Bitcoin Price Pushes Past $31k as US Judge Rules XRP Not A Security – Rally to $38k Impending?

Bitcoin price reclaimed resistance at $31,000 following a much-anticipated ruling in the lawsuit Ripple has been fighting against the Securities and Exchange Commission (SEC) since December 2020.

The largest cryptocurrency is up 2.4% to $31,200, boasting $607 billion in market capitalization and $23 billion in trading volume. This sudden bullish outlook can be seen across the market with Ethereum’s price rising 6.5% to $2,000.

XRP and the tokens the SEC had listed to be securities in early June exploded as investors reacted to the news that XRP is not a security. At the time of writing, XRP is up 70% to trade at $0.77 while ADA surged by 20% to $0.35, with MATIC posting a 15% upswing to $0.85.

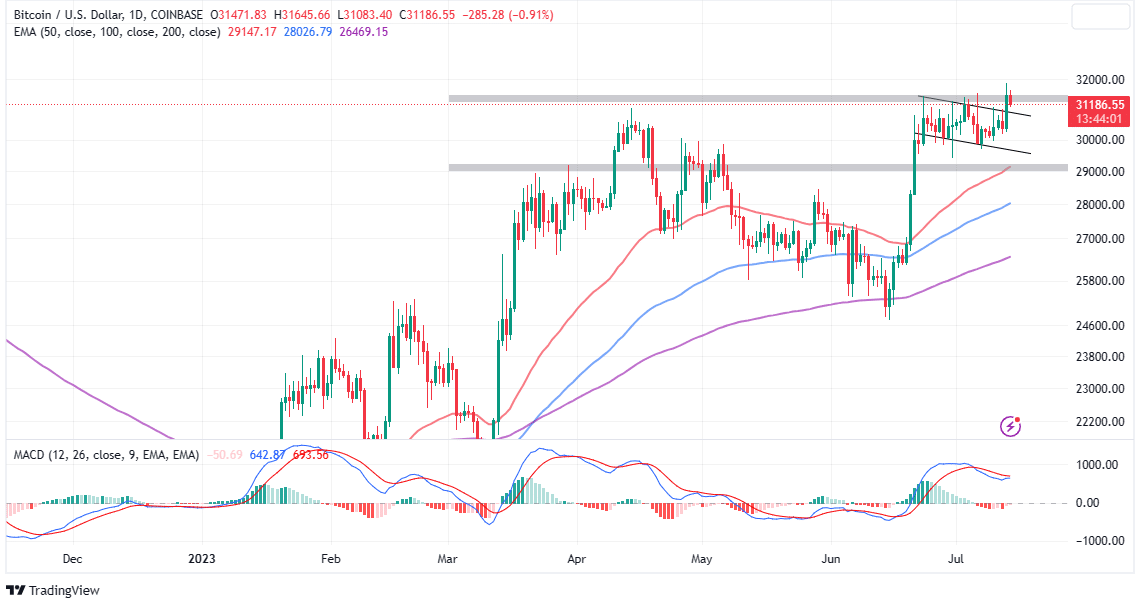

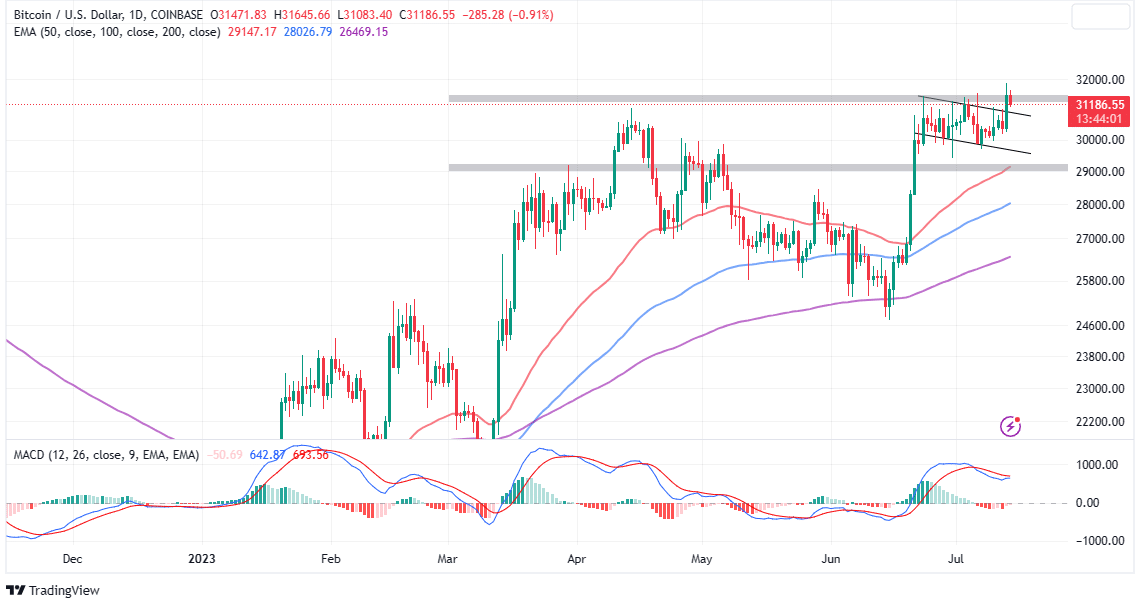

Bitcoin Price Flips Bullish And These Are the Levels To Watch

Bitcoin price holds marginally above $31,000 on Friday with the Moving Average Convergence (MACD) indicator likely to flash a buy signal on the four-hour chart. Traders looking forward to increased exposure to BTC longs would be looking out for a bullish cross marked by the MACD line in blue flipping above the signal line in red.

Despite Bitcoin breaking above the short-term descending channel as observed, the seller congestion at $32,000 seems to be the biggest stumbling block to the expected move to $35,000 and $38,000.

For now, holding above the channel and subsequently $31,000 is crucial for the continuation of the uptrend. However, bulls will only be safe with the Bitcoin price breaking and upholding support at $32,000.

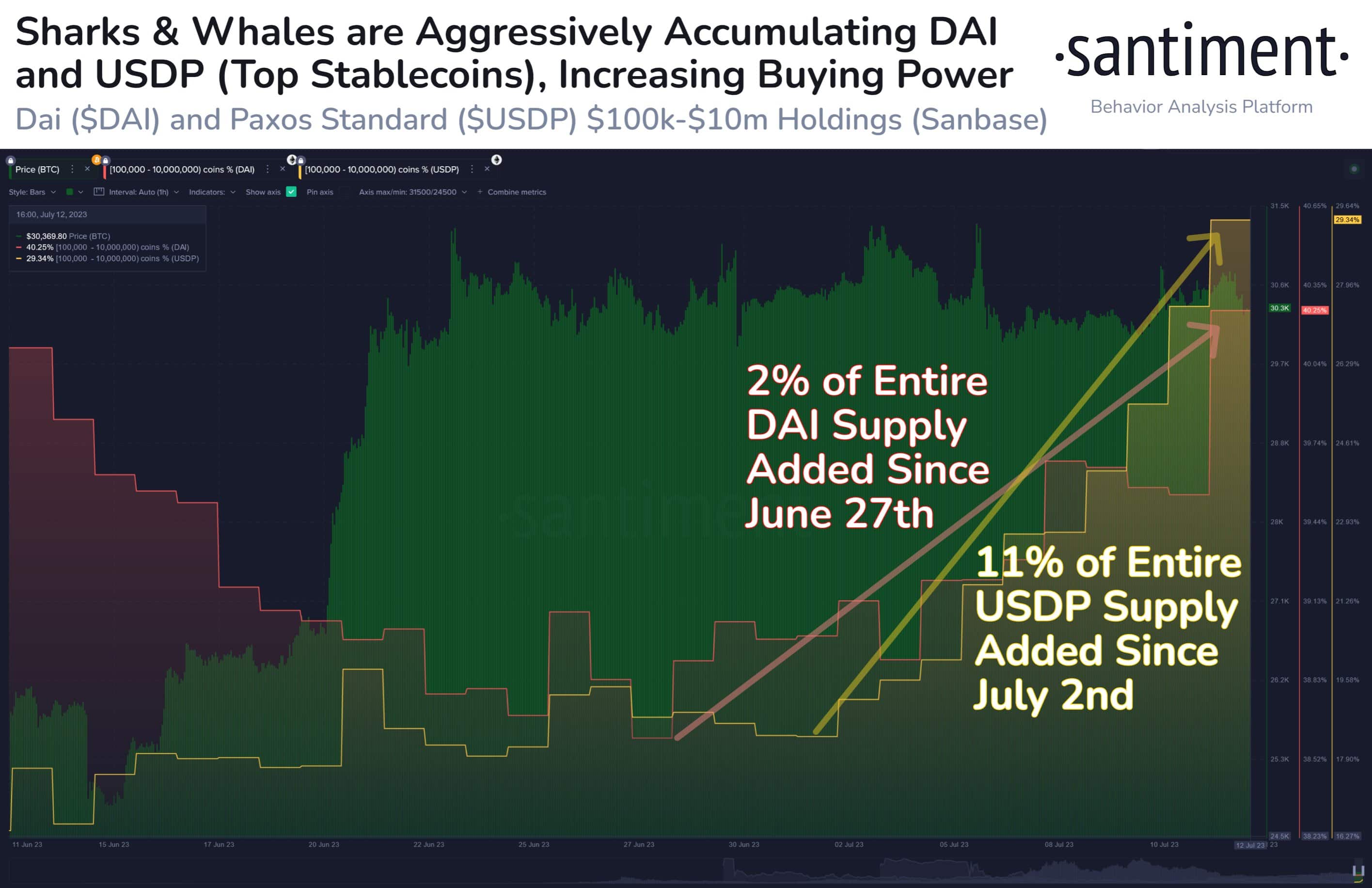

On-chain insights from Santiment compel traders to pay attention to address activity, particularly shark address activity. As reported earlier in the week, BTC accumulation is on the rise mainly among shark (0.1 – 100 BTC) and fish addresses (0 – 0.1 BTC).

“Sharks and whales are watching the $30k to $31k Bitcoin price ranging, just like the rest of traders. And it appears that they are accumulating stablecoins like $USDP & $DAI quite rapidly, which increases the probability of future big crypto buys,” Santiment said via a Twitter post.

If support at $31,000 weakens during the weekend, Bitcoin might resolve to the long-standing consolidation above $30,000. However, such a move would push a lot of pressure on lower support levels with investors likely to sell to buy BTC at $28,000 and $25,000.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs