Bitcoin Price Crash to $96,530 Ahead Per Expert As Gold Wins in Debasement Trade

Highlights

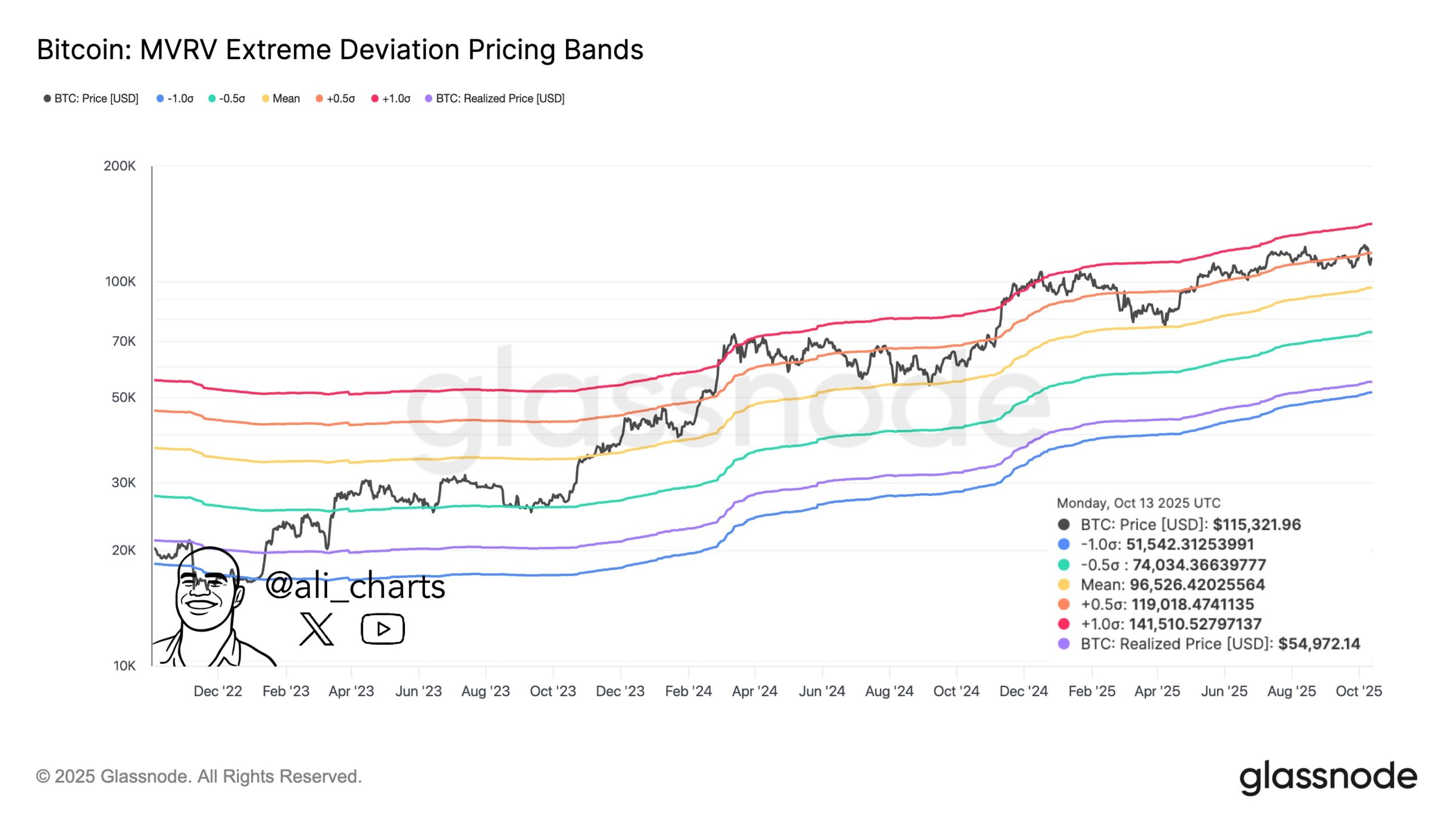

- Analysts warn of a potential Bitcoin price crash toward $96,530 if bearish pressure continues.

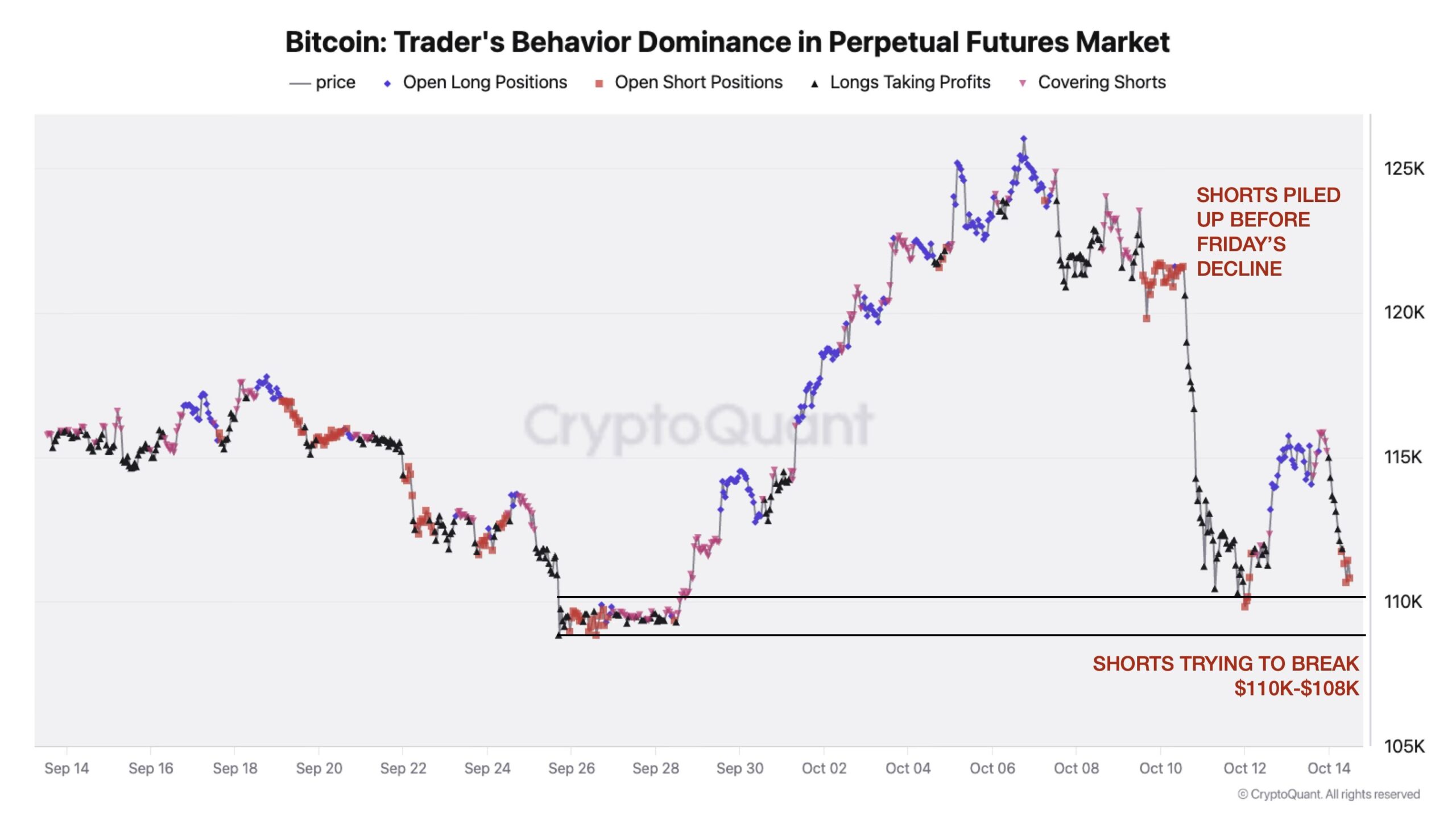

- Short traders are intensifying activity around the $110,000–$108,000 range, as BTC fails on the upside.

- Gold has emerged as a clear winner in the ongoing “debasement trade,” breaking above $4,200 per ounce for the first time ever.

Bitcoin price has plunged to the $110,000 support zone amid a major crypto market liquidation, as analysts warn of a potential 15% further decline ahead. Furthermore, as the ‘debasement trade’ kicks in, Gold has had the upper hand, with prices soaring to $4,200 per ounce. Short traders are piling up, and if they break the immediate support level, BTC could crash to $96,530.

Bitcoin Price Crash Tests Crucial Support in a Make-or-Break Event

CryptoQuant Head of Research Julio Moreno noted that short traders are repeatedly attempting another Bitcoin price crash to the key $110,000–$108,000 range. Moreno highlighted that this is the third such attempt, adding that a significant buildup of short positions occurred just before Friday’s crypto market crash.

On the other hand, crypto analyst Ali Martinez also stated that BTC needs to regain the $119,000 level to maintain its bullish momentum. He noted that the on-chain data and BTC pricing bands hint that failure to regain these levels, could trigger a correction with potential Bitcoin price crash to $96,530.

Bloomberg senior commodity strategist Mike McGlone questioned Bitcoin’s recent performance, noting that despite carrying “over twice the risk,” it has delivered roughly the same returns as the S&P 500 since surpassing the $100,000 mark.

McGlone added that, with most risk assets underperforming gold in 2025, the trend could signal a potential “sell bell” for broader markets. Furthermore, Bitcoin ETF outflows suggest that institutions are selling amid current market conditions.

Gold Gains An Upper Hand In Debasement Trade

With the US Dollar losing its value, Gold seems to be having the upper hand over other asset classes as part of the debasement trade. The current Bitcoin price crash has further widened the difference between the two. However, BTC might regain strength as Fed Chair Jerome Powell hinted at upcoming Fed rate cuts in his recent speech.

Gold futures surged past $4,200 per ounce for the first time in history, marking a nearly 60% gain in 2025 alone. The precious metals rally has outpaced major equity benchmarks, with gold and silver rising more than four times the performance of the S&P 500. Speaking on the development, Bitwise Investment CEO Hunter Horsley wrote:

“It’s all a debasement trade. It increasingly seems that all asset classes – equities, real estate, crypto, commodities, fx, fixed income, credit, infra – can and should be evaluated by the extent to which they benefit from the underway and coming currency debasement”.

Analysts note that this simultaneous strength in safe-haven assets and risk markets reflects growing concerns about the stability of fiat currencies. The strong performance of gold and silver amid a broader equity uptrend signals waning investor confidence in fiat currencies.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Breaking: MSTR Stock Price Climbs As Michael Saylor’s Strategy Adds 17,994 BTC

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

Buy $GGs

Buy $GGs