Breaking: Bitcoin Hits New ATH Above $125k as ‘Uptober’ Kicks Off in Full Force

Highlights

- Bitcoin rose from an intra-day low of $121,577 to reach a new ATH of $125,500.

- This comes as several factors spark renewed bullish sentiment in the crypto market.

- Experts predict that the flagship crypto could reach as high as $200,000 by year end.

The Bitcoin price has hit a new all-time high, after staging a monstrous rally since the start of October, climbing above its previous ATH of $124,400. This comes as market participants look forward to several bullish market catalysts that could happen in this fourth quarter.

Bitcoin Price Hits New ATH Amid ‘Uptober’ Excitement

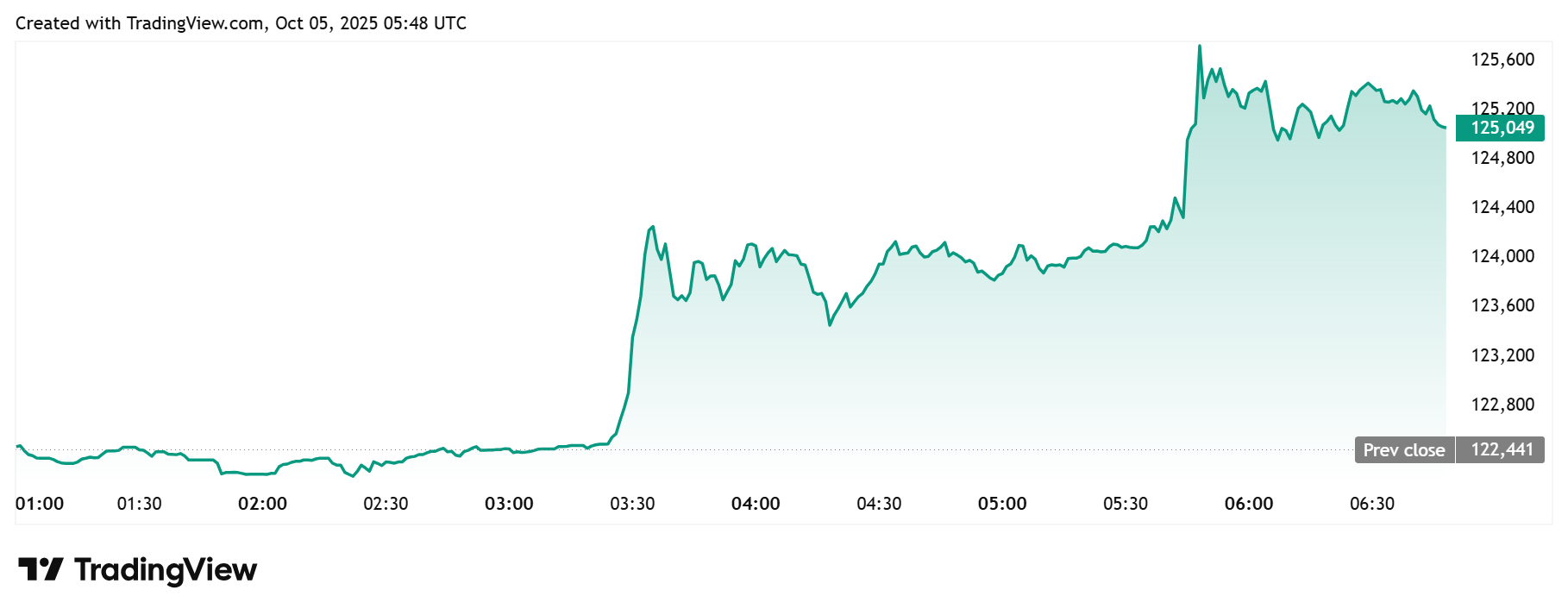

TradingView data shows that the flagship crypto has hit a new ATH of $125,500, rising from an intra-day low of around $121,500. This has come amid the ‘uptober’ excitement, with BTC already up over 6% to start this month, which is its best second-best performing month based on historical data.

This Bitcoin price rally comes just less than two months following its run to its previous ATH of $124,400 in August, which came as market participants priced in the first rate cut of the year, which happened at the September FOMC meeting. Now, just as during that period, the market appears to be pricing in another Fed rate cut at the upcoming FOMC meeting this month.

As CoinGape reported, there is currently around a 97% chance that the Fed will make a 25 basis points (bps) rate cut at the upcoming meeting. This looks more than likely due to the softening labor market.

Meanwhile, CoinGape also reported that the Bitcoin ETFs have seen renewed interest, recording their largest weekly inflows of the year last week, with $3.24 billion flowing into these funds. As such, this demand from institutional investors has also contributed to the Bitcoin price rally to a new ATH.

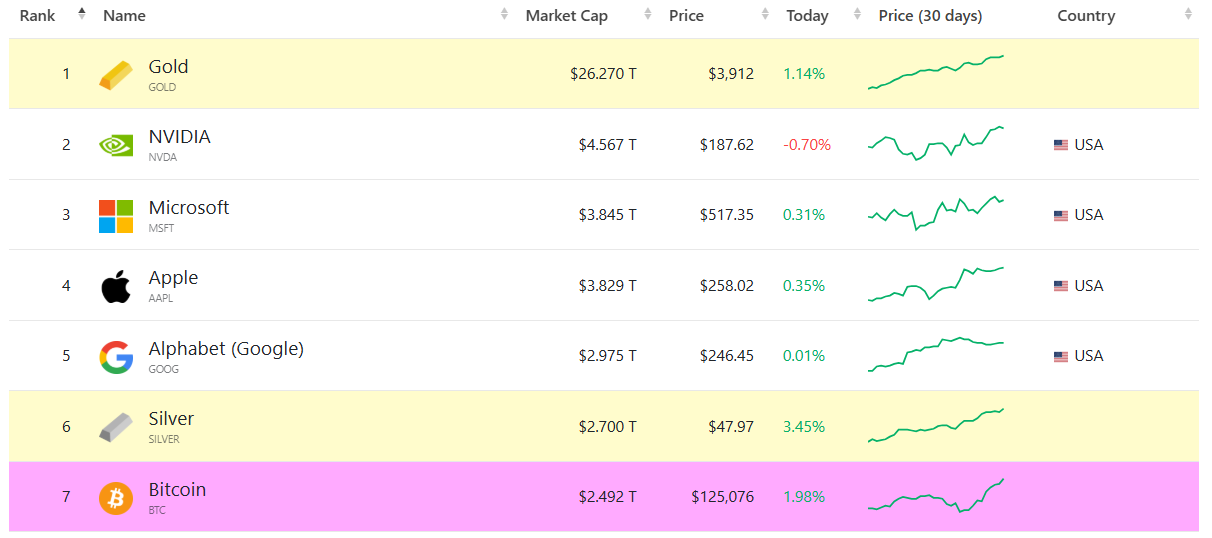

With its rally above $125,000, BTC now boasts a market capitalization of $2.5 trillion and is the seventh-largest asset, just behind silver. The flagship crypto is well ahead of ‘Mag 7’ stocks, Meta and Amazon, which currently boast a market cap of $1.78 trillion and $2.3 trillion, respectively.

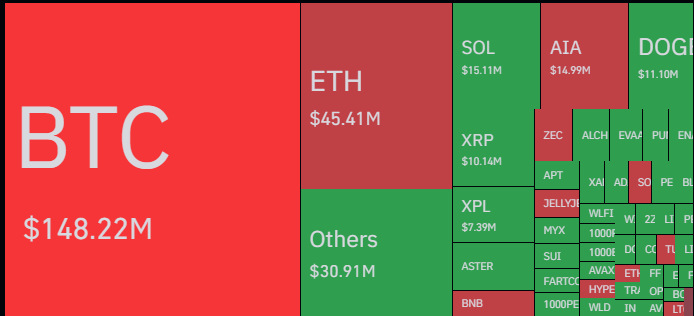

$148 million in BTC positions have been liquidated in the last 24 hours amid the Bitcoin price rally to a new all-time high, according to CoinGlass data. $132 million was short positions, while $16 million were long positions.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

Buy $GGs

Buy $GGs