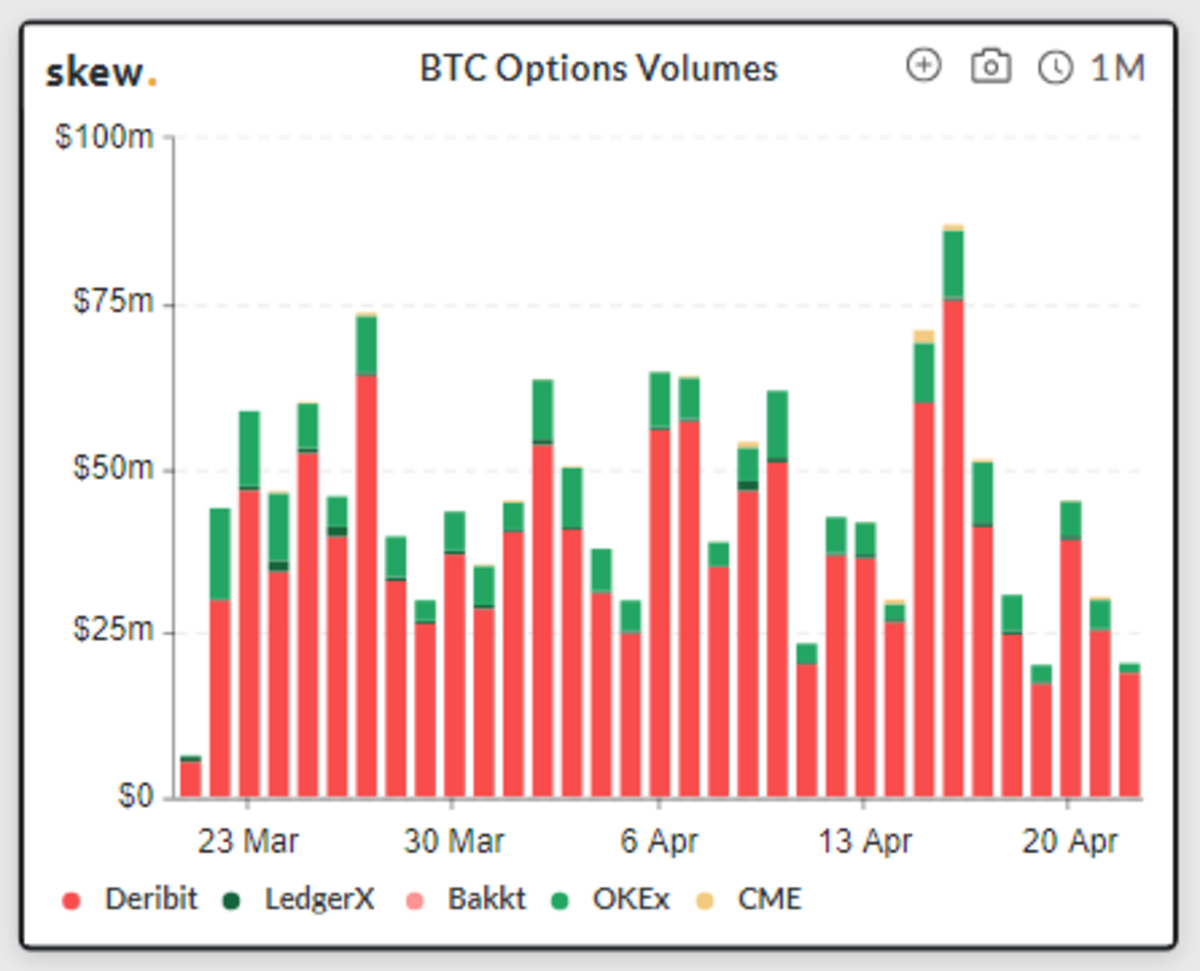

Moreover, Bitcoin options trading volumes remain low giving mixed signals on the possible movement of BTC/USD in the near term.

Will BTC breach $8000 in April?

The spike in open interest offers some hope on BTC/USD pair breaching the ever-evading $8,000 mark. However, looking at the spot and option volumes charts, the market looks bearish to say the least. Since spiking to $80 million in daily volumes on April 16, the volumes have dropped significantly to around $30 million, showing low participation by investors in the market.

Notwithstanding, Bitcoin currently changes hands at $6,850, dipping slightly below the daily 50-day moving average resistance – supporting the bearish sentiments on the market. Crypto trader and analyst Crypto Michael believes $7,000 will be key to keep the price of BTC afloat to distract from a scary bearish move on the market.

Still going according to plan.

Small breaker here, but I think the $6,975-7,000 area is more crucial for a break.

Weak volume on the breakout as well, which makes me cautious on any longs. pic.twitter.com/lcYRBeLbhe

— Crypto Michaël (@CryptoMichNL) April 22, 2020

One exchange however that is taking over the Bitcoin derivatives space is Binance, the world’s largest cryptocurrency exchange. The exchange recently announced that its recently launched Bitcoin options have already traded over $1 billion in volume since inception on Apr. 12.

Images from Skew Markets

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch