Bitcoin Price Hits New ATH At $77k As Trump Trade Continues

Highlights

- Bitcoin soars to a new ATH of $77,199 following Trump's election win, driven by heightened market optimism.

- U.S. Federal Reserve cuts rates by 0.25%, boosting investor interest in Bitcoin as a hedge against inflation.

- Bitcoin ETF demand surges, with Blackrock IBIT recording $1 billion daily inflows as crypto gains mainstream acceptance.

Bitcoin price surged to a new all-time high of $77,199 following Donald Trump’s recent US election victory, which has sparked renewed interest in BTC as a “risk-on” asset.

The price surge comes as investors expect the U.S. economic landscape to shift under Trump’s leadership, fueling optimism for cryptocurrencies as alternative investments.

Bitcoin Price Hits New ATH At $77k

The election of Donald Trump has injected a wave of optimism into financial markets, with Bitcoin among the main beneficiaries. Following the election results, investors have shown increased appetite for riskier assets, expecting potential changes in U.S. economic policy that could favor capital growth.

Bitcoin-related products have seen a notable uptick in inflows, pushing the cryptocurrency to unprecedented levels.

Adding to this momentum, the United States Federal Reserve recently lowered interest rates by 0.25%, a move widely anticipated by the market. This rate cut, coupled with Powell’s statement that “economic activity has continued to expand at a solid pace,” has contributed to the bullish sentiment surrounding Bitcoin.

Federal Reserve Signals Cautious Optimism on Economic Outlook

The Federal Open Market Committee (FOMC) meeting concluded with a rate cut, signaling cautious optimism for the U.S. economy. Federal Reserve Chair Jerome Powell highlighted that “labor market conditions have generally eased, and the unemployment rate has moved up but remains low.” He also noted that inflation is progressing towards the Fed’s 2% target but remains elevated.

Concurrently, the recent Bitcoin price movement has also led to substantial liquidations across the market. According to data from Coinglass, the entire network saw $215 million in liquidations in the past 24 hours.

The Fed’s decision to lower interest rates has reinforced investors’ interest in alternative assets like Bitcoin, seen as a hedge against potential inflationary pressures. This environment of low rates combined with high economic expectations has strengthened Bitcoin’s appeal, driving more capital into the digital asset market.

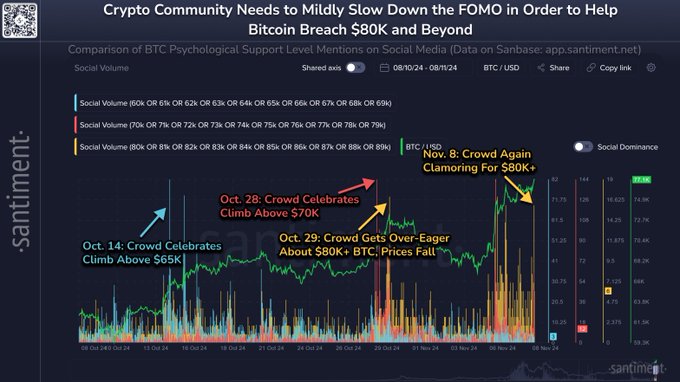

However, despite the hitting an ATH, Santiment has warned of a reversal as excitement builds around the possibility of Bitcoin price reaching $80,000, they have observed that overly eager crowd sentiment often precedes a price retracement.

“When the crowd has gotten too eager about $80K+ BTC, we’ve seen prices retrace,”

Peter Brandt Predicts Bitcoin Peak at $150,000 in 2025

Veteran commodity trader Peter Brandt has projected that BTC price could reach $150,000 by August 2025. Brandt, known for his technical analysis, stated that Bitcoin is currently in the “sweet spot” of its bull market cycle. According to his analysis, Bitcoin’s price patterns following previous halving events suggest a similar trajectory this cycle.

Brandt measures Bitcoin’s cycles differently, observing that the timing between the bear market bottom and halving tends to mirror the period from halving to the bull cycle peak. Based on this symmetry, Brandt expects Bitcoin to peak sometime in 2025.

As BTC price continues its rally, analysts believe that the demand for Bitcoin ETFs could soon surpass that for gold ETFs. A top market analyst recently suggested that Bitcoin ETFs might triple the trading volume of gold ETFs, underscoring a growing shift towards digital assets among investors.

This increasing interest in Bitcoin ETFs like Blackrock IBIT hitting $1 billion daily inflows is seen as part of a broader move toward institutional acceptance of cryptocurrencies. The rise in Bitcoin’s price, coupled with growing ETF demand, could pave the way for further adoption in mainstream financial markets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs