Bitcoin Price To Face Potential Correction If It Hits This Level

Highlights

- Analysts warn of potential correction after Bitcoin reaches its local top.

- Bitcoin's price may soar past $77,000 if it maintains momentum above $65,125.

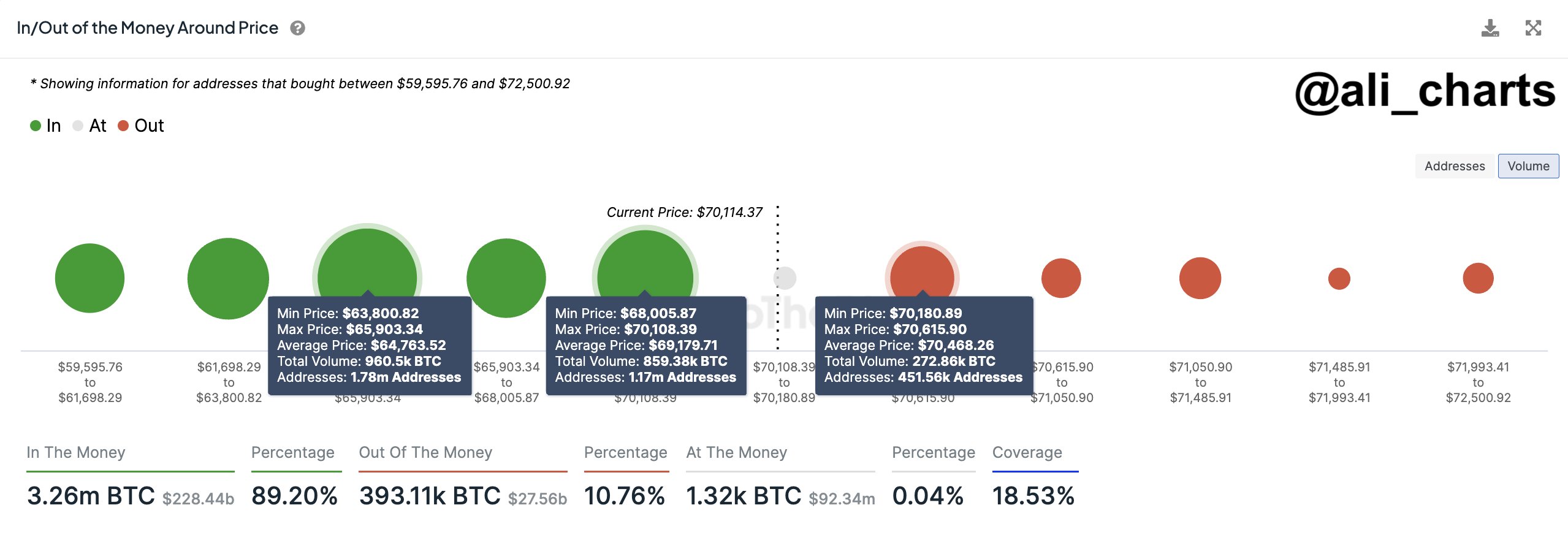

- A key supply zone between $70,180 and $70,600 indicates strong support for Bitcoin.

Bitcoin price faces potential correction or a pullback in the next few days, as macroeconomic factors and weak technical charts raising uncertainty. After a robust surge that nearly saw Bitcoin breach the $72,000 mark, the flagship crypto has encountered a slight pullback in its gains, with traders taking a cautious approach ahead FOMC Minutes release today. currently, BTC price is under consolidation and sentiment to determine the direction in the upcoming days.

Meanwhile, this fluctuation comes amid a broader market rally, fueled by optimism surrounding the potential approval of the U.S. Spot Ethereum ETF by the SEC. However, amid the drop in BTC price, a prominent analyst has provided a bullish outlook for Bitcoin while warning of a potential risk for investors.

Analysts Expect Bitcoin Price To Cross $77K

In a recent X post, renowned crypto market analyst Ali Martinez stirred discussions with his latest price predictions for Bitcoin. Notably, Martinez’s analysis, based on the “MVRV Pricing Bands”, suggests that Bitcoin could soar to $77,593 if it maintains its current trading momentum above $65,125.

Meanwhile, in another X post, Martinez highlighted a key supply zone between $70,180 and $70,600. He said that 450K addresses have acquired 273K BTC at this zone, indicating strong support levels. He even added that “the odds are in favor of the bulls!”

Martinez’s optimistic outlook aligns with the broader sentiment in the crypto market, where investors and analysts alike are eyeing further upside potential for Bitcoin. However, while the prospects of Bitcoin’s price surpassing $77,000 are enticing, he has also urged caution amid the market’s inherent volatility.

Also Read: WisdomTree Secures FCA Approval To List Bitcoin, Ether ETPs On LSE

Evaluating The Risks

Despite the bullish momentum, analysts caution against overlooking potential risks associated with Bitcoin’s price movement. While Martinez’s predictions paint a bullish picture, market dynamics can swiftly change, leading to unexpected downturns. With Bitcoin hovering near key resistance levels, there’s a possibility of heightened volatility in the short term, potentially triggering a brief correction.

Meanwhile, in his recent analysis, Ali Martinez noted that Bitcoin can face a brief correction after reaching its local top at $77,593. Considering that the market participants are advised to closely monitor market developments and exercise caution when navigating Bitcoin’s price fluctuations.

Although optimism prevails in anticipation of further gains, maintaining a balanced approach to investment strategies remains prudent. As of writing, the Bitcoin price was down 1.7% over the last 24 hours and exchanged hands at around $70,016.20. Despite the price drop today, the BTC price has noted gains of nearly 12% over the last seven days.

Simultaneously, the Bitcoin Futures Open Interest (OI) has also fallen 2.17% over the last 24 hours to 498.77K BTC or $34.99 billion.

Also Read: Cardano Founder Charles Hoskinson Accuses US Fed Of Corruption, Here’s Why

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

Buy $GGs

Buy $GGs