Bitcoin Positions Worth $1 Billion Liquidated in 30 Minutes Post BTC’s $5k Correction

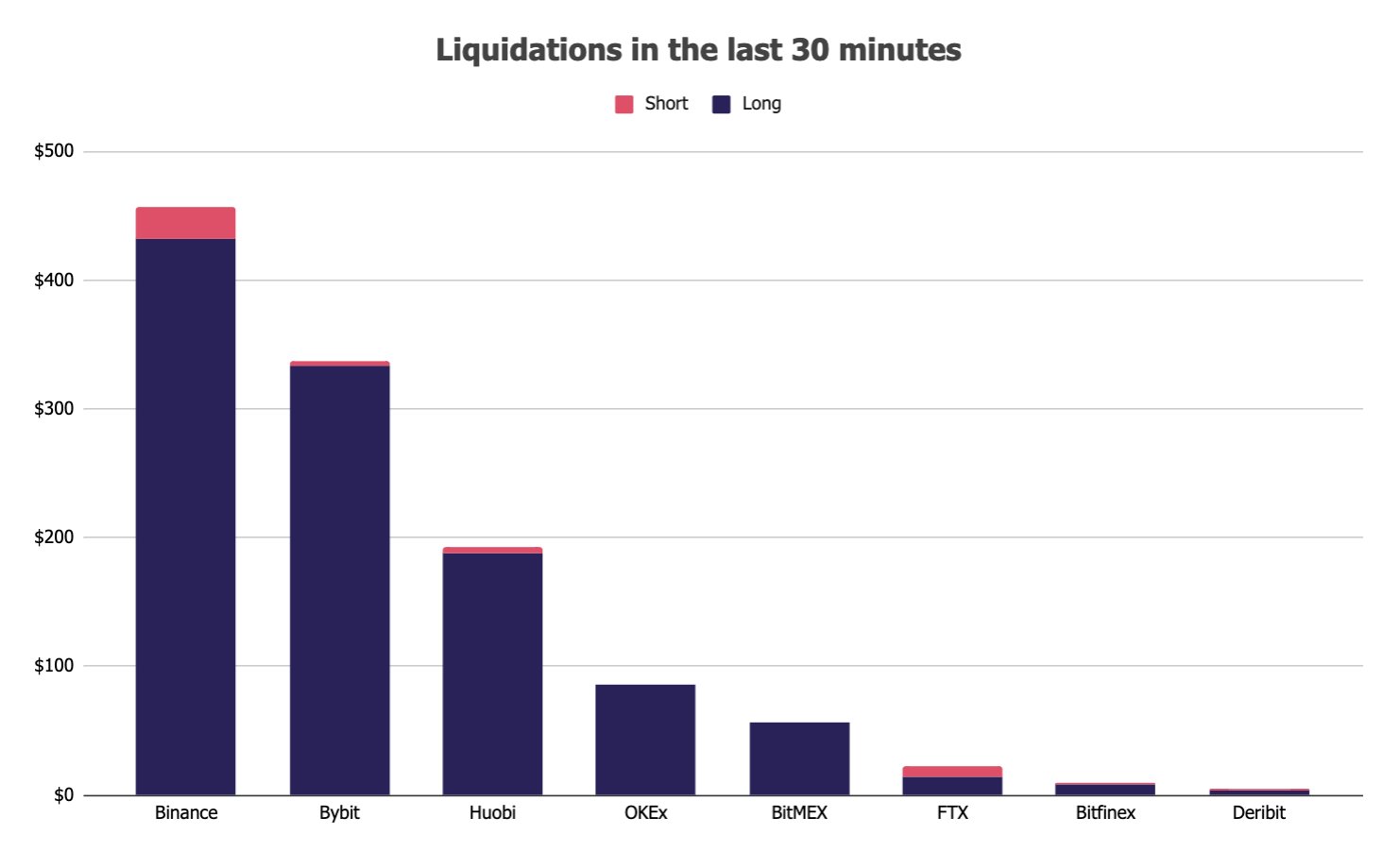

Bitcoin price recorded its new all-time-high above $62K only a couple of days back, having spent a majority of February and the first week of March in a consolidation phase. However, the price recorded a sharp correction of $5K this morning resulting in the liquidation of more than a billion-dollar worth of BTC derivative contracts within 30 minutes.

The significantly higher leverage position is one of the key reasons behind Binance’s huge success in the Futures market. At one point the daily trading volume for BTC Futures on Binance reached $2.7 billion.

A similar liquidation was seen across the exchanges when Bitcoin price finally broke to new ATH above $62K, liquidating billions in short positions.

Open Interest on Exchanges Record a Sharp Dip

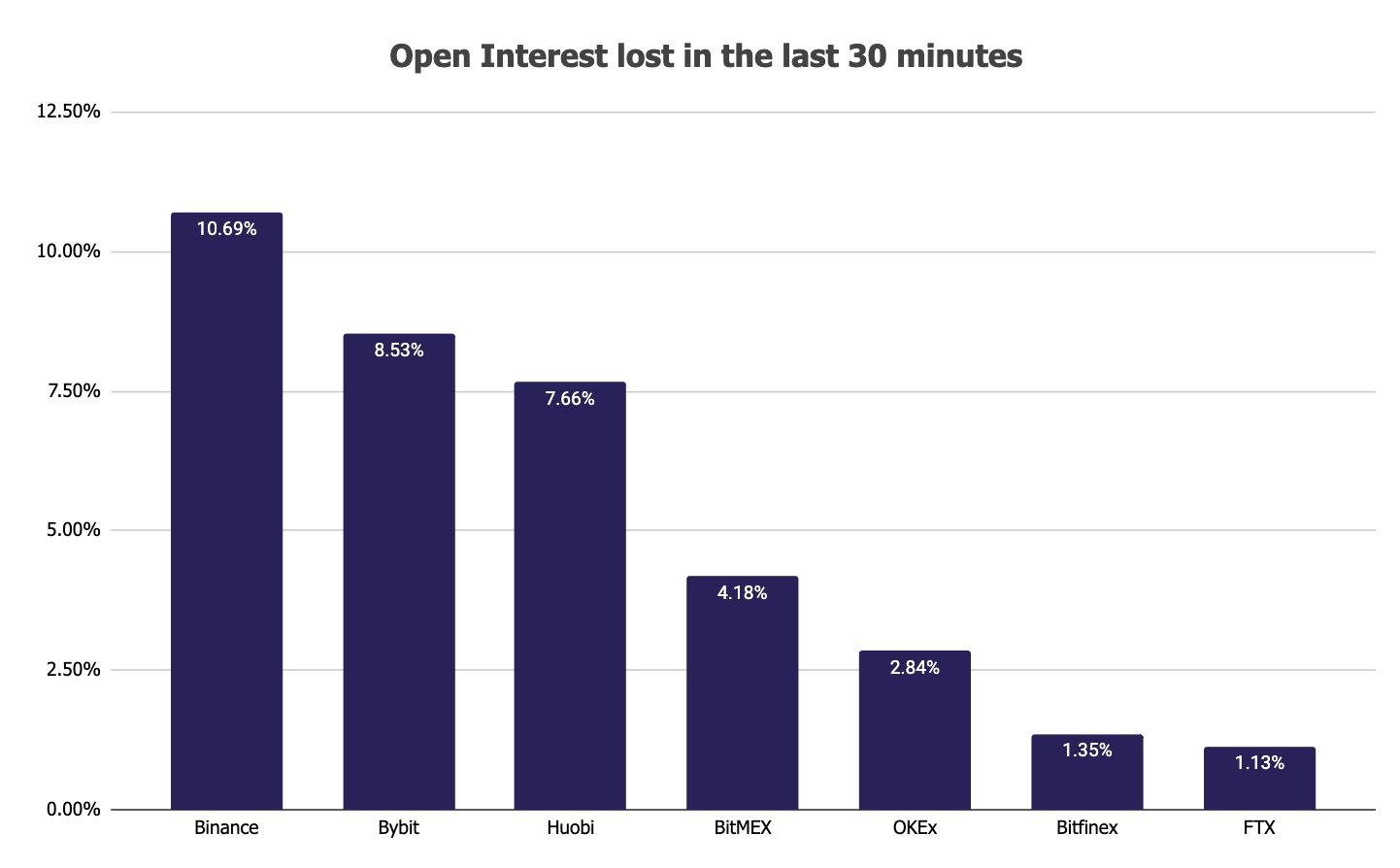

The sharp price correction followed by major BTC liquidation across exchanges was so ruthless that the open interest for Bitcoin Futures also recorded sharp corrections on these exchanges. Binane again topped the chart with its Open Interest falling 10.69% followed by Bybit with 8.53% and then Huobi with 7.66%.

Many even attributed the recent price correction to the Indian cryptocurrency ban FUD which has been going on for quite some time now. The early reports suggested that the government is planning to launch its own digital currency and would put a blanket ban on the use of other cryptocurrencies including Bitcoin.

The Finance Minister in an interview claimed that they might not go for an outright ban and would consider checking the use case viability of the crypto assets, sending a sense of relief among Indian crypto enthusiasts. However, the very same day some ‘inside reports’ with apparent parliamentary “sources” claimed that the Indian government would indeed proceed with the blanket ban and would also take cognizance of crypto mining in the country.

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k