Bitcoin Price Forecast: BTC Draws Closer To ATH Near $65,000 Amid Potential Demand From Developing Countries

- Bitcoin price regains momentum as bulls launch fresh bid for the all-time highs.

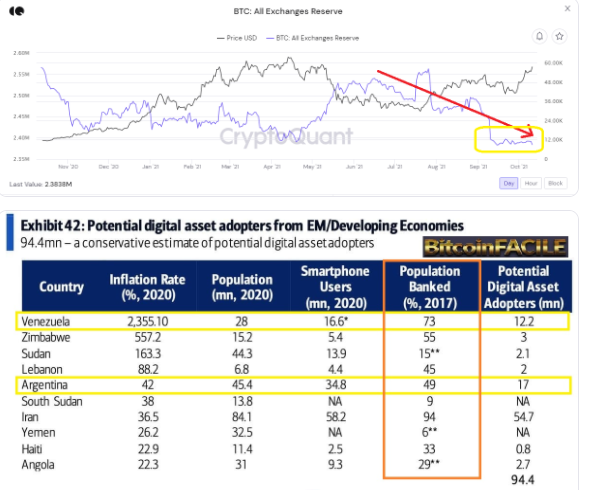

- More than 94 million people from developing countries would be ready to shun national currencies for cryptocurrency.

The cryptocurrency market is back in the green after a couple of retracement days, mainly for most altcoins. On the other hand, Bitcoin displays a bullish case, briefly stepping above $57,000 on Tuesday.

At the time of writing, the largest cryptocurrency trades around $56,500. Bulls are unlikely to give up on the journey to the all-time high, especially when they are closer to cracking through $60,000.

Bank Of America Reports 94 Million People In Developing Nations Ready To Adopt Cryptocurrency

According to a recent report by the Bank of America, roughly 94 million from various developing countries would prefer digital assets to the more stable local, national currencies, weighed down by hyperinflation.

Moreover, this figure could shoot up significantly when the percentage of unbanked people in the world is considered.

In line with the declining Bitcoin reserves on exchanges, supply would be significantly squeezed. According to CryptoQuant, “if the digital gold rush really starts in emerging markets, the next few months will be decidedly overheated.”

Bitcoin Price Hold Above Crucial Support

Bitcoin price correction from $58,000 secured support around the 61.8% Fibonacci retracement level. Further down, the 50% Fibo reinforces the demand zone in green. With these two buyer congestion areas intact, Bitcoin does not have much to worry about on the downside. This means that buyers can focus on lifting above $60,000 and closing the distance to $645,000.

BTC/USD Daily Chart

The overall technical picture is bullish for Bitcoin, especially on the daily chart. As the MACD moves higher above the mean line, the odds increase in favor of the uptrend. Note that a confirmed break above $58,000 will likely cement the bulls’ position and influence in the market, thus setting a precedence for more gains.

Bitcoin Intraday Levels

Spot rate: $56,330

Trend: Bullish bias

Volatility: Low

Support: The 61.8% and the 50% Fibonacci

Resistance: $58,000 and $60,000

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs