Bitcoin Price: Flag Pattern And On-Chain Data Signal Reversal To $88K Soon

Highlights

- A bullish flag pattern on Bitcoin's weekly chart suggests a potential surge to $88K.

- Market sentiment indicators like RSI and MVRV suggest imminent buying opportunities for Bitcoin.

- Institutional investors have accumulated 7,130 BTC, indicating confidence in a future price rebound.

The recent retreat in Bitcoin price has taken the market by storm, while some experts remain optimistic about its future. Latest on-chain data and technical indicators suggest a significant bullish reversal may be on the horizon, potentially driving Bitcoin to $88,000.

Notably, this optimistic forecast is fueled by a combination of historical trends and a notable flag pattern, igniting investor confidence amid the broader market volatility.

On-Chain Data Indicates Bitcoin Price Rally To $88K Soon

Prominent crypto market analyst Crypto Faibik has predicted a bullish turn for Bitcoin, citing a “Bullish Flag Pattern” on the weekly chart. In a post on the X platform, Faibik asserted that Bitcoin could surge to $88,000 by July or August.

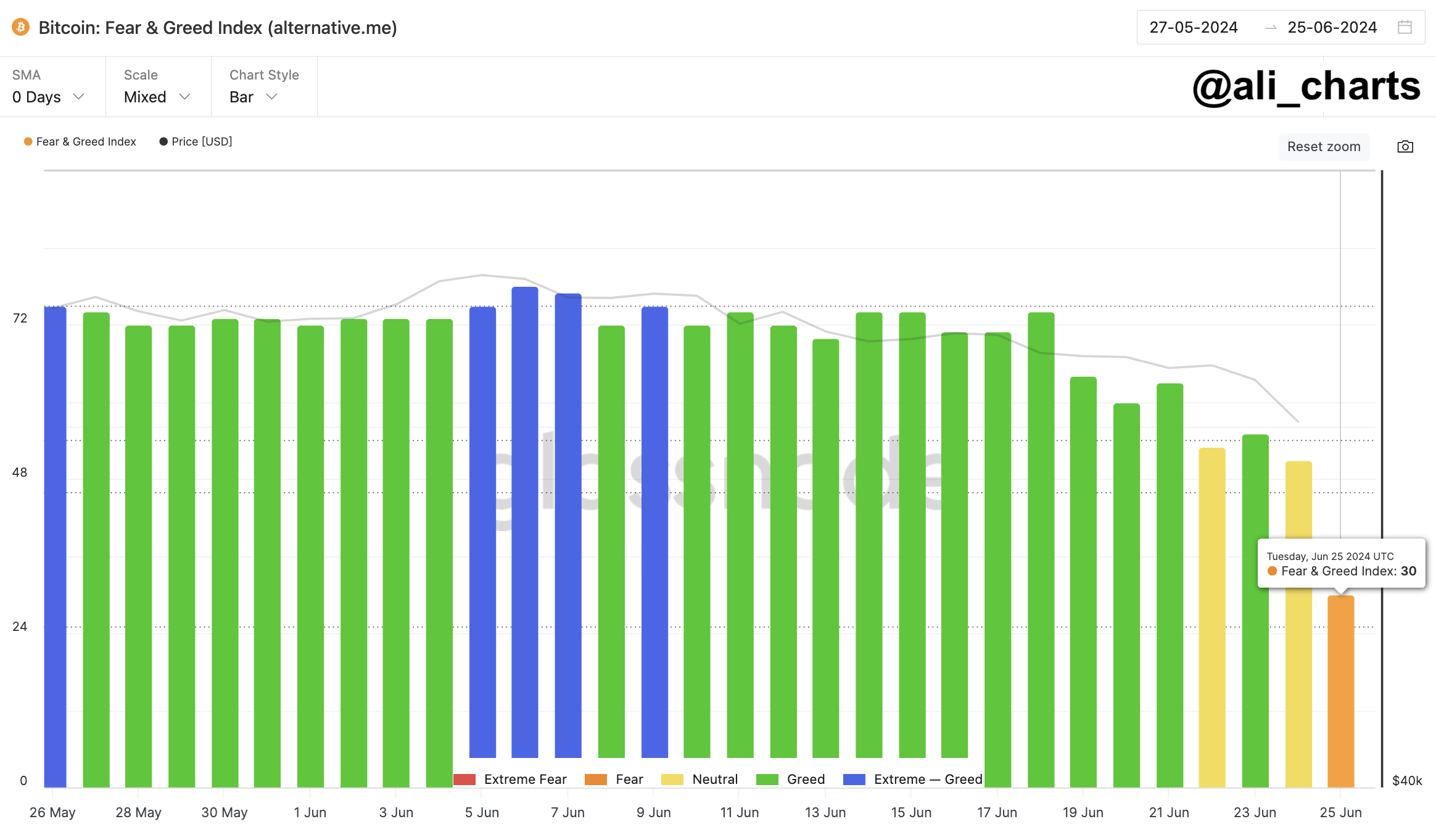

Notably, the flag pattern, often seen as a continuation signal, suggests that Bitcoin might be preparing for another upward move after its recent consolidation. Supporting this outlook, another well-known analyst, Ali Martinez, emphasized the current “Fear” sentiment in the market, as reflected by the Bitcoin Fear and Greed Index, which has fallen to 30.

Meanwhile, Martinez noted that this drop in sentiment typically presents buying opportunities. Besides, he pointed out that the Relative Strength Index (RSI) hitting oversold levels has historically preceded substantial price rebounds.

Martinez highlighted that in previous instances over the past two years, similar RSI conditions led to Bitcoin price increases of 60%, 63%, and 198%. In addition, Martinez also pointed to the Market Value to Realized Value (MVRV) Ratio, which is currently below -8.40%.

Looking at the historical trends, such levels have led to notable price surges. He observed that the MVRV ratio dipping to these levels previously triggered price jumps ranging from 28% to 100%. With Bitcoin currently under $60,000 and the MVRV ratio at -8.96%, Martinez suggests this could be an ideal time for investors to buy the dip.

Also Read: Jack Mallers’ Strike Launches In UK, Will It Boost Bitcoin Adoption?

Institutional Accumulation and Market Dynamics In-Play

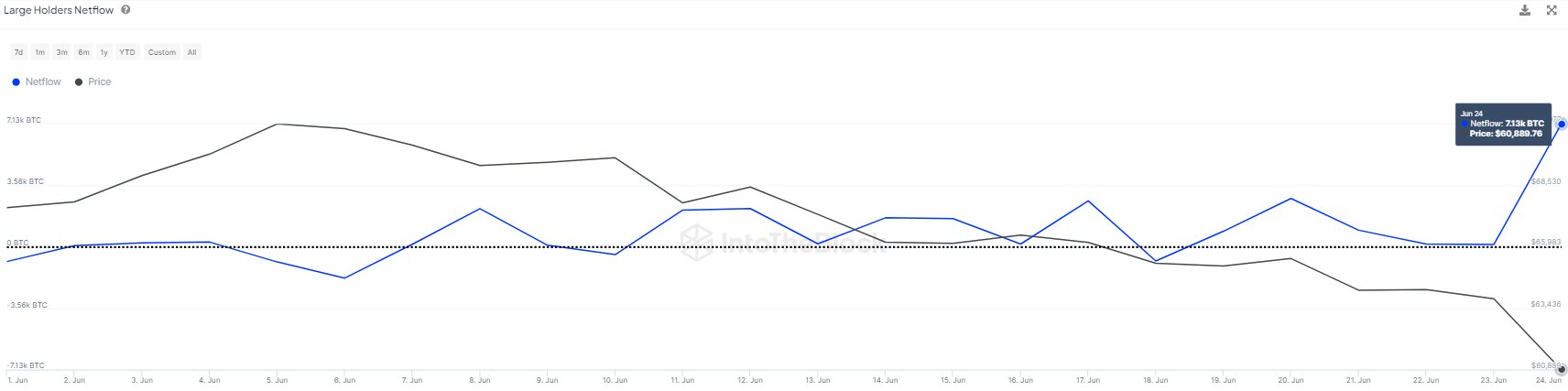

Complementing these technical analyses, data from on-chain analytics firm IntoTheBlock indicates substantial accumulation by large Bitcoin holders. According to their report, wallets controlling at least 0.1% of the total Bitcoin supply added 7,130 BTC, valued at approximately $436 million, in a single day.

This significant net inflow marks the highest level since late May, suggesting that despite market fears, uncertainty, and doubts (FUD) institutional investors are capitalizing on the recent price dip to accumulate more Bitcoin.

The combined insights from Crypto Faibik, Ali Martinez, and IntoTheBlock highlight a growing sentiment among market participants that Bitcoin’s recent decline might be a precursor to a strong recovery. The flag pattern and on-chain accumulation align with the historical resilience of Bitcoin during periods of market fear, suggesting a possible rally toward $88,000.

On the other hand, recent reports indicate that Morgan Stanley is likely to approve Bitcoin ETFs on its platform for customers by August 2024 end. The report, citing a “very senior source”, has further fueled optimism over growing institutional interest in the flagship crypto.

As of writing, Bitcoin price exchanged hands at $61,254.19, noting a flat change from yesterday. Furthermore, the crypto has touched a low of $58,601.70 in the last 24 hours, with its trading volume soaring over 32% to $37.15 billion.

Also Read: Metaplanet Creates Offshore Arm for Enhanced Bitcoin Strategy

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs