Bitcoin Price Falls Below $90K Again as BTC ETF Sees $480M in Outflows

Highlights

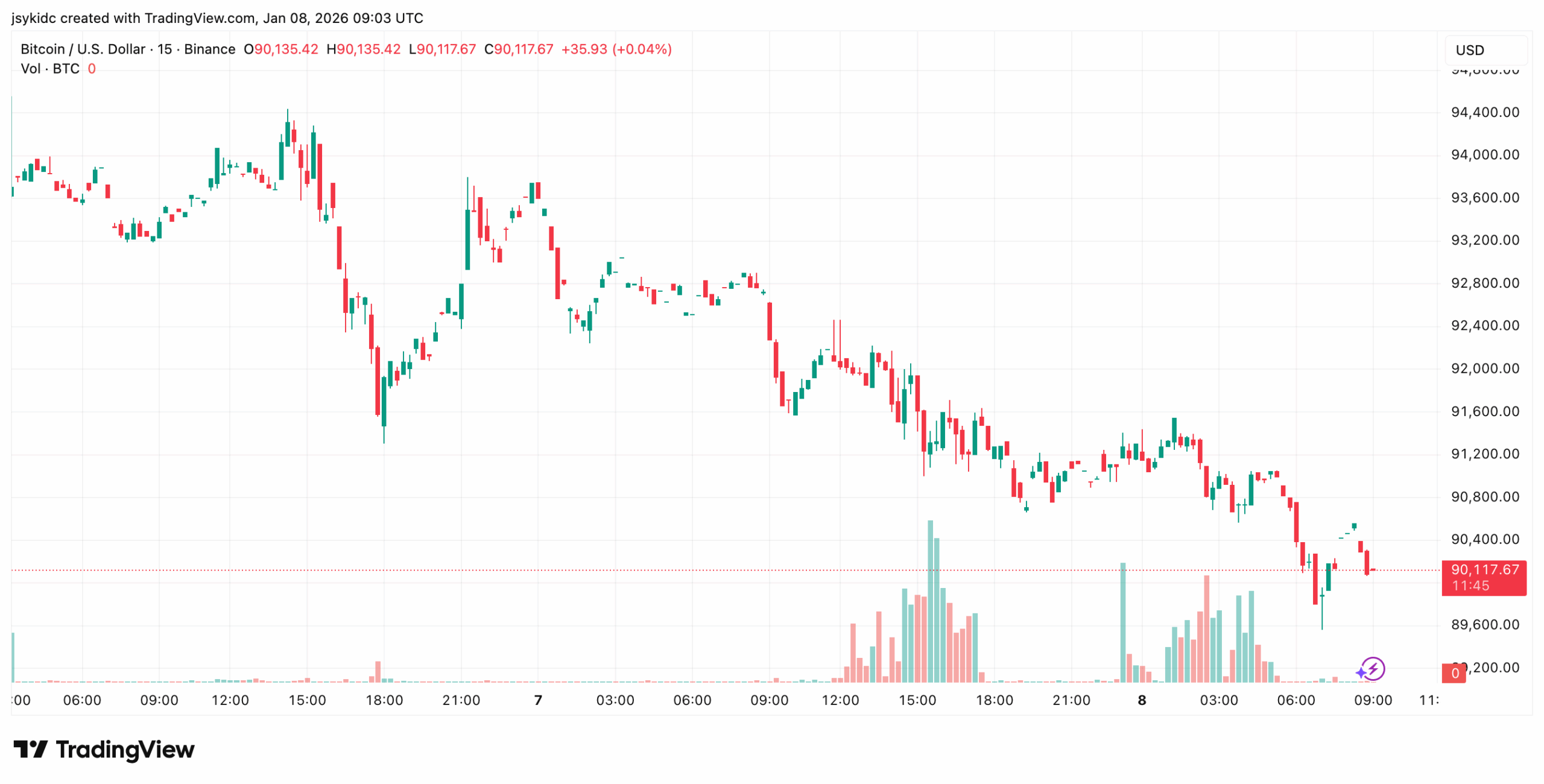

- Bitcoin slipped below the $90,000 mark, ending its early January rally.

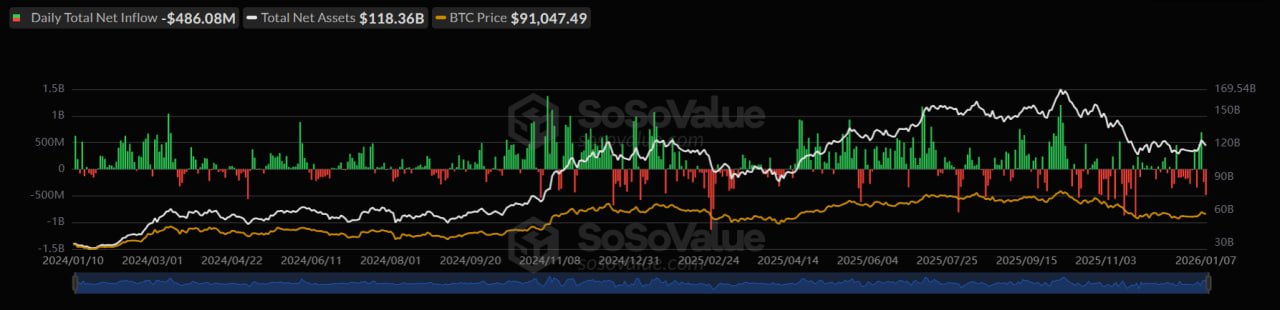

- U.S. spot BTC ETFs also recorded over $486 million in net outflows.

- Analysts suggest the pullback may be driven by profit-taking.

The initial January trend for the crypto market seemed to have run out of steam as the Bitcoin price slid below the level of $90,000. The U.S. spot BTC ETFs also recorded the largest outflow this year.

Bitcoin Price Pulled Back as BTC ETFs Posted Outflows

The crypto was spotted below $90,000 in Thursday’s market trading, thus negating some of the positive performance seen in the first week of the new year. The value has dipped by a slight 2% in the last 24 hours. Still, it is up by more than 3% over the past week.

The dip comes on the back of a very strong start to the week for the value of the coin. The Bitcoin price had surged past the $94,000 mark earlier in the week. This had led to speculation that it could inch even closer back to the $100,000 mark.

Investor sentiment retreated further, as U.S. spot BTC ETFs saw net outflows of over $486 million. This is the second consecutive day of net outflows, which is the first time in 2026. The net outflows are in complete contrast to the net inflows seen a couple of days back.

BlackRock’s IBIT is the only fund that recorded net inflows. According to data from SoSoValue, most other issuers recorded redemptions, a short-term trend that is unfolding.

These developments occur barely a week after the BTC ETF recorded the highest inflow within a single day since last October, when more than $697 million entered the market. It occurred as analysts deemed this as renewed interest in the market, having weathered the lows of late 2025.

0xNobler, a crypto analyst, shared that large market participants are pushing the Bitcoin price to go below $90,000 in order to remove over-leveraged traders.

🚨 BREAKING

BILLION-DOLLAR BITCOIN MANIPULATION IS HAPPENING RIGHT NOW!

WINTERMUTE AND BINANCE ARE DUMPING $BTC BELOW 90K TO LIQUIDATE RETAIL LONGS.

THIS IS ANOTHER COORDINATED MANIPULATION – DON’T GET SHAKEN OUT!! pic.twitter.com/zrs4DvZxt5

— 0xNobler (@CryptoNobler) January 8, 2026

Bullish Signals Persist Beneath the Surface

This was a retreat regardless of positive macroeconomic figures that are typically supportive of crypto. The JOLTS Jobs data in the United States showed up lower than anticipated in November. This further cemented the indication of a potential cut in interest rates in the country. Usually, such numbers have translated to a positive adjustment in the coin, but not in this case.

Meanwhile, Morgan Stanley also recently filed S-1 applications with the U.S. SEC for a BTC ETF. Such institutional investor engagement in regulated cryptocurrency investments should not therefore necessarily be entangled with Bitcoin price volatility.

This is also being aided by corporate treasury activity. Strategy acquisitions continue as it added another 1,286 BTC to the pool this week. American Bitcoin linked to Trump announced they’ve increased their pool of total BTC and are in the top 20 publicly listed treasuries of the coin.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise