Bitcoin Price Reaches $67000 Clinching $1.32 Trillion Market Cap, What’s Next?

Highlights

- BTC price jumps 3% to over $67,000, with a weekly run of more than 10%.

- Cooling CPI inflation, Fed Chair Jerome Powell dovish remarks, and bullish sentiment to drive btc price upwards.

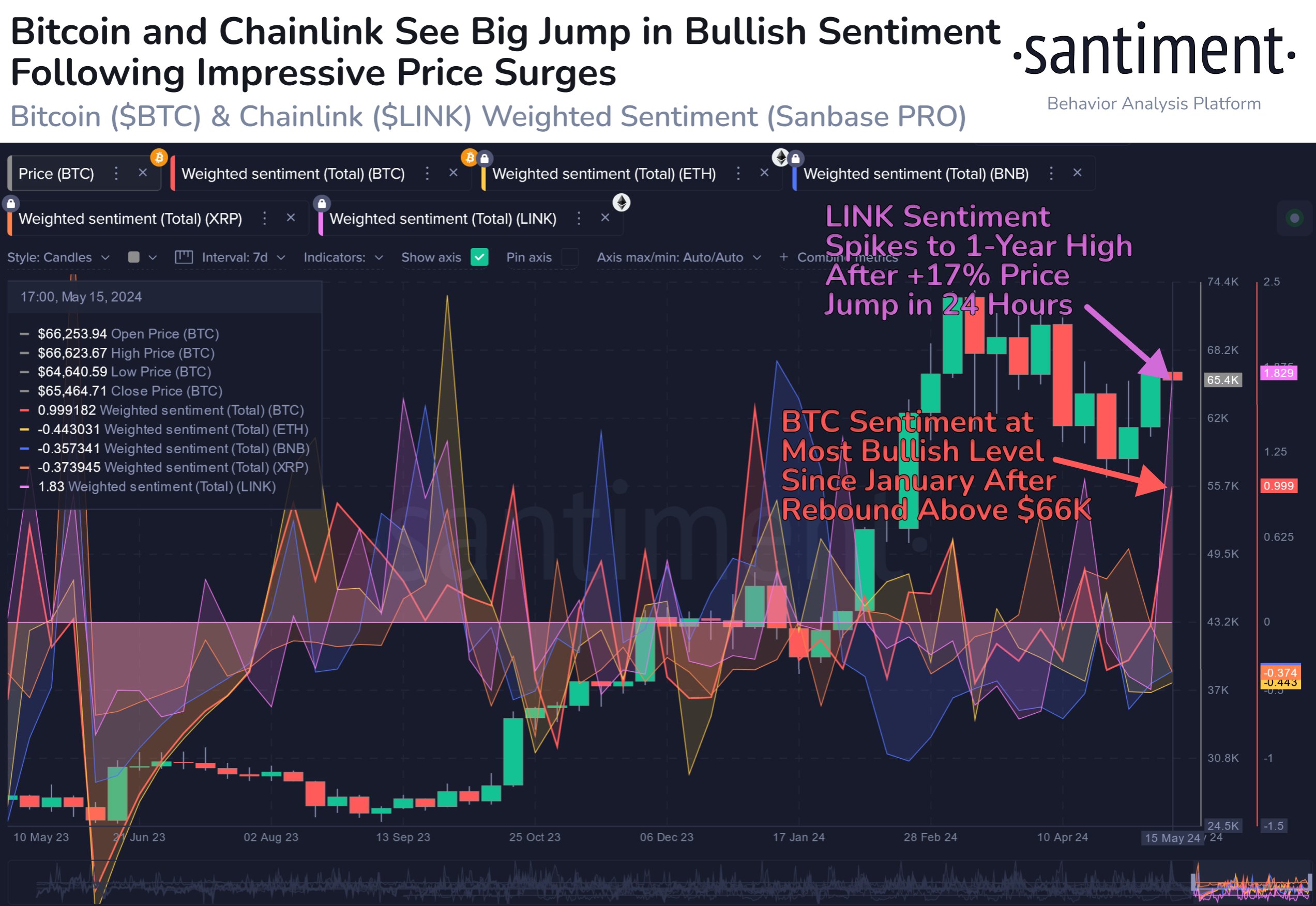

- Santiment data indicates the sentiment has shifted toward Bitcoin after the sudden jump over $66,000.

Bitcoin further extended its rally on Friday as bulls got stronger against bears, with BTC price rising over $67,000. The market value of Bitcoin climbed over $1.32 trillion amid a renewed positive sentiment in the crypto industry after cooling CPI inflation and Fed Chair Jerome Powell denied stagflation and other related concerns. Is further upside possible or another leg down next?

US stock market indexes rose after traders embraced that slowing inflationary pressures restored the possibility of a September rate cut, while strong corporate earnings further boosted confidence.

Bitcoin Price Soars Over $67,000

BTC price jumps 3% to over $67,000, with a weekly run of more than 10%. The 24-hour low and high are $64,613 and $67,459, respectively. Moreover, the upsurge coming in comparatively low trading volumes indicates whales and big investors turned bullish on Bitcoin, along with the liquidation of high-leveraged positions.

CoinGlass data indicates more than $130 million were liquidated across the crypto market in the last 24 hours. Bitcoin saw nearly $45 million in liquidation, with $31 million in short positions liquidated. Most of the liquidation happened in the last few hours.

Over 42K traders were liquidated and the largest single liquidation order happened on crypto exchange BitMEX as someone executed a trade of XBTUSD valued at $4.80 million.

CryptoQuant founder Ki Young Ju said Bitcoin is the middle of a bull cycle. On-chain data Growth Rate Difference signifies the bull cycle should end by April next year.

#Bitcoin is in the middle of the bull cycle.

Its market cap is growing faster than its realized cap, a trend that typically lasts around two years.

If this pattern continues, the bull cycle might end by April 2025. pic.twitter.com/o4k8B1Rkhv

— Ki Young Ju (@ki_young_ju) May 17, 2024

Also Read: China To Drive Next Rally in Bitcoin, Gold Prices, Here’s How?

Will Bitcoin Rally Continue?

Popular analyst Rekt Capital revealed that Bitcoin price is now out of post-halving “danger zone”. He predicted BTC price to start rallying toward $150,000.

Bitcoin options traders made more calls for a strike price as high as 70,000, with some even having calls for $80,000 for May 31 monthly expiry.

Furthermore, Santiment data indicates the sentiment has shifted toward Bitcoin after the sudden jump over $66,000. Chainlink also joined Bitcoin to witness bullish sentiment, with traders anticipating a further rally in the next coming weeks.

Also Read:

- Crypto Regulation FIT21 Gets Support From CCI and 60 Organizations

- Terra Luna Classic Proposal Is Inconsistent With Binance, CoinMarketCap

- 3 Meme Coins With 100X Potential Today

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs