Bitcoin Price Prediction: BTC Steps Out, Eyes On The $40,000 Target

- Bitcoin price settles above crucial support at $34,000, highlighted by the 50 SMA.

- All the short-term technical levels have aligned for a massive upswing toward $40,000.

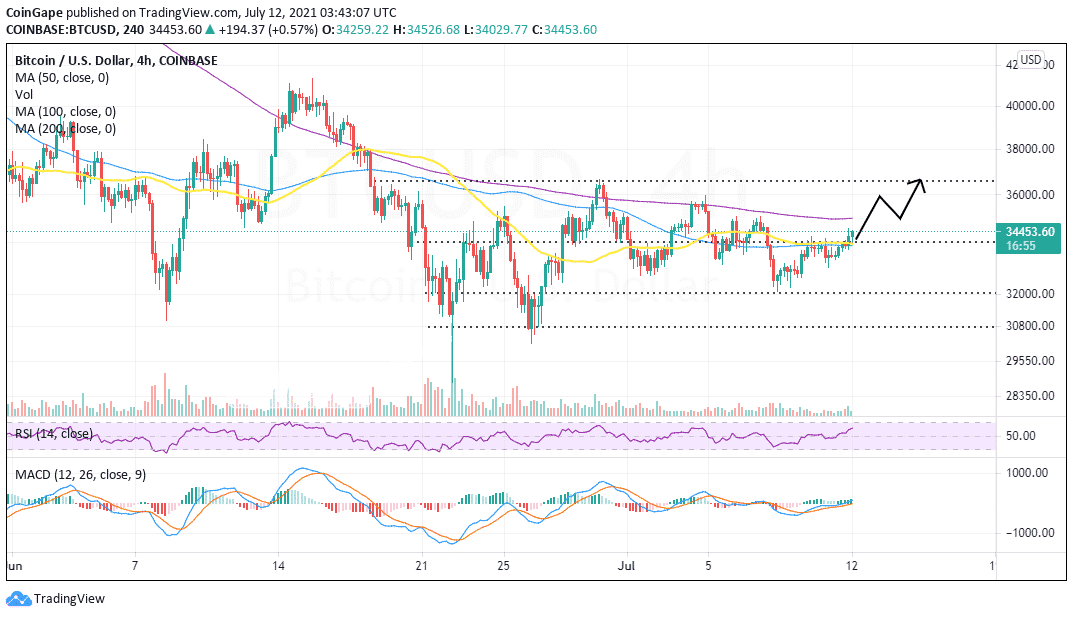

Bitcoin price closed the weekend session in the green, trading above $34,000. The trading last week was mainly drab and characterized by a considerable dip from weekly highs above $35,000 to lows under $33,000.

As the new week takes off, the bellwether cryptocurrency is back to trading above $34,000. Here, the 50 Simple Moving Average (SMA) and the 100 SMA provide the much-needed support.

Bitcoin price begins restarts the journey to $40,000

A four-hour close above $34,000 will validate the next move, perhaps the crucial hurdle at $35,000 as shown by the 200 SMA. As Bitcoin takes down consecutive barriers, investors gain confidence in the uptrend. Hence. The odds for Bitcoin trading above $40,000 continue to soar.

The Moving Average Convergence Divergence (MACD) indicator is a technical tool used to track the trend of an asset and calculate its momentum. A consistent rise from the negative territory to the area above the mean line (0.00) adds credence to the bullish outlook.

Moreover, the MACD allows sends out buy or sell signals, allowing investors to back the downtrend or the uptrend. At the time of writing, Bitcoin’s least resistance path is upward. This optimistic outlook has been reinforced by the 12-day Exponential Moving Average (EMA) crossing above the 26-day EMA).

BTC/USD four-hour chart

On the upside, a break above $35,000 (the 200 SMA) will emphasize the growing bullish grip on the price.

It is worth mentioning that the Relative Strength Index (RSI) has lifted above the midline and heading toward the overbought region as a show of bulls flexing their muscles for renewed action this week. Realize that the RSI follows the trend of an asset and shows how strong it is. A strong bullish trend like Bitcoin’s ongoing uptick tends to call more buyers into the market, thereby intensifying the tailwind for gains toward $40,000.

Bitcoin intraday levels

Spot rate: $34,420

Trend: Bullish

Volatility: Growing

Support: $34,000 and $32,000

Resistance: $35,000 and $36,000

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs