Bitcoin price reclaims $14,000 and why $15,000 is imminently achievable

- Bitcoin bulls are eager to establish strong support above $14,000.

- BTC/USD has a relatively smooth path to $15,000 according to on-chain metrics like the IOMAP model.

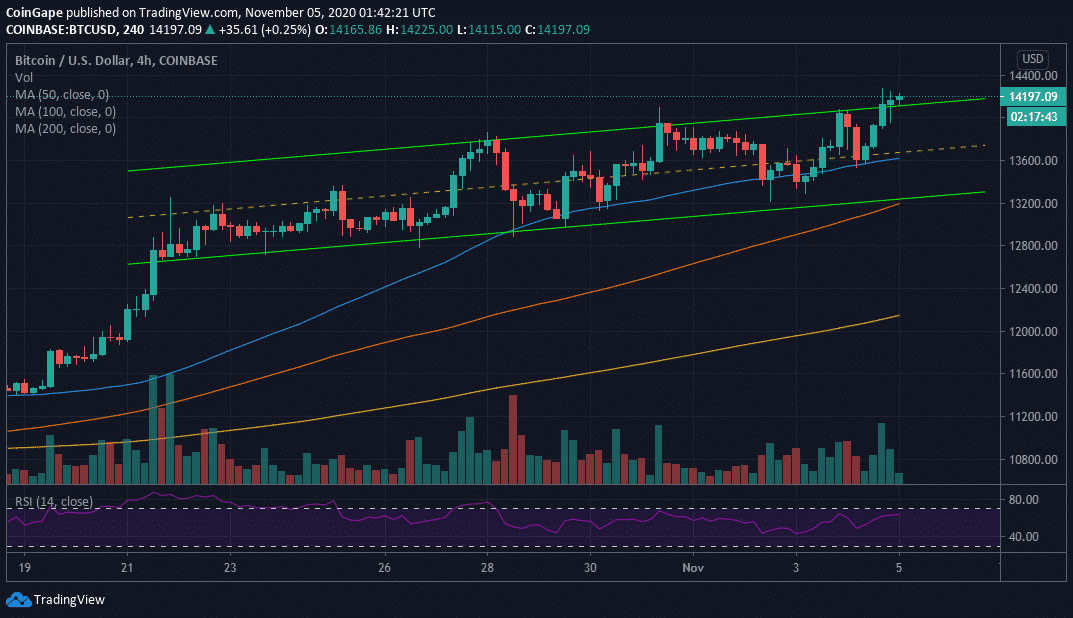

The flagship cryptocurrency resumed the uptrend, blasting above $14,000 for the third time in less than seven days. BTC/USD extended the bullish leg upwards, trading new yearly highs around $14,270. The breakout occurred amid rising tension ahead of the United States presidential election results. It is likely for the stock market to crumble if Joe Biden wins. On the other hand, Bitcoin and cryptocurrencies stand to gain amidst a bleeding stock market.

At the time of writing, Bitcoin is changing at $14,180 as bulls fight to sustain the uptrend and close in on the coveted $15,000. The price holds above an ascending parallel channel, which gives credence to the bullish outlook.

Bitcoin bulls are mainly in control at the time of writing, as highlighted by the Relative Strength Index (RSI). However, a low trading volume suggests that price movement will be gradual or limited in the near term.

BTC/USD 4-hour chart

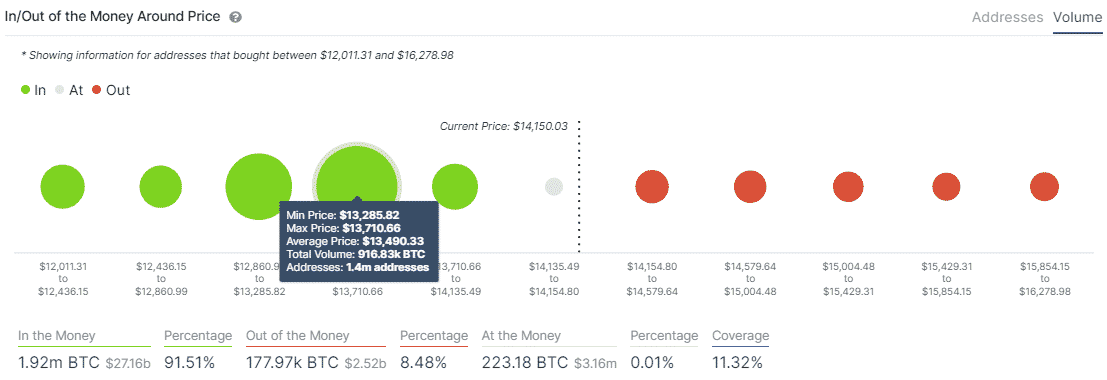

IntoTheBlock’s IOMAP reveals the lack of a strong resistance towards $15,000, which means that Bitcoin has a relatively smooth ride towards $15,000. On the downside, the bellwether cryptocurrency is sitting above an area with immense buyer congestion.

For instance, the most robust anchor runs from $13,286 to $13,711. Here, 1.4 million addresses had previously bought nearly 917,000 BTC. Therefore, it is doubtful that BTC will plunge massively in the coming sessions.

Bitcoin IOMAP chart

It is worth mentioning that the bullish outlook will be invalidated if Bitcoin slides back into the ascending channel and fails to secure support above $14,000. Bulls are eager for revenge could also increase sell orders creating enough volume to pull Bitcoin to the next critical support at $13,600, as shown by the 50 SMA.

Bitcoin Intraday Levels

Spot rate: $14,171

Relative change: 5%

Percentage change: 0.05%

Trend: Bullish

Volatility: Low

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Oil Prices Climb as Iran Set To Deploy Mines in Strait of Hormuz

- Why Is Crypto Market Up Today? 5 Key Reasons Behind the Rally

- Top U.S. Banks Weigh Lawsuit Against OCC Over Crypto Firm Charters

- CLARITY Act: Key Democrat Says Banks May Have to Compromise as Senate Eyes Crypto Bill’s Markup

- XRP News: Brad Garlinghouse Predicts ‘Defining Year’ For Ripple With XRP At The Center

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

Buy $GGs

Buy $GGs