Bitcoin Price Analysis: BTC Rallies 5% To Reclaim The $65K Crucial Level

Bitcoin price has rallied 5.40% over the last 24 hours to trade above $65,000. Overcoming the overhead resistance zone between $64,324 to $66,834 is crucial to BTC rallying higher to new ATHs.

Bitcoin price is currently trading at $65,375 after rising approximately 5.4% over the last 24 hours. Meanwhile, Bitcoin’s market dominance has dropped from around 48% when BTC rallied to hit a new all-time high around $67,000 on October 20 to 43.29% at the time of writing. In addition, data from CoinMarketCap indicates that the overall crypto market capitalization continues to rise and now stands at $2.85T, a 3.50% increase over the last 24 hours.

An observation by CryptoQuant CEO Ki Young Ju has revealed that Bitcoin reserves across all crypto exchanges have been decreasing, which is an indication of strong buyer appetite. This could explain the BTC price push above $65K.

Bitcoin price ready for the big push to new record highs

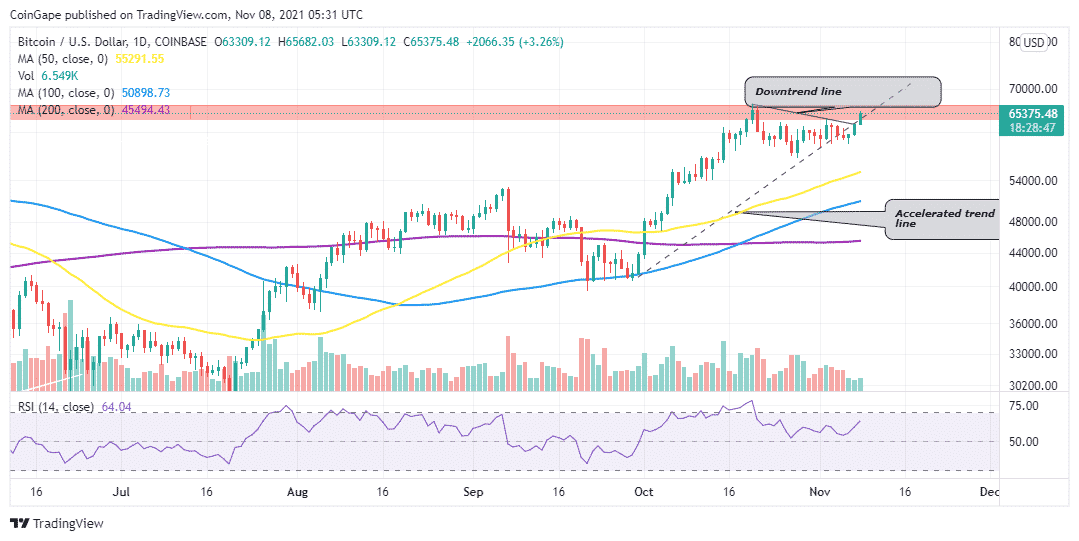

Bitcoin was rejected by the downtrend line on November 02 as buyers failed to push the price above the supply zone at $64,324 to $66,834. This was an indication that the bears were determined to pull the Bitcoin price down.

The three bearish sessions between November 03 and 05 saw bears succeed in pulling BTC/USD below the accelerated trendline losing the $62,000 support.

This was, however, an opportunity for more investors to get on board as the buying pressure that followed has seen Bitcoin reclaim the $65,000 support level which is crucial for buyers who are aiming for the ATH above $67,000.

However, before this happens, buyers need to overcome selling pressure from the aforementioned supply zone (red band).

BTC/USD Daily Chart

The upsloping moving averages and the upwards movement of the RSI towards the overbought region is an indication that the bulls are currently in control of the Bitcoin price.

This bullish outlook will, however, be invalidated of the Bitcoin price drops back below the accelerated trendline. If this happens, BTC may drop to tag the $62,000 psychological level. The zone between the $62,000 level and the 50-day Simple Moving Average (SMA) is likely to attract robust bullish support from the buyers.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise