Bitcoin Price Falls Below $100k Despite U.S. Government Reopening

Highlights

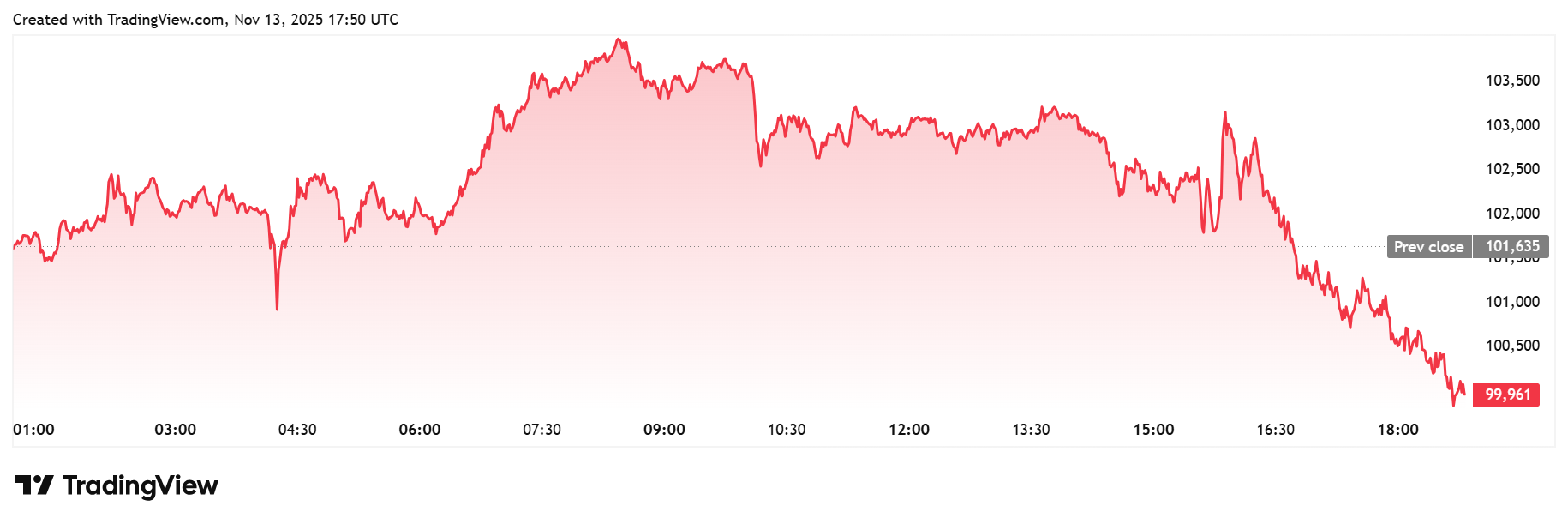

- Bitcoin dropped below $100,000 from an intraday high of around $104,000.

- This follows a drop in the odds of a December Fed rate cut.

- The government reopening has turned out to be a sell the news event.

The Bitcoin price has dropped below the psychological $100,000 level for the second time in as many weeks. This latest price crash comes despite the U.S. government reopening, which was expected to serve as a bullish catalyst for the markets.

Bitcoin Price Crashes Below the $100,000 Level

TradingView data shows that BTC has crashed below $100,000 today, hitting a low of $99,300 and dropping below a $2 trillion market cap in the process. This follows the reopening of the U.S. government after U.S. President Donald Trump signed the short-term funding bill.

The government reopening has now turned out to be a sell-the-news event, despite earlier projections that it would boost market sentiment. Notably, the Bitcoin price had surged earlier in the week to as high as $106,000 after the Senate passed the bill in anticipation that the longest government shutdown would end this week.

As CoinGape reported, BTC is also falling amid significant selling pressure, including from institutional investors. The Bitcoin ETFs have recorded 8 days of net outflows in the last 11 days. This includes outflows of $577 million and $558 million recorded on November 4 and 7, respectively.

Furthermore, research firm 10x Research noted that buyers are no longer stepping in, which has kept the Bitcoin price flat despite several potential bullish catalysts. 10x Research also claimed that the crypto market has entered into a mini-bear phase, based on on-chain indicators.

Uncertainty Around A December Rate Cut

Meanwhile, the uncertainty around a December Fed rate cut has also contributed to the BTC crash and the current bearish sentiment in the market. As CoinGape reported, the odds of a December rate cut have dropped to new lows with a cut no longer certain.

Notably, the two rate cuts this year had sparked a significant rally for the Bitcoin price, with the flagship crypto reaching new all-time highs (ATHs) just before the Fed lowered rates in September and October. However, with another cut now uncertain, market participants may be sitting on the sidelines until there is a clearer picture of the Fed’s potential decision at the December FOMC meeting.

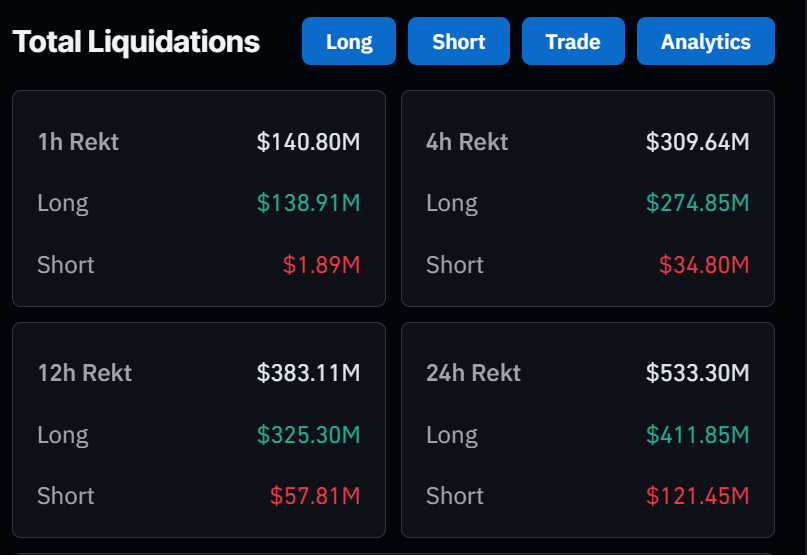

Long positions have suffered the most liquidations amid this crash below $100,000. CoinGlass data shows that $140 million has been liquidated in the last hour, with $138 million being long positions. Meanwhile, in the last 24 hours, there have been $532 million in liquidations, with $411 million being long positions.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs