Breaking: Bitcoin Price Hits New All-Time High As Traders Price In Rate Cut

Highlights

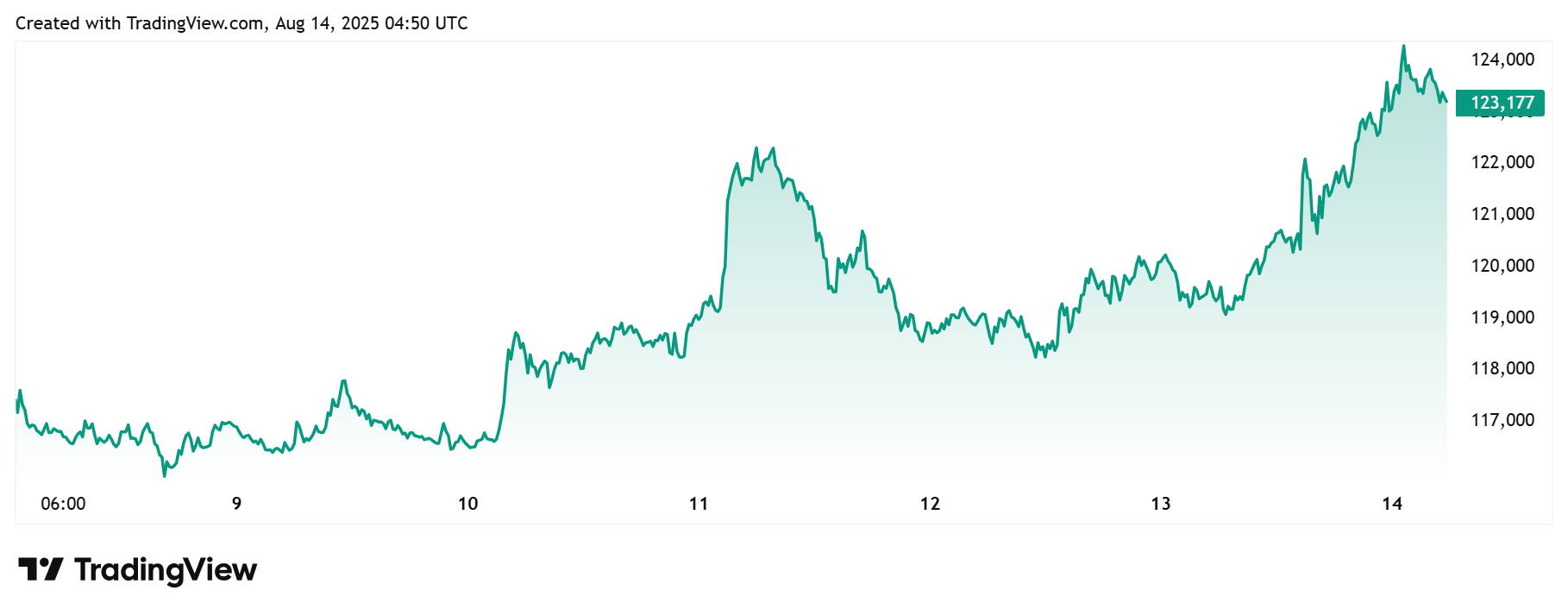

- Bitcoin has hit a new all-time high (ATH) above $123,000.

- The flagship crypto surged from an intraday low of $118,939.

- This comes as traders fully price in a Fed rate cut in September.

The Bitcoin price has reached a new all-time high (ATH), providing a bullish outlook for the crypto market. This development comes as traders price in a 25 basis points (bps) Fed rate cut at the September meeting.

Bitcoin Price Reaches New All-Time High Above $123,000

TradingView data shows that the BTC price has broken above its previous ATH at around $123,000, rallying to a new ATH of $124,400 in the process. The flagship crypto is up over 2% on the day, rising from an intraday high of $118,939.

This comes just about a month after the Bitcoin price reached its previous high of $123,091. The flagship crypto had reached that milestone back in July, ahead of the ‘Crypto Week’ which ushered in the GENIUS, the first major crypto legislation in the U.S.

CoinGape had earlier reported that BTC was eyeing a new all-time high ahead of the U.S. CPI and PPI data this week. The CPI data came in at 2.7%, lower than expectations, which was a positive for the flagship crypto. Meanwhile, the PPI data is also expected to show that inflation in the U.S. is still steady.

As such, traders are now pricing a 25 basis points Fed rate cut in September, which has contributed to the Bitcoin price rally. A rate cut is bullish as it would inject more liquidity into the crypto market and boost risk-on sentiment. U.S. Treasury Secretary Scott Bessent has also raised the possibility of a 50 bps, which would be massive for BTC and other crypto assets.

It remains to be seen if the flagship crypto will enter into price discovery following its rally to a new ATH or if it will witness a healthy retrace. Meanwhile, other crypto assets have rallied alongside BTC. Notably, ETH is up over 28% in the last seven days and is now close to its ATH of $4,891.

Implications Of The New ATH

With the Bitcoin price rally to a new ATH, BTC is again the sixth-largest asset by market, ahead of Google and Amazon’s stocks. Meanwhile, the only assets ahead of the flagship crypto are Gold, along with Nvidia, Microsoft, and Apple’s stocks.

Meanwhile, thanks to the surge, Strategy’s Bitcoin holdings have reached a new ATH in terms of value. The company’s co-founder pointed out earlier today that their BTC holdings closed at an all-time high of $77.2 billion.

Today, Strategy’s Bitcoin holdings closed at an all-time high of $77.2 billion. pic.twitter.com/NgssOoIFKy

— Michael Saylor (@saylor) August 13, 2025

El Salvador’s President Nayib Bukele also showed his country’s BTC portfolio, which has reached new highs thanks to the Bitcoin price rally to a new ATH. The country now boasts an unrealized profit of over $468 million on its investment.

— Nayib Bukele (@nayibbukele) August 13, 2025

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise