Just-In: Bitcoin Price Breakout Bullish Pattern For $74000

Highlights

- Bitcoin price has soared more than 2% today, sparking optimism in the market.

- Technical analysis predicts that BTC could soar past $74,000, but there's a catch.

- On-chain data indicates increasing trading activity for the flagship crypto.

Bitcoin has surged over 2% today, capturing market interest and increasing trading activity. Notably, the flagship cryptocurrency continues to gain traction, especially following the approval of Bitcoin ETFs and Bitcoin halving.

Meanwhile, recent analysis and on-chain activity suggest a potential breakout that could see Bitcoin’s price reaching over $74,000.

Analyst Offers Bullish Outlook

Prominent crypto market analyst Ali Martinez has highlighted a bullish pattern for Bitcoin. In a recent post on X, Martinez noted, “Bitcoin appears to be breaking out from a symmetrical triangle!”

Besides, he also said that if BTC managed to close above the $69,330 resistance level, it could trigger a Bitcoin price rally to $74,400. This analysis points to a significant potential for upward movement if Bitcoin can maintain its momentum and break through the crucial resistance level.

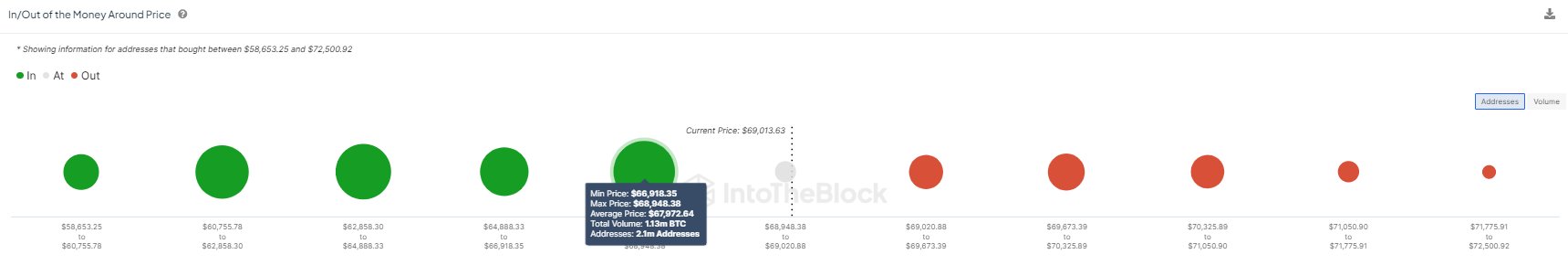

Besides, supporting this bullish outlook, a report from the on-chain data tracking platform, IntoTheBlock, has sparked further optimism. According to the report, Bitcoin is maintaining a steady momentum at $69,000 amid soaring demand from investors.

The report showed that the range between $66,900 and $68,900 indicates a “significant demand zone” for the flagship crypto. More than 2 million addresses have bagged around 1.1 million Bitcoin at this range. Notably, this accumulation indicates strong support and a solid foundation for potential price increases.

Also Read: 4 Top Altcoins Set For 100X Gains In June 2024

Bitcoin Price Soars

The combination of technical analysis and on-chain data suggests that Bitcoin is poised for a significant move. If the price can sustain above the key resistance level of $69,330, it could pave the way for a rally to $74,000 and beyond. Investors are closely monitoring these levels as they represent critical points that could determine Bitcoin’s next direction.

In addition, the current market sentiment is increasingly positive, driven by key events and developments. The approval of U.S. Spot Bitcoin ETFs has opened new avenues for institutional investment, bringing additional liquidity and legitimacy to the market.

As of writing, Bitcoin price was up 2.04% and traded at $69,056.03, after touching a 24-hour high of $69,313.26. Notably, the trading volume of the flagship crypto skyrocketed 119.15% to $24.29 billion in the last 24 hours, reflecting the increasing focus of the traders towards BTC.

Also Read: Binance Delisting & Ceasing Support of These Crypto, Prices Tank 25%

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs