Bitcoin Price Forecast: What Next For BTC If Bulls Secure This Crucial Support?

- Bitcoin price retests support at $34,000 after rejection at $36,000.

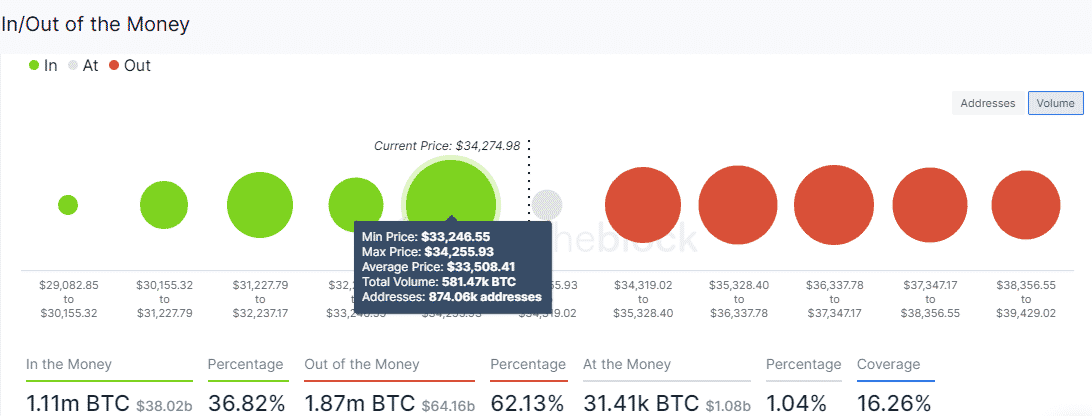

- The transaction history model reveals robust support roughly at $34,000.

Bitcoin price deals with an influx of selling orders on Thursday and toward the end of the Asian session. The recent rejection from slightly above $36,000 saw overhead pressure hover continuously while BTC sort higher support.

When writing, the pioneer cryptocurrency trades at $34,250 while dancing between two critical technical levels; the 50 Simple Moving Average (SMA) support and the 100 SMA resistance in the four-hour timeframe.

Bitcoin Price To Resume The Uptrend On Holding Key Support

The short-term technical outlook is bearish based on the Moving Average Convergence Divergence (MACD) indicator. This technical indicator follows the trend of an asset and calculates its momentum.

Last week, the MACD sent a bullish signal as the 12-day exponential moving average crossed above the 26-day exponential moving average. The bullish outlook was later affirmed by the MACD crossing above the zero line and into the positive region, a situation that saw Bitcoin price lift beyond $36,000.

Meanwhile, a bearish signal has been flashed after the above-moving averages switched positions. Besides, the indicator is heading toward the zero line, which emphasizes the hovering overhead pressure.

BTC/USD four-hour chart

Despite the short-term technical picture being bearish, Bitcoin is anticipating numerous support levels, starting with the 50 SMA, holding at $34,000. The In/Out of the Money Around Price (IOMAP) on-chain metric by IntoTheBlock reveals that the region between $33,247 and $34,256 is a substantial support zone.

Bitcoin IOMAP model

On the upside, the resistance levels continue to weaken, which means that Bitcoin may eventually lift toward $40,000 in the near term. However, the support levels mentioned must be defended at all costs.

Bitcoin intraday levels

Spot rate: $34,250

Trend: Bearish bias

Volatility: Low

Support: $34,000

Resistance: $36,000

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?