Bitcoin Price Analysis: BTC Back Above $50K As Market Recovery Begins

Bitcoin (BTC) continues its Monday recovery that has seen BTC/USD regain the crucial support above $50,000. Bitcoin price was continuously rejected by the $52,000 resistance level of December 07 as the big crypto gained carrying the crypto market with it.

Bitcoin Price Is Still Bullish

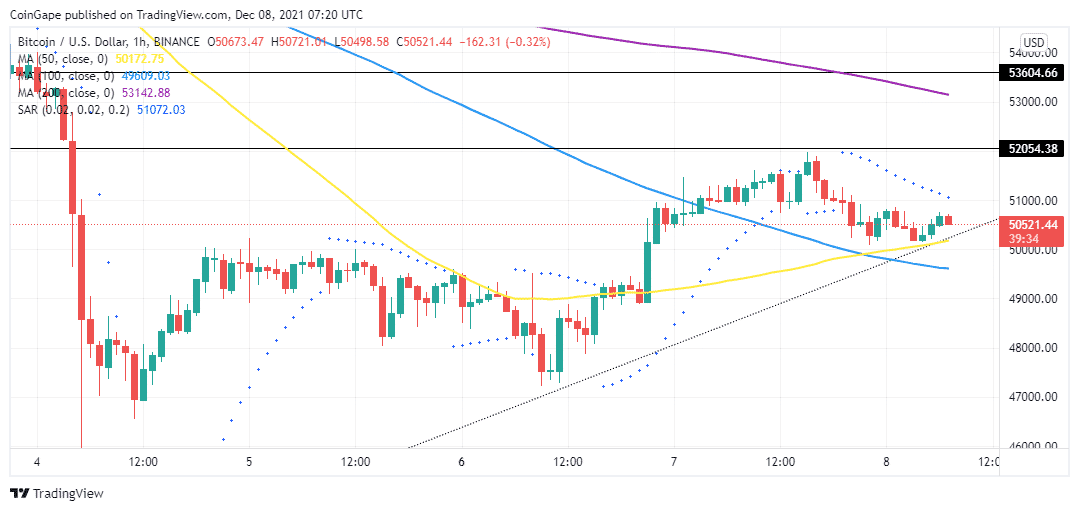

A look at the BTC/USD 1-hour candle chart below shows that Bitcoin was fiercely rejected by the $52,000 psychological level on Tuesday.

BTC/USD One-Hour Chart

At the time of writing, Bitcoin price seems to have retreated under this pressure towards the $50,000 level. BTC price teeters around $50,600 as the support from the wider market aims at pushing the price of the largest cryptocurrency by market capitalisation to retest the $53,600 resistance.

“Bitcoin rejecting at $51.6K. That’s an important level, just like $53.5K–55.5K is,” Tweeted Cointelegraph contributor Michaël van de Poppe.

“The trend still up since the recent crash, through which $49.6K is an area that I’d like to see hold if we want to retest the $53.5–55.5K zone.”

Hence, a daily closure above the $51,600 level could bolster the bulls wo might push the BTC price to tag cross above the $52,000 psychological to tag December 03 close around $53,600. This would represent an approximately 6% upswing from the current price.

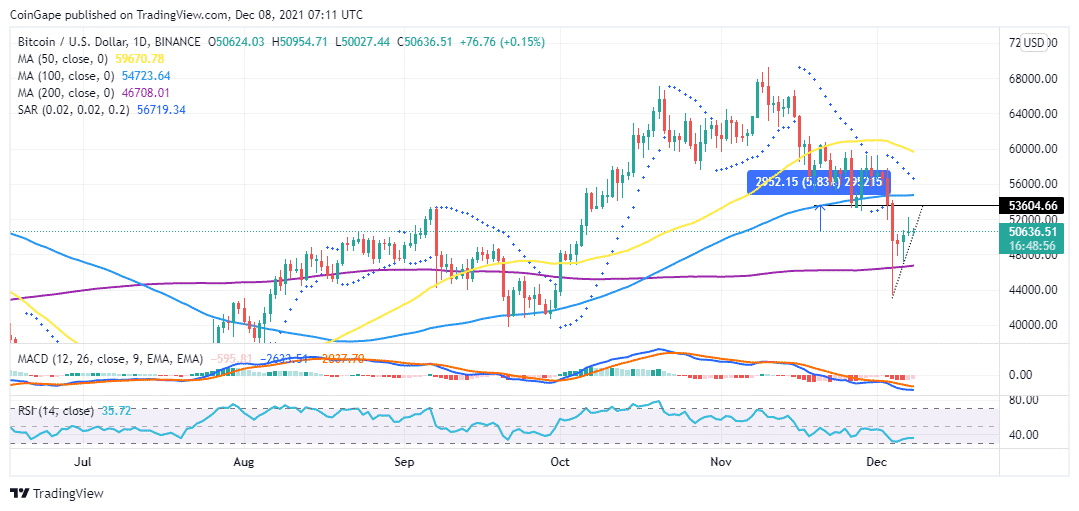

The upsloping Relative Strength Index (RSI) validates BTC’s bullish narrative

BTC/USD Daily Chart

However, nerves are still intense among crypto traders coupled with claims that current gains could be temporary and that the dip is yet to come.

No wonder the over 1% dip in Bitcoin price of the last 24 hours suggests that the bears are not done with pulling the price lower.

Therefore, if BTC/USD slips below the $50,000 level, it could trigger massive sell orders that are likely to take the price deeper. However, the big crypto might find support at the 200-day Simple Moving Average (SMA) around $46,708.

The movement of the MACD below the zero line in the negative region accentuates this pessimistic outlook.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

Buy $GGs

Buy $GGs