Bitcoin Price Could Drop To $57k Amid Israel’s ‘Imminent’ Attack

Highlights

- Analyst Justin Bennett has predicted that the Bitcoin price could drop to as low as $57,000.

- Israel's imminent attack against Iran could spark this price decline.

- BTC's long-term outlook is still bullish with several potential tailwinds in this fourth quarter.

The Bitcoin price could drop to as low as $57,000, according to a recent prediction by popular analyst Justin Bennett. Israel’s imminent attack against Iran could be what leads to this price decline, considering how the flagship crypto dropped to $60,000 following Iran’s missile attacks against Israel. However, BTC’s long-term outlook is still bullish as several tailwinds lie ahead in this fourth quarter.

Bitcoin Price To Drop To $57,000

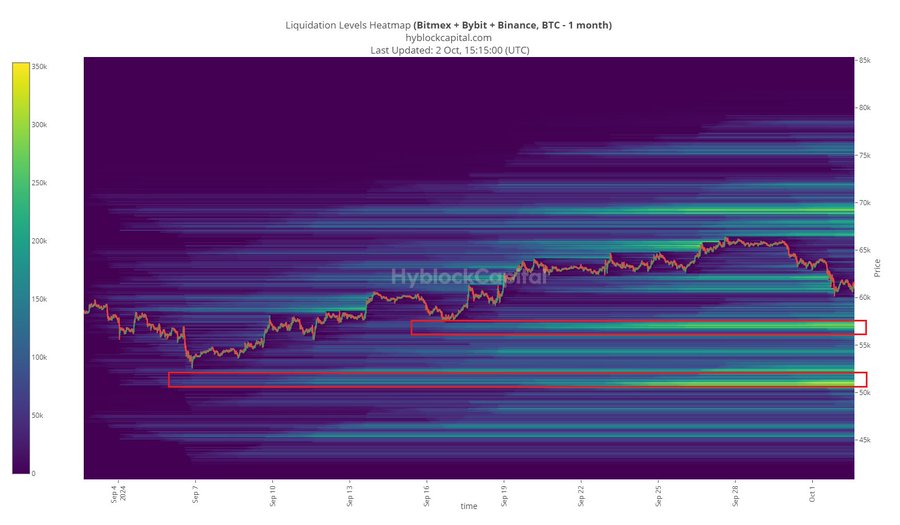

Bennett predicted on his X platform that BTC could drop to $57,000. This came following his statement that the range between $57,000 and $58,000 is the area to watch for Bitcoin to stay “constructive.”

The analyst also indicated that the flagship crypto was in bearish territory, stating that the only way for the BTC price to flip bullish is if it reclaims $62,000. The analyst claimed that the bears are in control until then and that dropping below $60,000 is possible.

The Bitcoin price and altcoins are currently facing huge selling pressure thanks to the escalation in the Israel-Iran conflict. Although BTC dropped to as low as $60,000 following Iran’s strike on Israel, it has since enjoyed a relief rally back above $61,000. However, Bennett warned market participants to be careful with this rally.

The analyst stated that the failure at $64,700 has opened up a sell-side liquidity. He noted that the BTC price already dropped to his first target of $60,000 and remarked that $57,000 “remains open for business.” Interestingly, he added that a case could be made for a price drop to $51,000, but he said it is unlikely at the moment.

Israel’s Imminent Strike Against Iran Could Spark Price Decline

Israel’s imminent strike against Iran could cause the Bitcoin price to drop to $57,000. Reports coming out of Israel are that the country plans to respond to the Iranian attack, which occurred on October 1. Israel’s Security Cabinet is said to have met and is planning an attack that could be worse than the one in April, which led to the killing of a top Iranian general in Syria.

Israel’s plan to attack Iran has also led to concerns that this could result in a full-blown war in the region. Such a development will lead to more fear and uncertainty in the market, sparking a wave of sell-offs and causing prices to decline further.

The Israel-Iran tension has already affected the crypto market rally, which was meant to begin this ‘Uptober.’ Therefore, a strike from Israel will only worsen things and send the Bitcoin price tumbling, with the broader crypto market also suffering a similar fate.

Long-Term Outlook Is Still Bullish

BTC’s long-term outlook is still bullish, considering several events could act as tailwinds for the flagship crypto. For instance, on the macro side, the US Federal Reserve could still cut interest rates by another 50 basis points (bps) before the year ends. China is already injecting liquidity into its economy. Global liquidity is surging thanks to these monetary easing policies, which is a positive for the Bitcoin price.

Furthermore, FTX will distribute $6 billion as part of customer repayments. These users will receive their repayments in cash and could again pump this liquidity into BTC and the broader crypto market.

Meanwhile, the US presidential election is 34 days away. The aftermath of the election has historically been bullish for the BTC price since it provides certainty to the market. Irrespective of who wins between Donald Trump and Kamala Harris, the flagship crypto could hit a new high once the election ends.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs