Bitcoin Price to Continue Falling in Q4, Predicts 10x Research & On-Chain Data

Highlights

- 10x Research predicts Bitcoin price could move $20,000 in either direction in Q4.

- Whales sold 147K BTC in a month amid weak seasonality and historical peak patterns.

- Matrixport and on-chain data suggest BTC turns bearish below $109,899.

Bitcoin price has tumbled over 10% from an all-time high of $124,457. While investors expect a bullish trend reversal in the upcoming seasonally strong Q4, a top crypto analyst warned that a rally supported by the historical pattern may not repeat this time.

Expert Predicts Bitcoin Price Outlook for ‘Uptober’

October is a historically strong month that drives Bitcoin price rally in Q4. Traders are positioned for another rally this ‘Uptober,’ but usual catalysts are apparently missing.

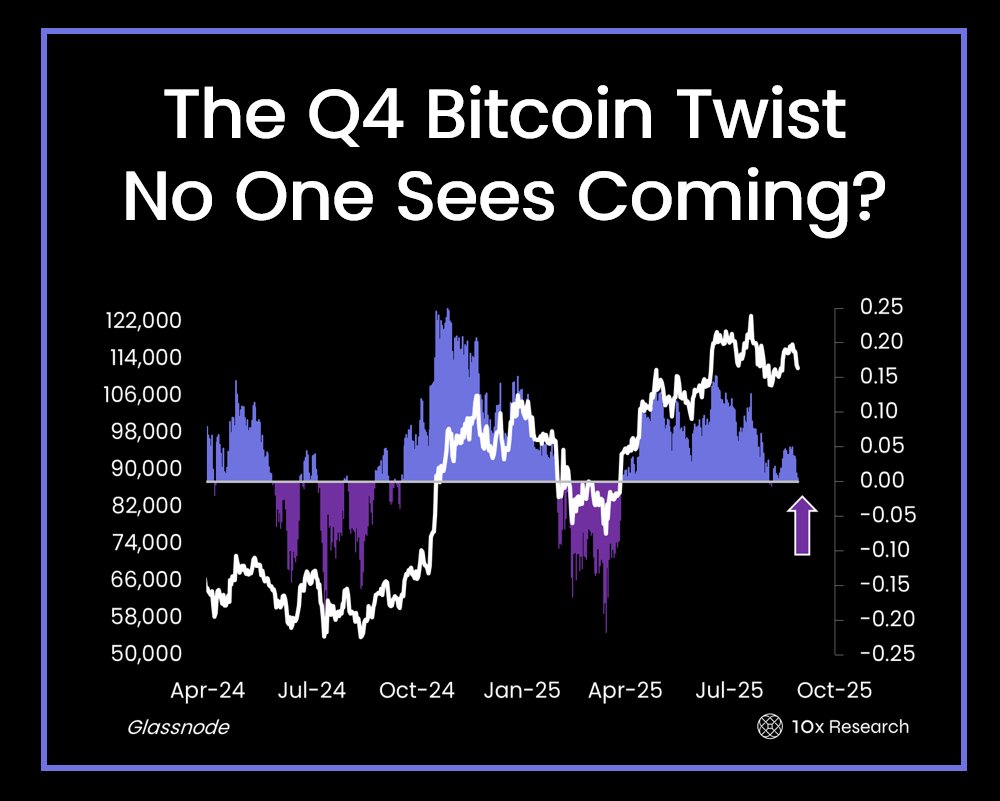

On September 24, 10x Research predicted BTC price could fall or rise by $20,000 as “key technical levels are converging.” Crypto options markets are flashing warning signals, with traders positioning heavily against a rally.

Meanwhile, multiple on-chain indicators are signaling at stress points that have historically marked major trend reversals. These headwinds, along with macroeconomic factors impacting the crypto market, suggest a big surprise awaits in Q4.

The firm added that they have accurately predicted the Q4 bullish rally for the last 3 years. When BTC was trading near $65,000, analyst Markus Thielen was among the few who predicted a rally to $100,000.

Notably, on-chain expert Glassnode predicted a Bitcoin crash to $105,500 amid the largest-ever $23 billion in BTC and ETH options expiry this Friday.

BTC Options Data Signal Bearish Trend

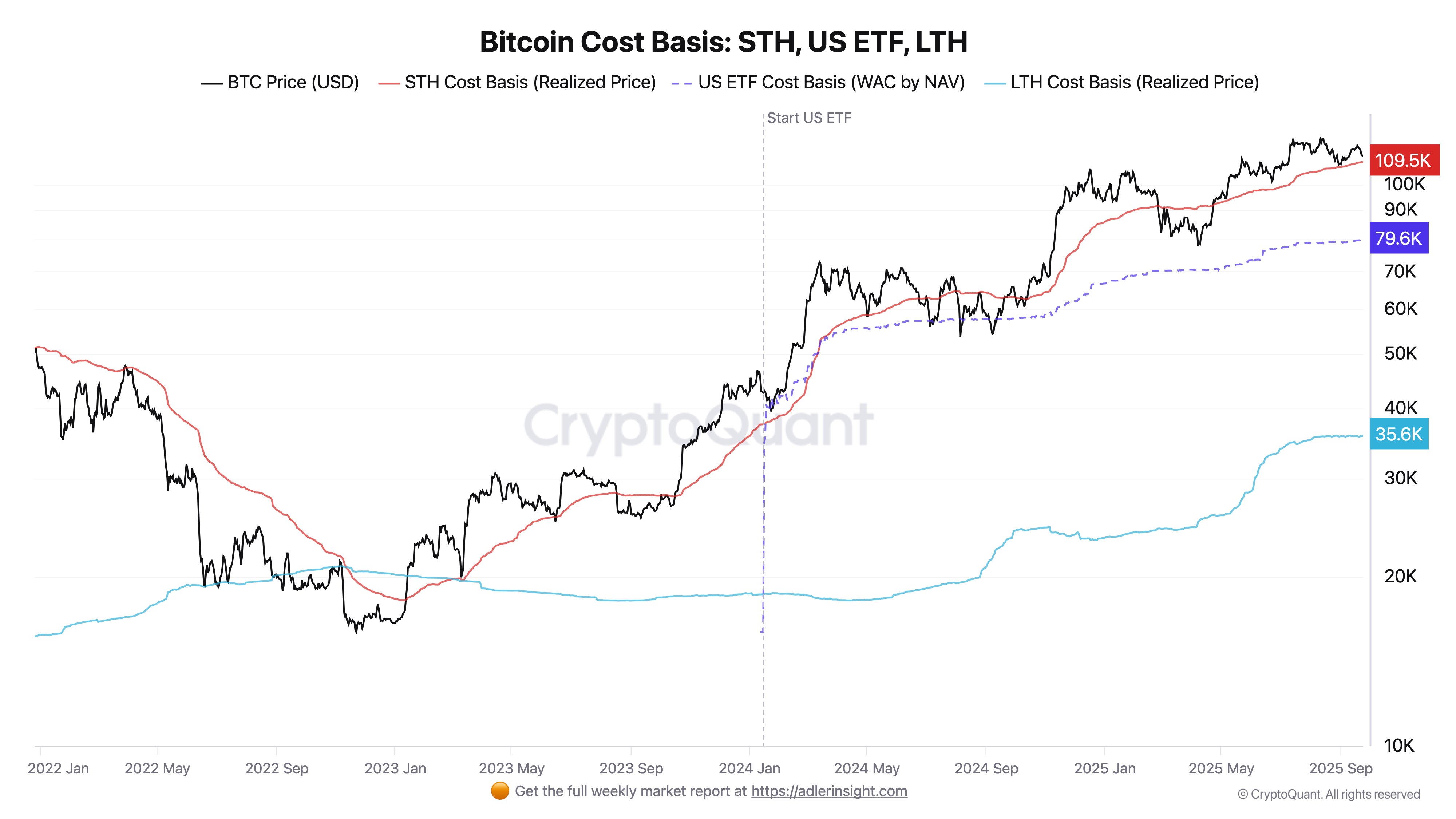

Julio Moreno, head of research at CryptoQuant, revealed that whales retaining net selling positions is a primary reason why Bitcoin price has crashed. In a month, whales have sold 147K BTC and the total balance is declining at the fastest monthly rate of the cycle.

Sentiment surrounding weak seasonality and historical peak patterns has triggered major selloffs across the crypto market. This was evident in outflows from spot Bitcoin ETFs and exits by notable entities, including a Satoshi-era Bitcoin OG.

Today, Matrixport predicted $109,899 as the key level to watch amid the current negative sentiment. Bull market stays intact as long as Bitcoin holds above it, but a slip below the level could trigger a major drop. Also, Bitcoin STH Cost Basis (Realized Price) metric shows Bitcoin price turns bearish below $109,580.

BTC is trading at $112,550, down 5% in a week. The 24-hour low and high are $111,229 and $113,351, respectively. Trading volume has dropped further by 13% in the last 24 hours, indicating a decline in interest among traders.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act