Bitcoin Price Nears Major “Short Squeeze”, Peter Brandt Signals BTC Rally

Highlights

- Bitcoin derivatives market signals an upcoming "short squeeze".

- K33 Research predicts sell-side exhaustion and sharp BTC price rally.

- Veteran trader Peter Brandt signals BTC price rally due to rising volatility.

Bitcoin derivatives market signals an upcoming “short squeeze” that can lead to a sharp rally in Bitcoin price, with an end of selloff in the largest crypto asset. Moreover, analysts have turned overall bullish due to technical strength in the BTC chart and the latest macroeconomic data.

Bitcoin Price To Witness “Short Squeeze”

Crypto market is staging sharp recoveries as the funding rates on Bitcoin and many altcoins are still negative, indicating a big short squeeze ahead.

According to K33 Research data, the seven-day average annualized BTC perpetual funding rate was the lowest on Tuesday since March 2023 — when US bank failures spooked investors — indicating a prevalence of downside risks.

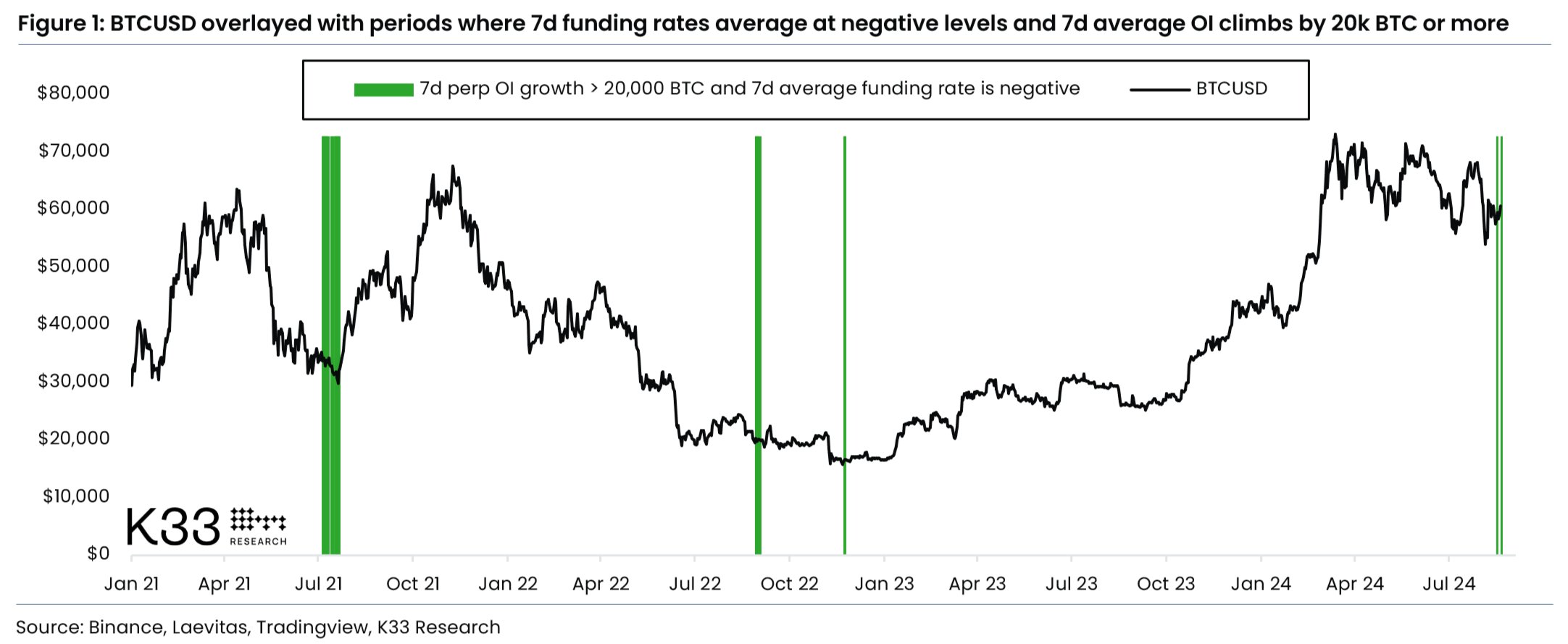

The report predicts a potential sell-side exhaustion, with a setup indicative of an imminent short squeeze coming soon. The chart illustrates a BTC open interest spike during negative perpetual funding rates.

“Perpetual swap funding rates have averaged at negative levels over the past week, while open interest has sharply increased,” K33 analysts Vetle Lunde and David Zimmerman wrote in a note. “This suggests aggressive shorting, structurally creating a setup ripe for a short squeeze.”

The sharp price jumps will force traders to close their short positions. The rise in short liquidation will fuel upside momentum in BTC price. This could change the overall crypto market direction, increasing the positive sentiment among investors.

Meanwhile, the global stock gauge rebounded to hit a record high while gold also set a new record hit. The US dollar index (DXY) and 10-year Treasury yield have hit yearly lows, triggering an uptrend in Bitcoin price.

Analysts Turned Bullish on BTC

Spot Bitcoin ETFs recording inflows for consecutive days and recovery in the Fear and Greed Index have fueled Bitcoin rally. However, the current US political landscape amid elections continues to impact BTC and other crypto. On Tuesday, Bitcoin ETFs saw $88 million in inflows, with BlackRock Bitcoin ETF recording $55.4 million.

Crypto analyst Rekt Capital expects BTC to enter post-halving reaccumulation phase if it closes above $60,600 this week. Bitcoin price is currently below $60,000 psychological level.

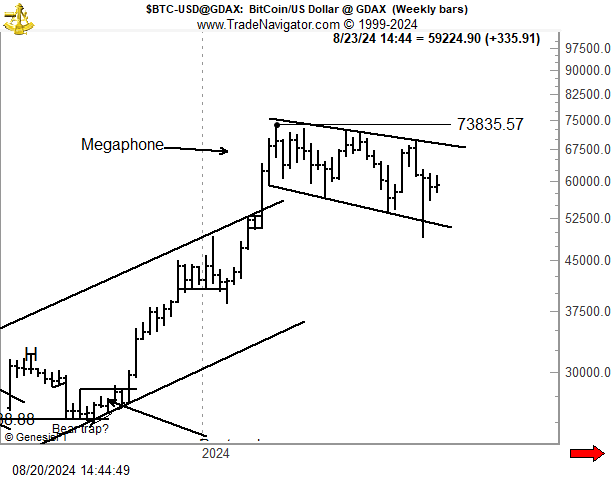

Veteran trader Peter Brandt said Bitcoin and Ether charts continue to drive interest. BTC weekly and daily graphs continue to form a megaphone or broadening triangle pattern. This indicates market volatility and uncertainty, but often signals an impending major price movement.

Bitcoin price could move towards its all-time high of 73,835, but he asserts there is no declaration of next trend yet. The recent $700 million BTC transfer by Mt. Gox and election dynamics continue to impact the market trend.

BTC price is rebounding to $60,000 after falling below $59,000. The price is currently trading at $59,648. Moreover, the trading volume has declined by 8% in the last 24 hours, indicating a decline in interest among traders. A recent BTC price analysis by CoinGape predicts when BTC could reach $70,000 again.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- USDT And USAT Get Adoption Boost as Tether Invests in Whop for Faster Settlements

- BTC Price Rises as U.S. Plans to Hold Trump Tariffs on China Steady

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

Buy Presale

Buy Presale