Bitcoin Price: Analyst Predicts ‘Big Week’ For BTC, Here’s Why

Highlights

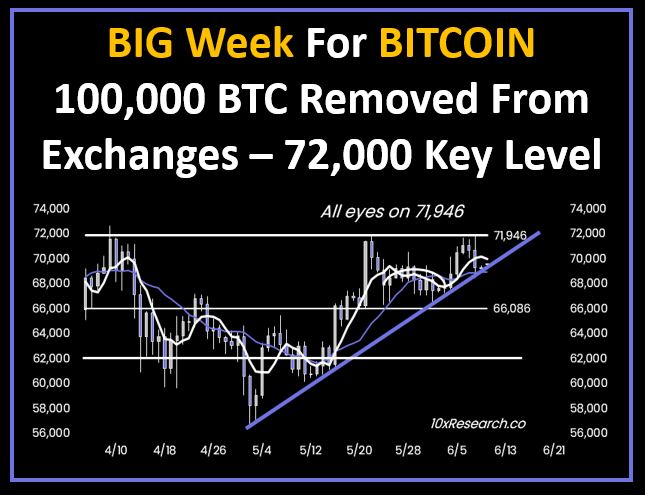

- Analysts predict a significant Bitcoin rally this week based on on-chain data.

- Major U.S. exchanges saw $6.75 billion in Bitcoin withdrawals, suggesting bullish sentiment.

- Bitcoin's reduced exchange supply could drive prices up if demand holds steady.

Bitcoin, the flagship cryptocurrency, has captivated the crypto market recently due to its volatile performance. After noticing a rally over the past few weeks, BTC has witnessed a slump after the robust U.S. job data.

Meanwhile, amid these fluctuations, a new analysis by 10X Research suggests that Bitcoin might be on the cusp of a significant rally. This prediction has caught the attention of both traders and long-term investors, hinting at a potential upward trajectory for the digital asset.

On-Chain Activity Signals A Big Week

Bitcoin’s recent movements have been closely scrutinized by market analysts. According to 10X Research, nearly 100,000 Bitcoins were withdrawn from exchanges in the past month, valued at approximately $6.75 billion.

Notably, this outflux from crypto exchanges was largely led by two major U.S. platforms: Kraken and Coinbase. Kraken saw a withdrawal of 55,000 Bitcoins, worth around $3.8 billion, while Coinbase experienced a withdrawal of 24,000 Bitcoins, valued at $1.7 billion.

Meanwhile, these massive withdrawals indicate a potential bullish sentiment among investors. When large amounts of Bitcoin are moved off exchanges, it typically signifies that holders intend to keep their assets rather than sell them in the near future. This trend could tighten the available supply on exchanges, driving up the price if demand remains steady or increases.

Notably, the firm’s analysis, shared on the social media platform X, highlights the unprecedented nature of these withdrawals and the implications for Bitcoin’s price action.

Also Read: How Bitcoin Will Benefit From End Of US-Saudi Petrodollar Deal

Bitcoin Price & Performance

The current market dynamics suggest that Bitcoin might be preparing for a significant breakout. The combination of reduced exchange supply and the lingering effects of the Bitcoin halving could create conditions ripe for a price surge. Notably, investors and analysts alike will be keenly watching the market for signs of a breakout, potentially making this a critical week for Bitcoin.

However, the recent volatile performance in the market, especially after the robust job data has sparked concerns over a hawkish stance by the Federal Reserve. Now, the market will keep a close watch on this week’s U.S. Consumer Price Index (CPI), and PPI data to track the inflation level in the nation. Besides, the FOMC interest-rate decision will also play a crucial role in shaping the market sentiment.

As of writing, Bitcoin price was up 0.23% and exchanged hands at $69,432.50, with its trading volume soaring 19% to $15.27 billion. The crypto has touched a high of $69,817.52 in the last 24 hours, after hitting a 30-day high of $71,946.46.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs