How Bitcoin ETF Launch Could Affect MicroStrategy’s Crypto Strategy

Crypto News: Microstrategy’s position as the largest institutional investor in Bitcoin makes its holdings comparable with a typical Bitcoin exchange traded fund (ETF). A flurry of spot Bitcoin ETF applications to the United States Securities and Exchange Commission (SEC) have singlehandedly stole the limelight in crypto market over the last few weeks. This is because the financial giants of the likes of Blackrock, Valkyrie and Fidelity have joined the race for the first ever Bitcoin ETF launch.

Also Read: LUNC Price to Hit $0.00009 High? Key Indicator Signals Reversal Sign at Support

Meanwhile, the Bitcoin price managed to hold steady in the current range with sideways movement. In parallel with the Bitcoin price, the Microstrategy stock price grew by an impressive 193% on year to date basis in 2023.

What Next For MicroStrategy If Bitcoin ETF Gets Approved

The MicroStrategy stock price has clearly been correlated with the Bitcoin price in recent years. Hence, the software company would naturally do well in raising capital if the crypto market rallies. In case a Bitcoin ETF is approved in the near future, the cryptocurrency market would likely go bullish, which in turn is beneficial for the company. As recent as June 28, 2023, the Micheal Saylor founded company bought 12,333 Bitcoin, taking its total holdings to 152,333 $BTC.

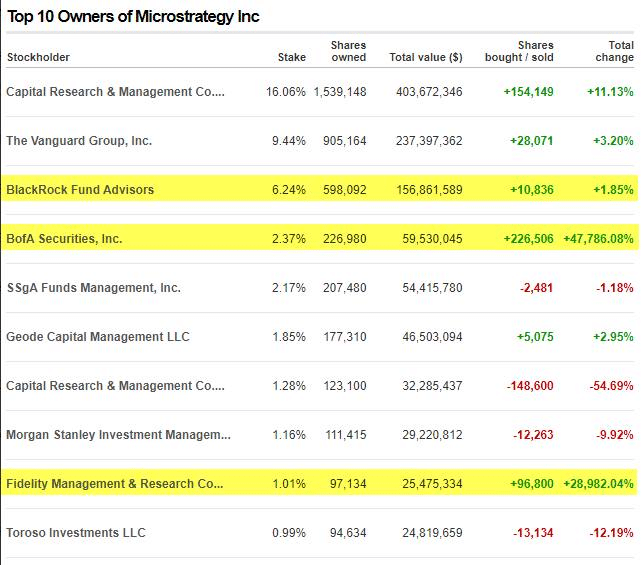

The BTC accumulation move from the world’s largest institutional Bitcoin holder came at a time when the biggest of asset managers were filing for the ETF applications. In fact, Microstrategy’s Bitcoin holdings is indirectly linked to the likes of Blackrock and Fidelity. Among the top stockholders of the company are Blackrock and Fidelity, which have filed for the spot Bitcoin ETF approval with the US SEC.

Also Read: UK and Singapore Unite for Crypto Standards: The Next Big Leap for Digital Asset Regulation?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs